The end of last week was a real rollercoaster on the global indices. On Thursday, many bears were opening champagne bottles, celebrating a long-awaited sell signal. As usual, sellers were a bit too optimistic and their dream was rapidly cancelled on Friday, when major indices surged.

The leading one was the S&P 500, which managed to set new all-time highs (intra-day). Over the weekend, there wasn't any major news, so markets opened in neutral territory, which favors buyers more, as, well…we’re close to all-time highs, duh!

Although buyers are winning, there's still something which can attract possible sellers.

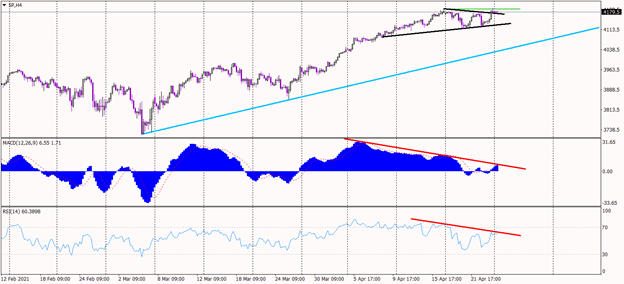

As we mentioned before, the S&P had a new ATH intraday. Additionally, the price broke out of the pennant (black lines) to the upside, which in theory brings us a fresh buy signal. What could be worrying for buyers is that the price created a shooting star on the H4 chart and possibly a double top formation, which can be confirmed by the MACD and RSI divergence.

The situation on the Dow is of course a bit similar, but here, the price did not manage to set a new ATH on Friday. What’s more, buyers did not manage to escape from the pennant pattern, yet.

As long as we stay inside this formation there’s no fresh buy signal. Only the price closing an H4 candle above that resistance will be an invitation to open a long position.

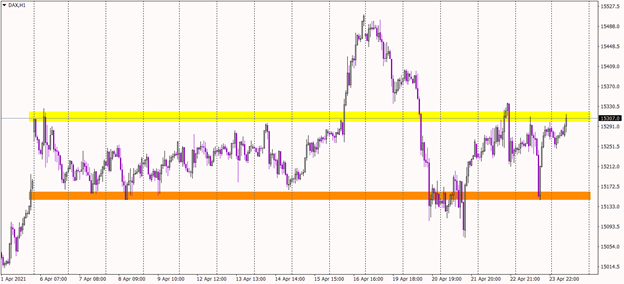

OK, let’s move to DAX, which is back inside a tight range between 15150 and 15300 points. Monday started below the resistance on 15300 and for now, that is a key level for this German index. Price staying below that level gives hope for sellers, but price breaking that line can trigger a proper long-term buy signal, which can possibly end in the making of new all-time highs.