Thursday’s session was as bipolar as it gets for the S&P 500.

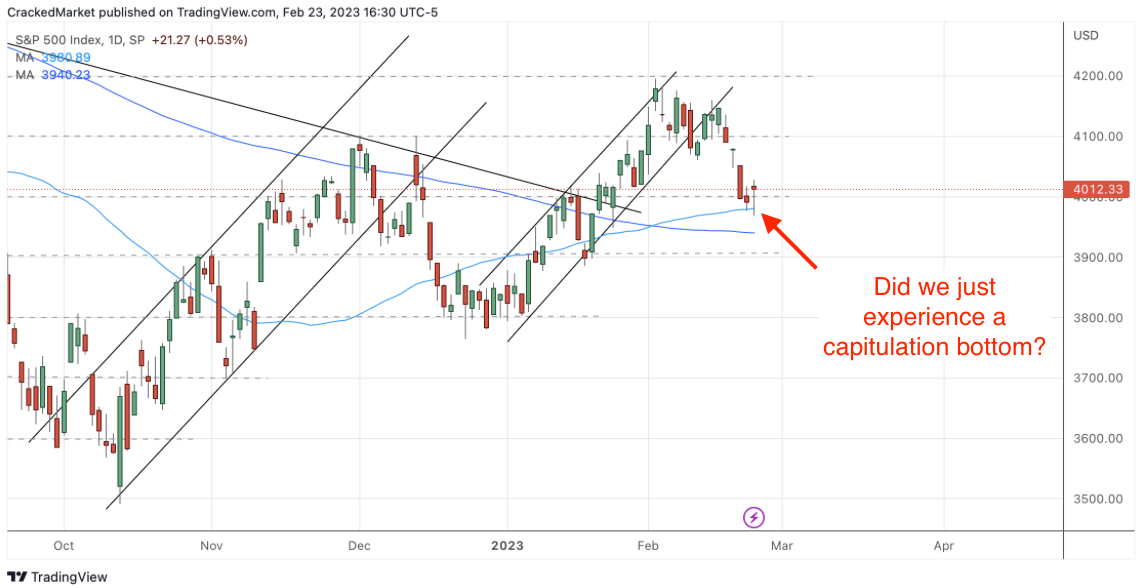

In a very disappointing fashion, the index turned respectable opening gains into fresh multi-month lows by lunchtime. That’s not the price action you expect from a healthy market. But just when all hope was lost, or more specifically because all hope was lost, supply dried up and prices bounced decisively into the close, finishing near the intraday highs.

As bad as the morning looked, the afternoon’s rebound was doubly impressive. Remember, it’s not how we start, but how we finish that matters most. What very easily could have triggered another big wave of selling reversed course in a beautiful capitulation bottom.

This was the trading signal we’d been waiting for and hopefully, you didn’t miss it.

As I’ve been writing for a while, I don’t believe this latest pullback from the highs is the start of something more insidious. Stocks go up and stocks go down, that’s what they do. And no one should be surprised when stocks pull back from multi-month highs and consolidate those gains. This is very normal and healthy behavior.

But no one claimed traders have to be rational. Give the market a few down days and all of a sudden everyone is predicting the next big crash. Sure, the market failed to bounce at 4,100 support and even undercut 4k, but that is par for the course for a market that rallied four hundred points in little more than a month. Two steps forward, one step back. Everyone knows that’s how this game works, yet they always forget that simple truth in the heat of battle.

I really liked Thursday afternoon’s bounce. This was the bounce I was looking for and I bought it with open arms. Without a doubt, the selling could return Friday, but my stops near Thursday’s midday lows will keep me safe. And if I get dumped out, that’s okay too. I move to the sidelines and wait for the next buying opportunity, something that could arrive as soon as Friday afternoon.

Everyone wants stocks to pull back so they can buy more, but every time the market gods answer their prayers, most of these people are too scared to buy. Don’t be the average trader. Have a trading plan and stick to it. The hardest trades to make often turn into our biggest winners.