Stocks extended Monday's gains, yet retreated from the daily highs – how bullish is that?

The short-term outlook hasn't changed as the S&P 500 still trades within Tuesday's intraday confines – we lack a clear short-term direction. In today's analysis, I'll cover what has changed and what has not since we last spoke. I'll also discuss the overnight dip on renewed corona fears – as if this news piece just arrived out of the left field. Yet, the market seems getting sensitive here.

S&P 500 in the Short-Run

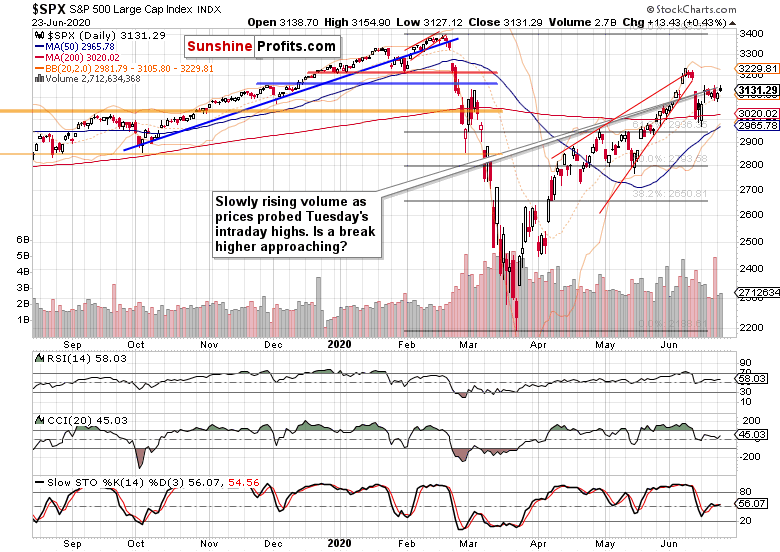

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

Monday and Tuesday have given us bullish price action, but the trading range of recent days hasn't been changed. Take a look at the price congestion, it's taking five trading days in a row already – the upcoming move either way would be sizable.

While yesterday's volume rose, it didn't increase enough to drive meaningful conclusions. Neither the daily indicators are clearly pointing either way in the short run.

In Monday's aftermarket, it was the Navarro–Trump exchange that hammered stocks.

The runup to today's regular session can be characterized by the corona second wave fears.

Such were my observations from today's intraday Stock Trading Alert:

Stocks appear to be getting increasingly spooked by the second wave fears, though all the pieces of the puzzle had been with us for quite a time already. Nonetheless, that spells a high likelihood of things not going the bullish way.

Yes, tensions are running high, and stocks have so far rebounded each time. But we all feel that the headline risk in this data-light week is skewed rather to the downside. Raise your hands if you expect another stimulus this week. That's it.

Technically, we see that downside risk precisely on the weekly chart – let's recall my comments from Monday:

The weekly chart shows last week's battle precisely. After reversing prior week's selloff on Monday and Tuesday, stocks stalled on Wednesday and Thursday. Friday's session opened encouragingly, and it appeared the bulls will close the week decently. Yet, despite two intraday rebounds, the sellers proved to be in the driving seat.

This week's candle got a bearish flavor as a result. The lower volume isn't as concerning as the upper shadow. The extended weekly indicators are whispering caution here as well, regardless of being still fit to power one or a few weeks of more upside before consolidating.

The candle-in-progress has caution written all over itself. The weekly chart also highlights the potential for quite some sideways trading. As I wrote earlier, stocks are in for a bumpier ride.

What would the credit markets say about the coming break's direction?

The Credit Markets’ Point of View

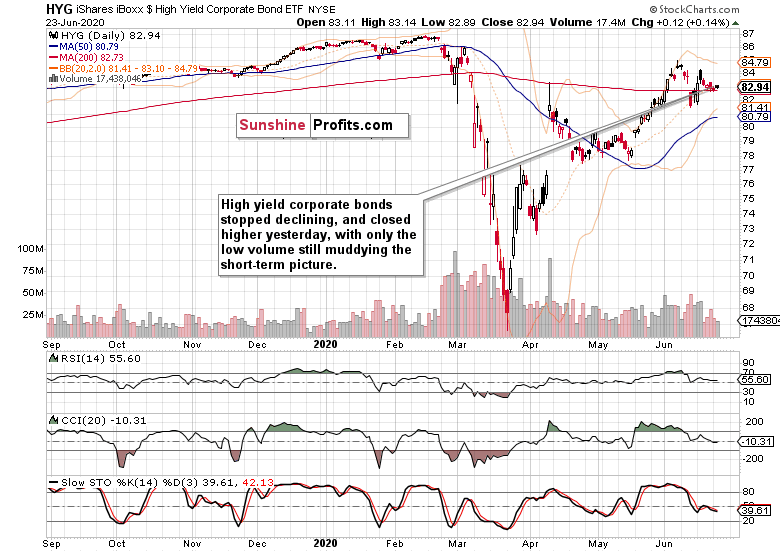

High-yield corporate bonds HYG ETF (NYSE:HYG) finally rose yesterday, but the volume was lackluster.

