Two weeks ago, see here, we asked the question if a major top was forming for the S&P 500. Using the Elliott Wave Principle (EWP) we found,

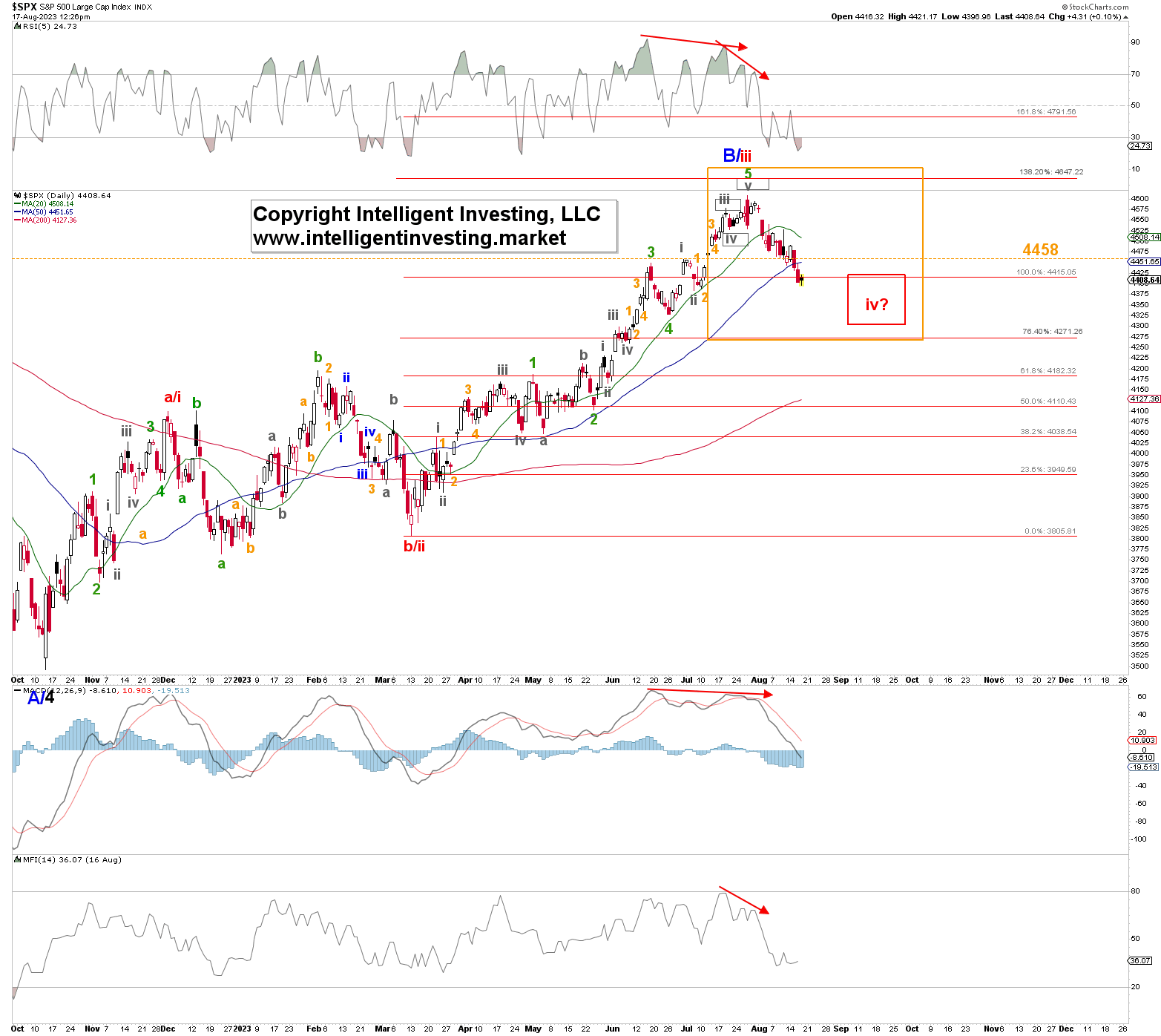

“Although the index has not dropped below the critical $4458 level … we must now be mindful that either the red W-iv to ideally $4300+/-25 is underway, or the blue W-B counter-trend rally has ended, and the index is working lower to $2700-2900. Please note the upside levels have been on our radar since October last year. See here when we were looking for the index to reach SPX4350-4650.”

Well, forewarned is forearmed, as on August 10 the index breached $4458 telling us the uptrend had ended and the SPX is working its way lower to the red W-iv target zone with $4300+/-25 ideally, shown in Figure 1 below, or worse. Much worse. More about that next time.

