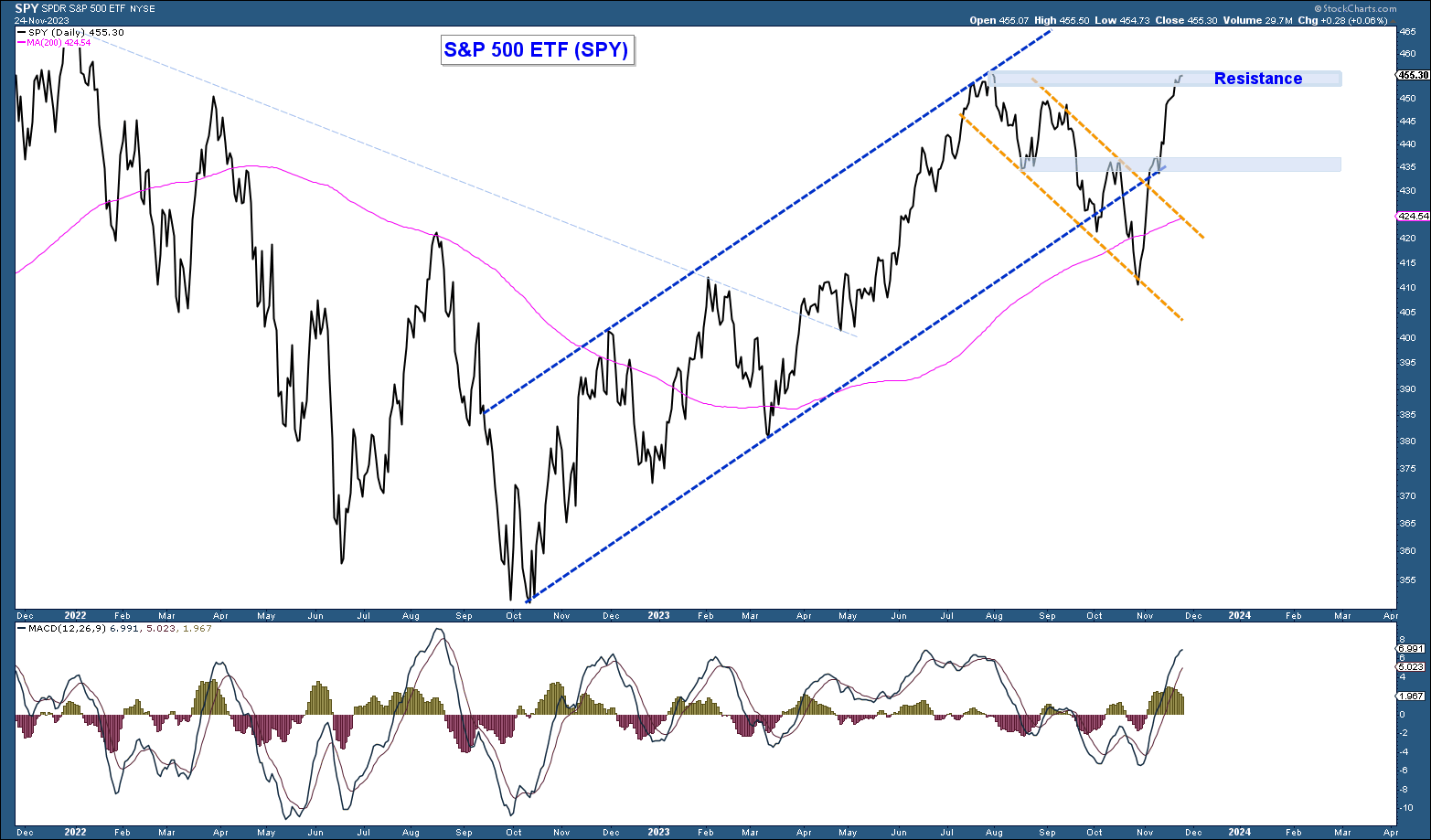

After reaching overbought levels and pulling back from August through October (declining orange channel in the chart below), the market has decisively broken out to the upside. The strength of the move suggests that the path of least resistance over the coming weeks and months is higher.

That being said, the market is short-term overbought, and the S&P 500 Index is sitting right at major resistance. Thus, the market may pull back/consolidate before making another run higher.

Any short-term market weakness should be viewed as a buying opportunity given longer-term market technicals have turned positive.

