This article discusses one diverse component of the broad global markets; the US S&P 500. And there are macro risk indicators, including the US Dollar and its relationship with the Gold and Silver ratio.

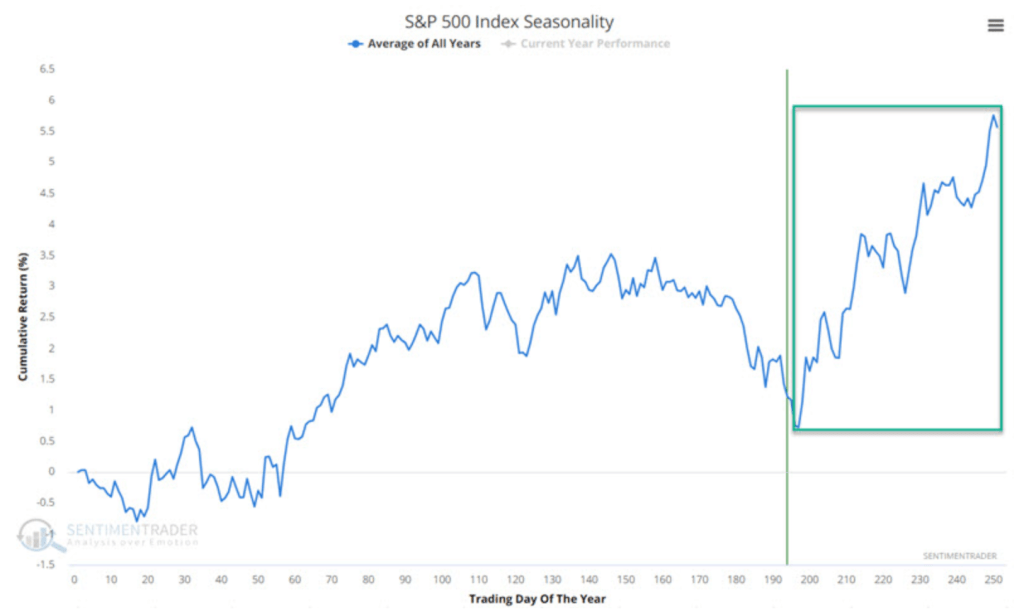

Filtering all of that out, we have anticipated a seasonal bounce or rally due to market sentiment well-biased to over-bearish, oversold conditions, and the seasonal pattern (on average) for SPX that has turned up.