Figure 1. Daily SPX chart with detailed EWP count and technical indicators

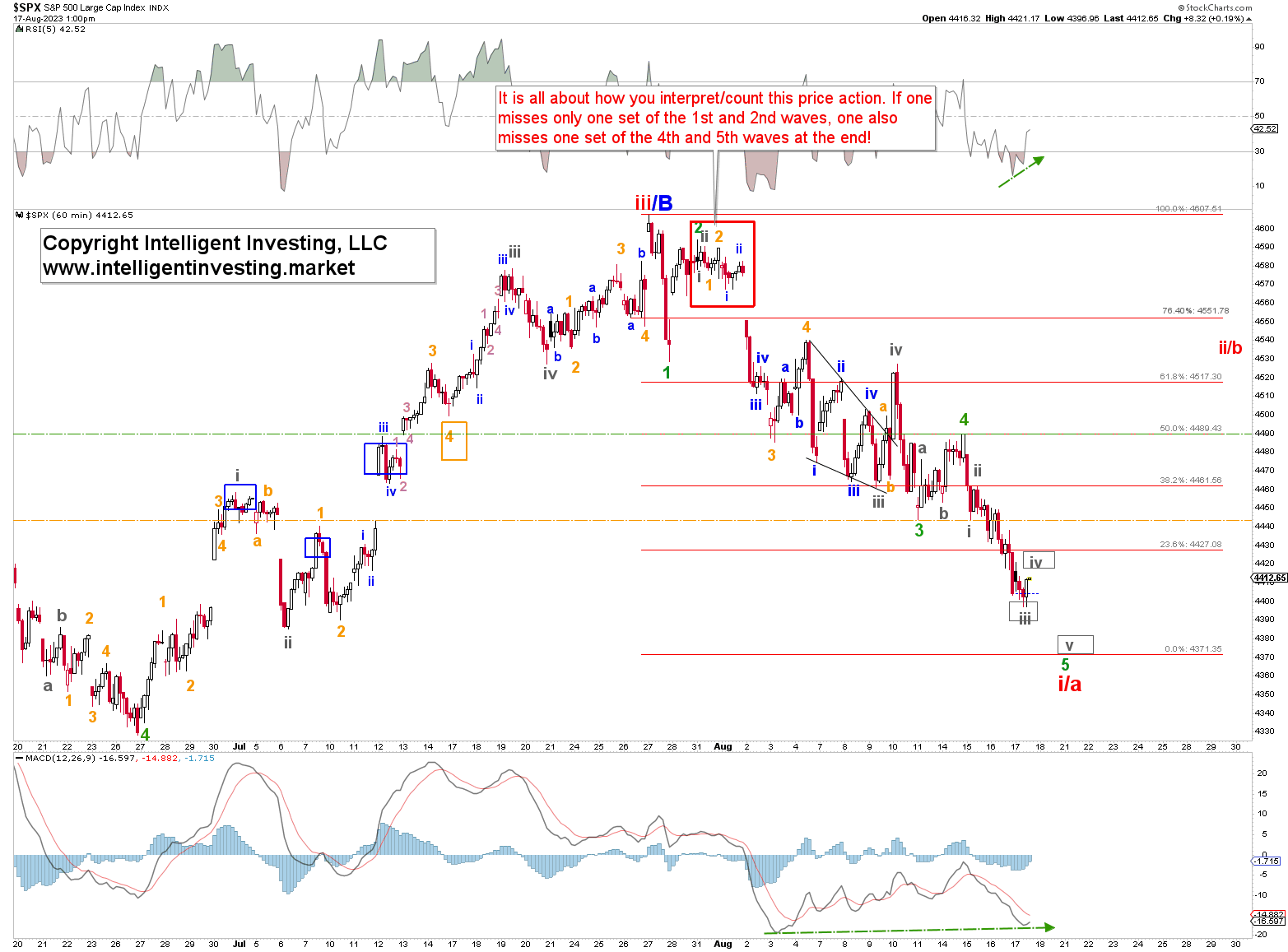

Namely, the price action encompassed by the orange box in Figure 1 is highlighted in Figure 2 below. It shows the index has most likely, or is close to, completing five waves lower since the July 27 high at $4707. This pattern has solidified the B-wave high is in place, which has been our big-picture primary expectation all along. But we still want to see a five-wave decline (five red waves i, ii, iii, iv, and v) at one wave degree higher, major-1, to be sure. This will set the SPX up for a decline to $2800+/-200.

Figure 2. Hourly SPX chart with detailed EWP count and technical indicators

Does that mean this setup is already certain? No, not at all. Risk management must always be respected as the index can still morph into "only" a larger a-b-c, with the W-b back up to ideally $4510-50 soon to commence, and then a W-c that can still target the low $4300s. That is why we initially W-a/i, -b/ii, and -c/iii until the a-b-c or i-ii-iii-iv-v is proven.

However, A-waves comprise a five-wave structure only a minority of times. Thus, a 5-3-5 (zigzag) correction is still possible but less likely. Nonetheless, "less likely" does not equate to "not going to happen," so we want to see the next higher degree 5-wave decline confirm the bearish count. But, with an initial five waves down, the Bears are now in charge regardless. If W-B has topped, it has only been days since that happened, and we cannot know the next day after the top that "the top" is in. It takes time for the markets to drop below certain key levels, in this case, $4458. So here we are, only 5% below "the top," and thanks to the EWP we already know a much more significant top may be in place. That is a tremendous, as early as it gets, foresight and what can help prevent havoc to one's portfolio.

The index will now have to rally above $4443, without dropping below today’s low again, to give us an early indication the red W-ii/b is underway, with confirmation above $4490. If it stalls around $4425+/5 and then drops below today’s low, we should expect $4370-80 before the index can retry its multi-day “dead cat bounce”.