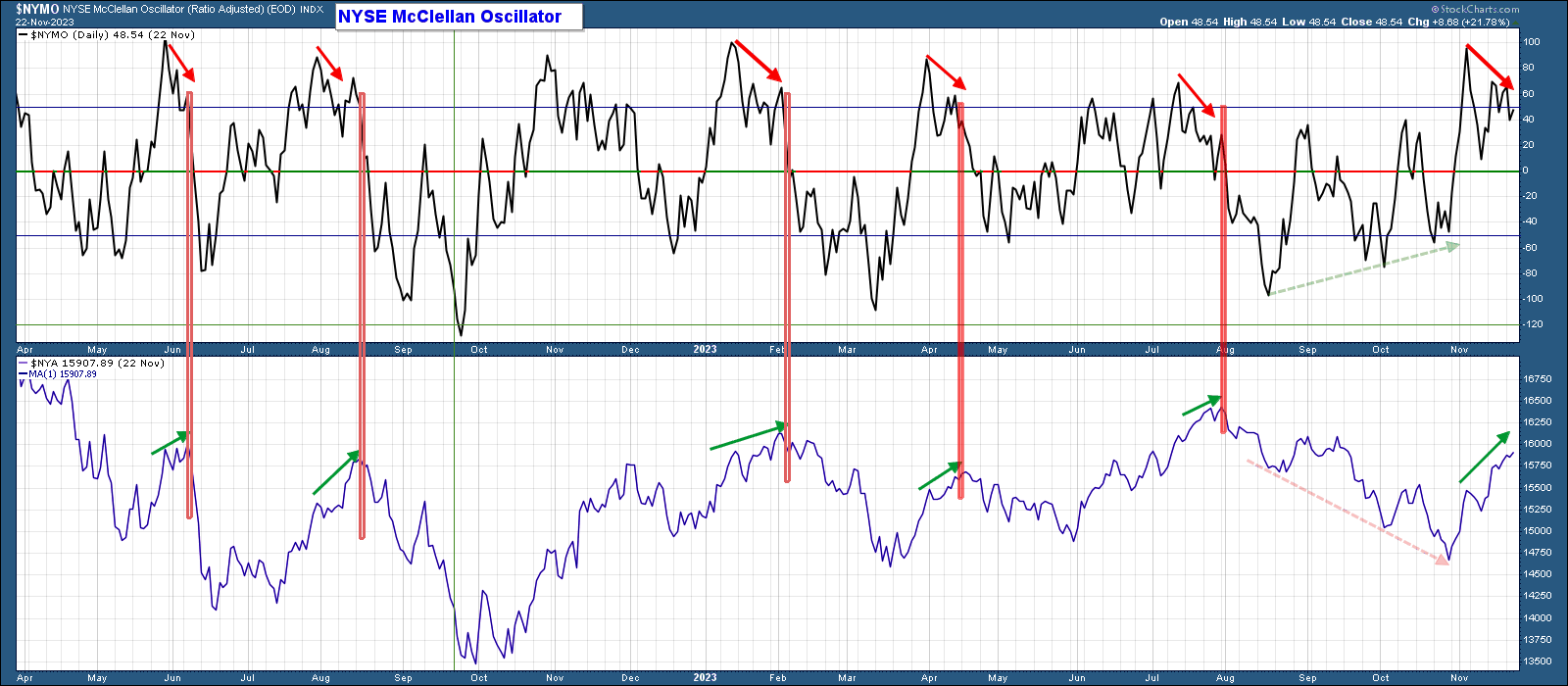

Market Breadth

A chart that suggests we may see near-term market weakness before a run higher is the NYSE McClellan Oscillator (chart below). The McClellan Oscillator is a breadth indicator that has recently been helpful with forecasting short-term market moves.

Notice how it has been common for the oscillator to display a negative divergence at key short-term market tops. This divergence is notated in red and occurs when the Oscillator falls as the index (bottom panel) advances.

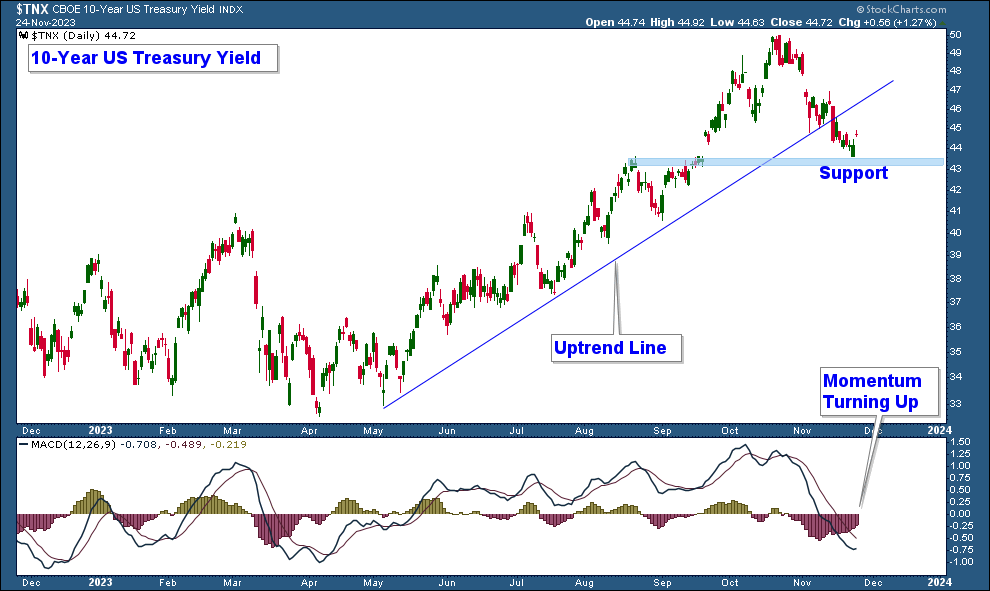

Bond Yields

The drop in bond yields off their late October peak coincides with the advance in stock prices that occurred at the same time. Below is a chart of the United States 10-Year in the top panel and the MACD (momentum indicator) in the lower panel.

Rising bond yields have been a headwind for stocks, and the recent decline is seen as a sign that inflationary forces may be abating. The yield on 10-year US Treasuries is sitting right on support after falling decisively below an uptrending trendline. This trendline break is bullish for the broader equity market and a move below support would be an additional bullish signal.