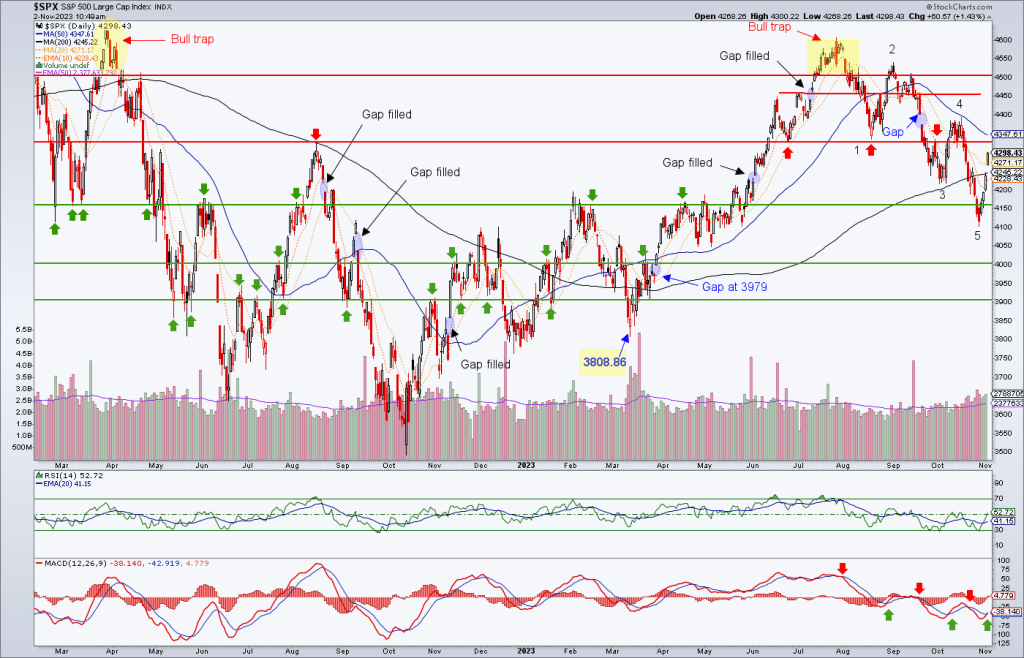

This is the daily ‘management’ chart for SPX we use in NFTRH most weeks. From this week’s NFTRH 781 while SPX was still ticking the low at 4117 (point 5):

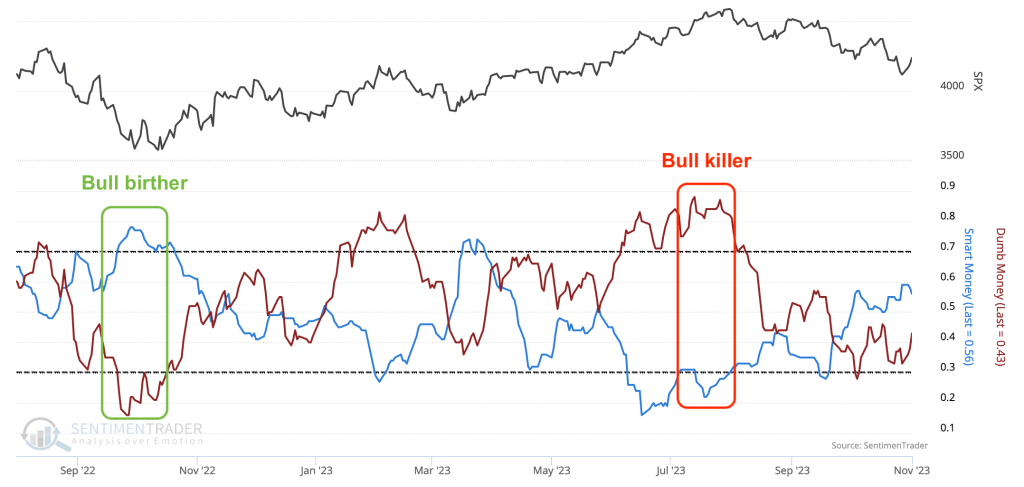

I am no Elliott Wave TA, but I would gather that if this were to be a more routine correction it would have corrected A-B-C down and bottomed with the early October test of the uptrending SMA 200. By taking one more wave up, failing at the SMA 50 and now impulsively cracking the SMA 200 deeper into the support cluster, I think we have a rhyme with the sentiment view we’ve been operating to; any coming seasonal rally (if applicable) could be the final act of the bull market after the “bull killer” Smart/Dumb sentiment reading last summer.

Below is the current chart, with a perhaps final act in progress. Again, a neat A-B-C correction would have been more conducive to a longer-term bullish ‘continuation’ view. But the failure of a would-be ‘C’ at point ‘3’ to hold as the low prompted a deeper probe into the thick support area, from which a bounce (at least) was very likely.

As you can see, clear visual resistance coincides with the 50-day moving average (4347). If that and point ‘4’ are taken out only then does the seasonal rally theme really start to pack a punch. We do, after all, allow for SPX to test its all-time high (4818.62), if not temporarily overthrow it, for a year-end grand bull suck-in.

However, SPX is still in a clear downtrend channel from the July high at this point. So if the seasonal is going to be more than a quick trade, follow through here or more downside grinding is needed. Regardless, due to many factors beyond the scope of this article, I expect a potentially severe bear market to begin in H1, 2024.

