One of the most common sayings in the stock market world is “never short a quiet market.” We might be seeing that in the S&P 500 now, even though there is a world of reasons to think that stock markets are getting ready to roll over. That being said, the technicals aren’t necessarily lining up with that same argument, and there are a couple of things that I would point out on this chart.

The Friday close was very strong. Granted, it did not break out above the resistance barrier, but it didn’t exactly shy away from rallying into the weekend. Part of this may have been due to Larry Kudlow suggesting that the trade talks with China were going “very well.” Possibly another move by the Plunge Protection Team, but at the end of the day, it moves the market. This chart is an excellent example of why what happens is much more important than why something happens. In short, if the market breaks out to the upside, quite frankly it doesn’t matter if was in a recession or not.

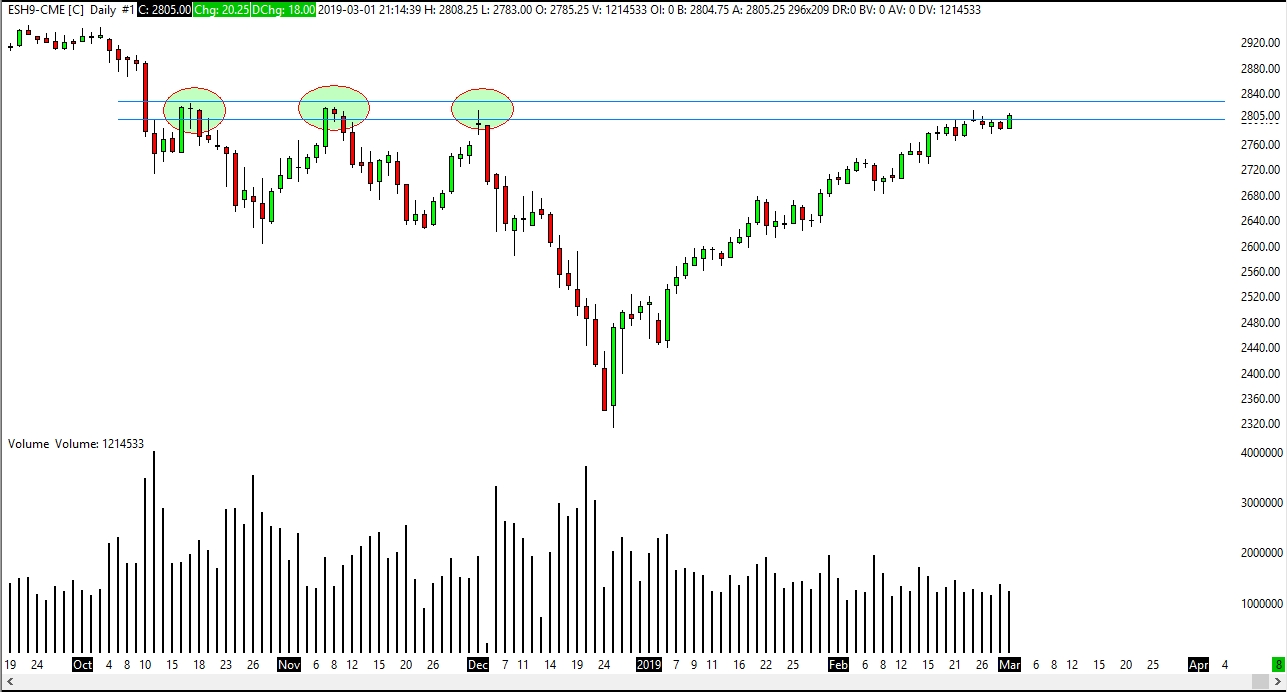

At this point, I would point out the three green circles on the chart, this is the resistance barrier that we are facing. The last three times we have been here, we ended up having a three candle reversal. In other words, participants sold rather quickly. However, we have been hanging in this area for quite some time now, and the market doesn’t necessarily seem to be overly concerned about this barrier. This tells me that at the very least people aren’t exactly uncomfortable. That’s a good sign that all it’s going to take is some type of good news to send us higher. In fact, we haven’t had a significant pullback and quite a while.

This is a market that has had plenty of reasons to fall apart on the way up from the bottom in December and quite frankly hasn’t bothered to. At this point, it appears that market participants are more worried about the Federal Reserve staying dovish than anything else. While it is difficult to buy the S&P 500, it certainly almost impossible to sell it. That in and of itself probably determines where we go next.