- Bearish reversal detected below 5,930 key medium-term resistance of the SPX 500.

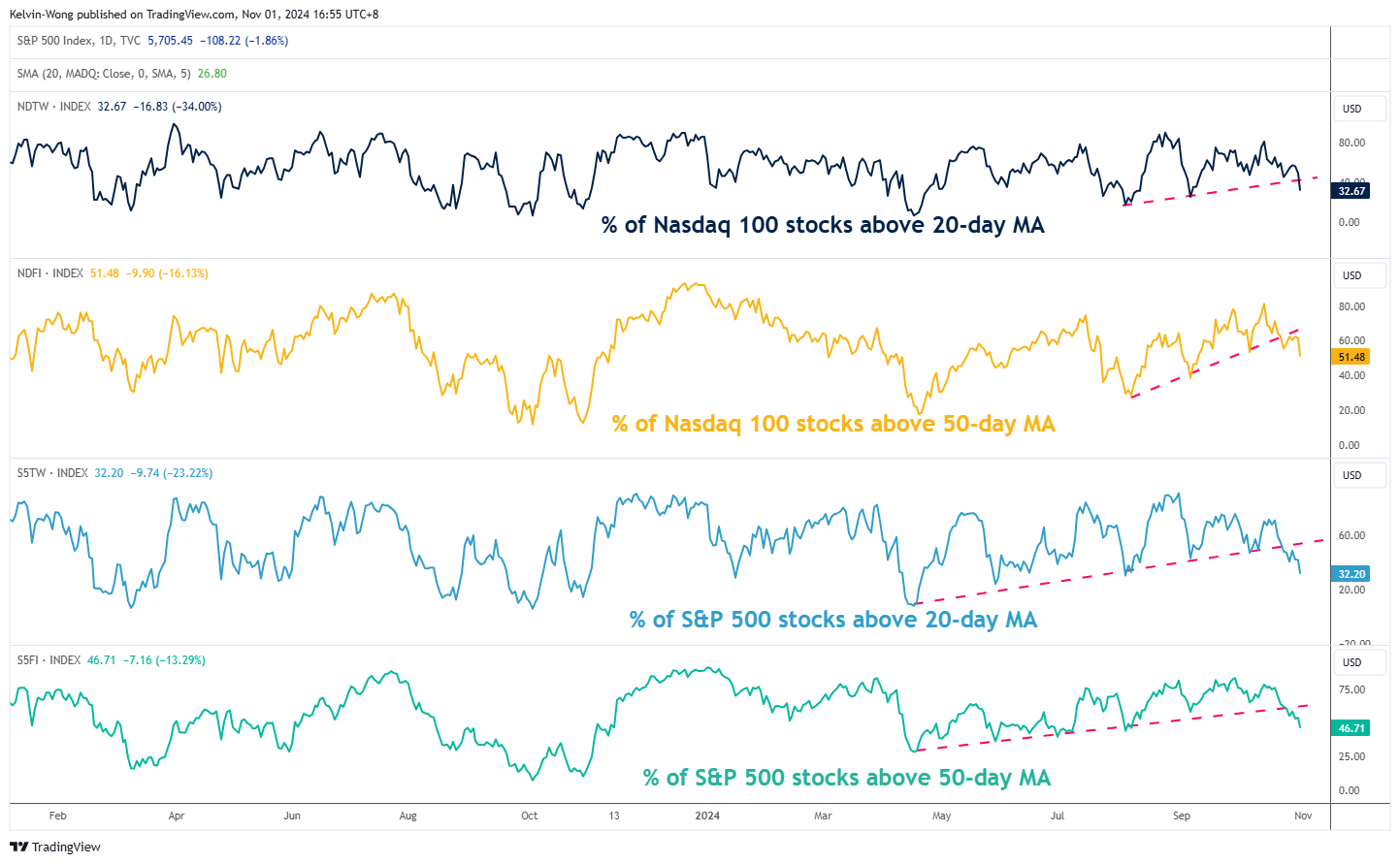

- Market breadth indicator (% of component stocks above 20-day and 50-day moving averages) has deteriorated.

- The odds have increased for a medium-term corrective decline on the SPX 500 as the key US presidential election risk event looms on 5 November.

Since our last publication, the S&P 500 has reversed down by 3% from its current all-time high of 5,878 printed on 17 October, and right below the 5,930 key medium-term resistance highlighted earlier. It also ended October with a monthly loss of almost 1% dragged down by lackluster revenue guidance from three mega-cap technology stocks: Microsoft (NASDAQ:MSFT), Meta Platforms (NASDAQ:META), and Apple (NASDAQ:AAPL).

Market breadth has turned weak

(Source: TradingView)

One of the market breadth measurements on the S&P 500 has turned weak where the percentage of its component stocks trading above their respective 20-day and 50-day moving averages have turned southward bound.

The percentage of S&P 500 component stocks trading above their 20-day moving averages has declined sharply from 72% to 32% within two weeks.

A similar observation can also be seen in the percentage of S&P 500 component stocks trading above 50-day moving averages as it dropped from 77% to 47% over the same period (see Fig 1).

The rapid deterioration seen in these market breadth indicators of the S&P 500 to breach below their respective 50% levels has suggested that the medium-term uptrend phase of the S&P 500 has been damaged ahead of next week’s key US presidential election polling day on 5 November.

Bearish breakdown of “Ascending Wedge”

(Source: TradingView)

Thursday, 31 October price actions seen on the US S&P 500 CFD Index (a proxy of the S&P 500 E-mini futures) have staged a bearish breakdown below the bearish reversal “Ascending Wedge” support from 5 August 2024 swing low now turns an intermediate pull-back resistance at 5,811.

In addition, the MACD trend indicator traced out a prior bearish divergence condition earlier on 23 October after a similar bearish divergence flashed out on the leading MACD Histogram a week earlier on 14 October.

These observations suggest that the US S&P 500 CFD Index may have formed a medium-term top and is in the process of shaping a potential medium-term (multi-week) corrective decline sequence.

Watch the 5,930 key medium-term pivotal resistance, and a breakdown with a daily close below 5,675 (close to the 50-day moving average) sees the next medium-term supports coming in at 5,390 (also the 200-day moving average) and 5,100.

On the other hand, a clearance with a daily close above 5,930 invalidates the bearish tone to expose the next medium-term resistances at 6,110/130 and 6,390 (also the upper boundary of the major ascending channel from March 2020 low).