- Aggregate S&P 500 earnings are on track to rise for the first time in a year. Retailers are on tap next week.

- Previous 8-day declining streaks in the VIX have been bullish for the S&P 500.

- But with prices testing resistance in the 4400-4415 area, patience is warranted for bulls.

Fundamentally speaking, the S&P 500 is having a solid year. Major corporations were able to protect their profit margins by “passing through” increasing costs from rising inflation, allowing earnings growth to get back on track after a mini “earnings recession” in the early part of the year. Indeed, according to the earnings mavens at Factset, the index is on track to see aggregate Q3 earnings rise 3.7% y/y, the first year-over-year gain since Q3 2022.

Looking ahead, next week brings major earnings reports from retailers like Home Depot (NYSE:HD) (Tuesday), TJX (NYSE:TJX) (Wednesday), Target (NYSE:TGT) (Wednesday), and Walmart (NYSE:WMT) (Thursday), as well second-tier tech firms like Palo Alto Networks (NASDAQ:PANW) (Tuesday), Cisco Systems (NASDAQ:CSCO) (Wednesday), and Applied Materials (NASDAQ:AMAT) (Thursday). In particular, the retailers should provide insight into the health of US consumers, which so far, have shown no sign of reigning in their spending yet.

S&P 500 Technical Analysis: Previous 8-Day VIX Decline Streaks

One interesting move that some traders have identified is the eight consecutive day decline in the VIX, or Wall Street’s “fear gauge.” The index measures the implied volatility of options on the S&P 500 and generally moves inversely to the stock market index itself.

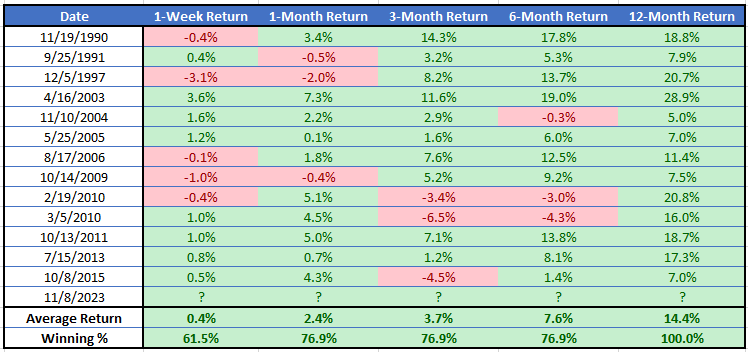

Streaks of eight consecutive days of declines are relatively rare historically, occurring just 13 times since 1990, or roughly once every 2.5 years. Interestingly, these streaks have historically led to above-average returns in the S&P 500, though of course past performance isn’t necessarily indicative of future returns. Following the previous 8-day losing streaks in the VIX, the S&P 500 (price only) has seen the following average returns:

- 0.4% over the following 1 week (vs. 0.2% in all periods since 1990)

- 2.4% over the following 1 month (vs. 0.7% in all periods since 1990)

- 3.7% over the following 3 months (vs. 2.2% in all periods since 1990)

- 7.6% over the following 6 months (vs. 4.5% in all periods since 1990)

- 14.4% over the following 12 months (vs. 9.3% in all periods since 1990)

Overall, the broad US index has traded higher one year later 100% of the time since 1990 after an 8-day losing streak in the VIX.

Source: TradingView, StoneX. Note that past performance is not necessarily indicative of future returns.