But in the here and now, we (NFTRH) have expected a hard test of support as something that would reset July’s “bull killer” extreme over-bullish (contrary bearish) sentiment profile. That reading bookended Q4, 2022’s extreme over-bearish (contrary bullish) reading per Smart/Dumb money readings at Sentimentrader and several other sentiment indicators we routinely track.

Everybody hated stocks when NFTRH was writing contrary bullish a year ago and if a seasonal rally plays out more people will love stocks, thinking the worst is over. In that situation, I’ll speculate bullishly (I already am, while still focusing mainly on the ‘no lose’ proposition of holding interest-bearing cash) in rotational areas that look best per the current macro backdrop (updated per NFTRH Trade Log & portfolio in weekly reports). But we will remain firm in anticipating what is next. This is not likely to be a sustainable bull market resumption.

The above is just a snippet of the type of comprehensive US and global stock market, precious metals, commodity, currency, sentiment, and macro analysis NFTRH provides every week in reports and in weeks. But I hope it helps provide perspective for your Q4 decision-making. The Q4, bounce/rally theme has discrete dos and don’ts. The 2024 bigger picture macro will have even clearer guidelines to operate by in order to find success. If you would like consistent and accurate guidance through the process, consider an affordable subscription to this “best of breed” broad market management service.

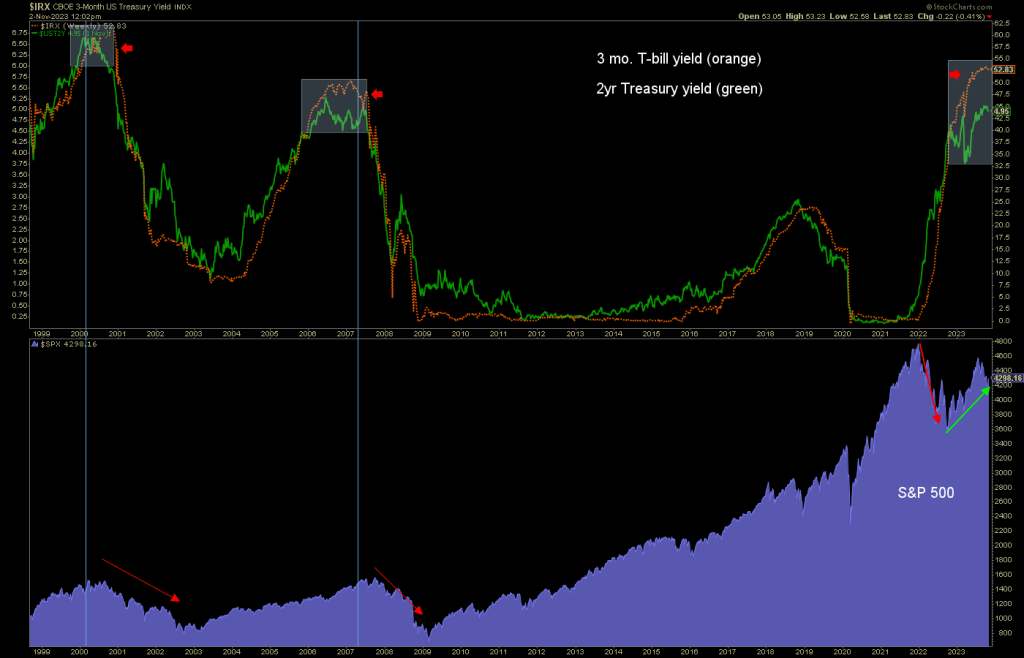

Final thought: Today (Thursday, 11.2) the headlines state that the market is rallying on hopes that the Fed is done hiking. One big problem for Champaign cork-popping bulls: It’s when the hiking regime ends after the 2 Year Treasury Yield has diverged from the Fed proxy T-bill yield for some time, that bear markets tend to begin.