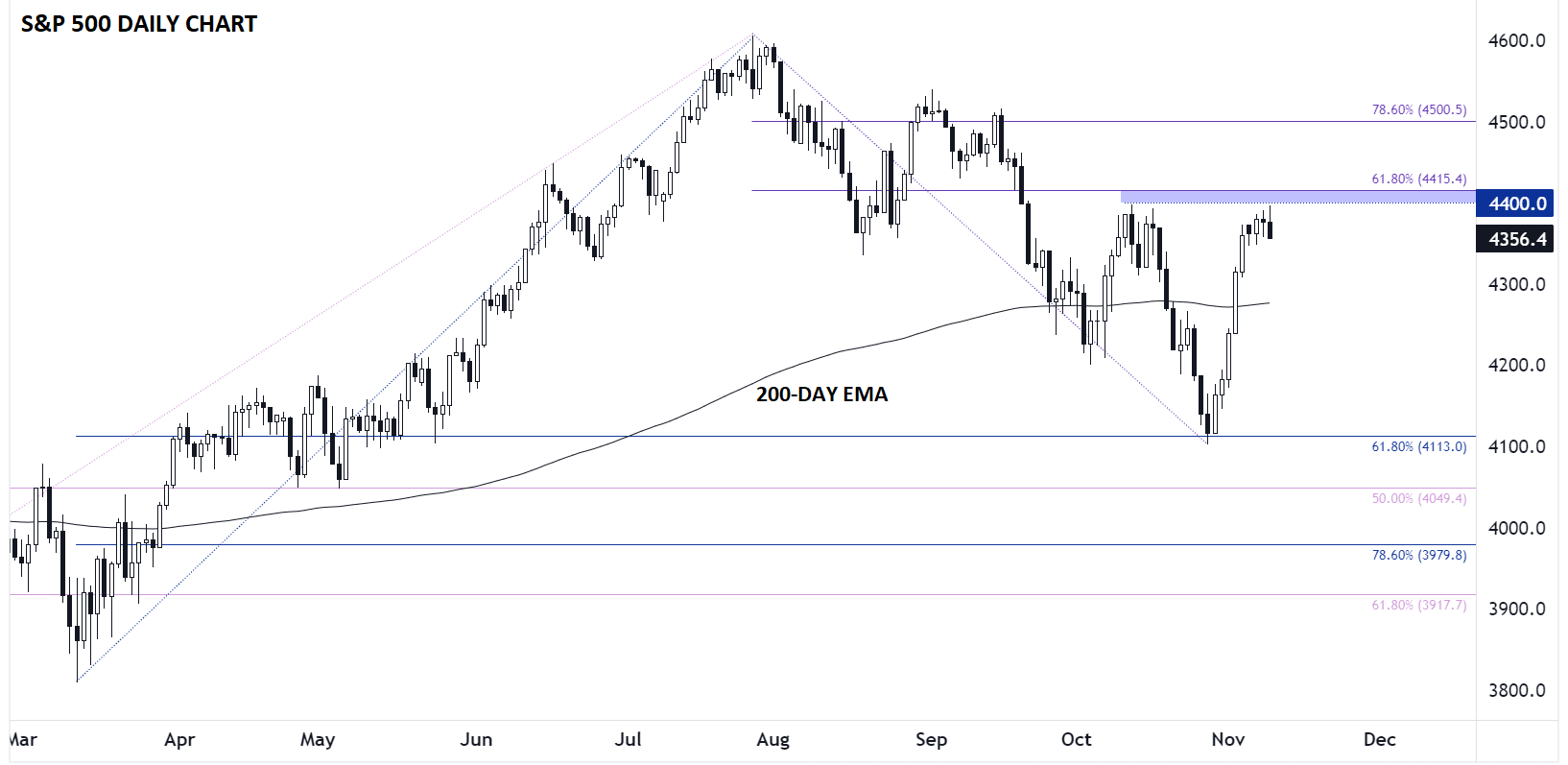

S&P 500 Technical Analysis – SPX Daily Chart

Source: TradingView, StoneX

Shifting back to more traditional technical analysis, the S&P 500 has seen an impressive rally off its late October low near 4100, though the pace of the rally has clearly slowed so far this week. Moving forward, key resistance looms in the 4400-44015 area, which marks the confluence of previous resistance and the 61.8% Fibonacci retracement of the July-October drop.

After such a strong rally last week, a pullback toward the 4300 area wouldn’t be surprising moving into next week. From a bigger-picture perspective, bulls will need to see the index conclusively break above 4415 before declaring that the post-July streak of lower lows and lower highs is over.

Despite the potential bullish implications of the VIX’s 8-day streak of declines, traders may still want to wait for confirmation that the S&P 500 itself is back in rally mode for now.