Does it mean an upswing will follow, or does this fact make it hard to trust it? As is the case with stocks, I look for downside vulnerabilities here, too.

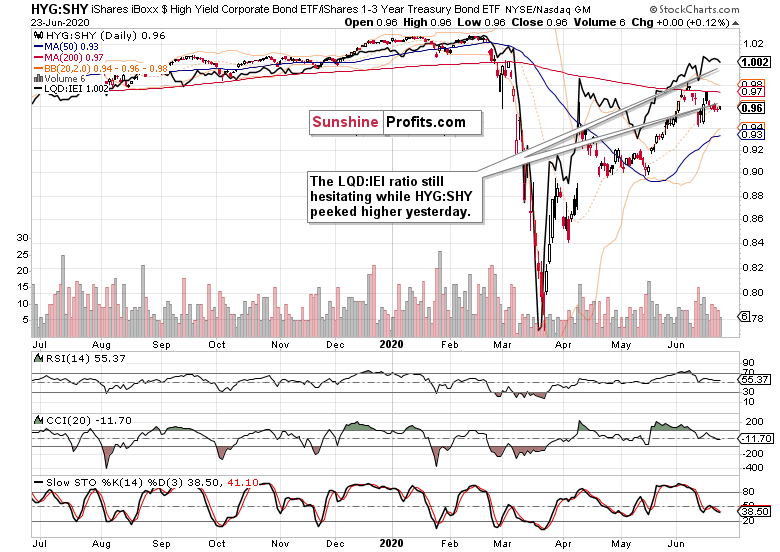

It's certainly concerning that investment grade corporate bonds to the longer-term Treasuries (LQD:IEI) ratio turned slightly lower yesterday, while the high-yield corporate bonds to short-term Treasuries one (HYG:SHY) rose. That';s a short-term red flag.

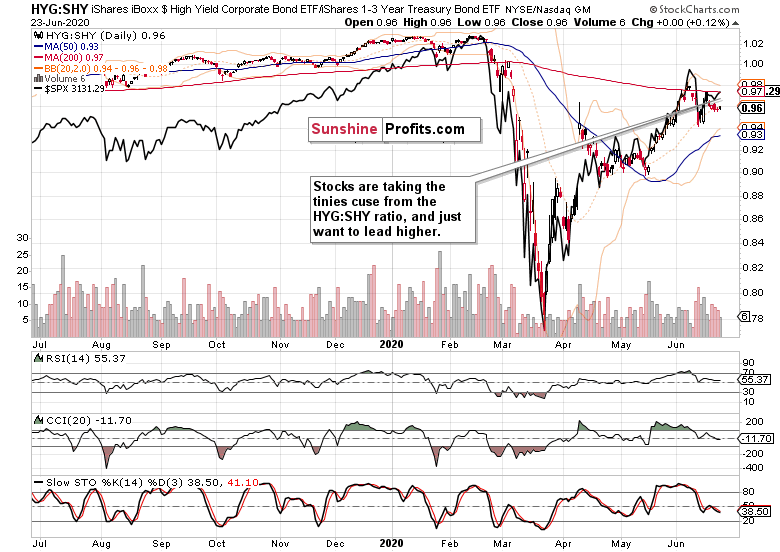

The S&P 500 peeked higher yesterday, while the HYG:SHY ratio followed upwards, too. But the net result is another short-term overextension in stocks, and that can turn on a dime.

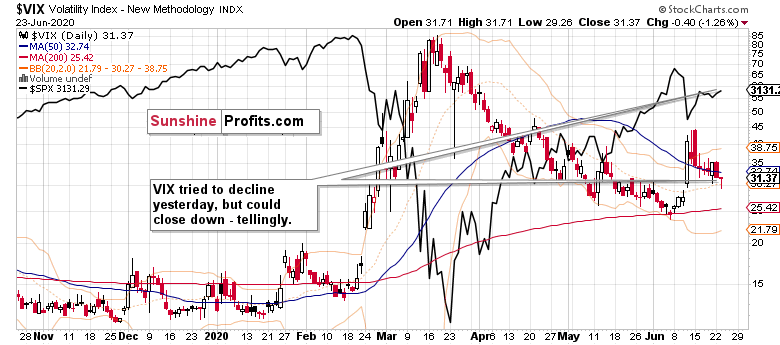

The favorite volatility measure, the VIX, also shows that not everything as regards the downside, might be already in. This forward-looking metric appears not to be in the mood to decline much more.

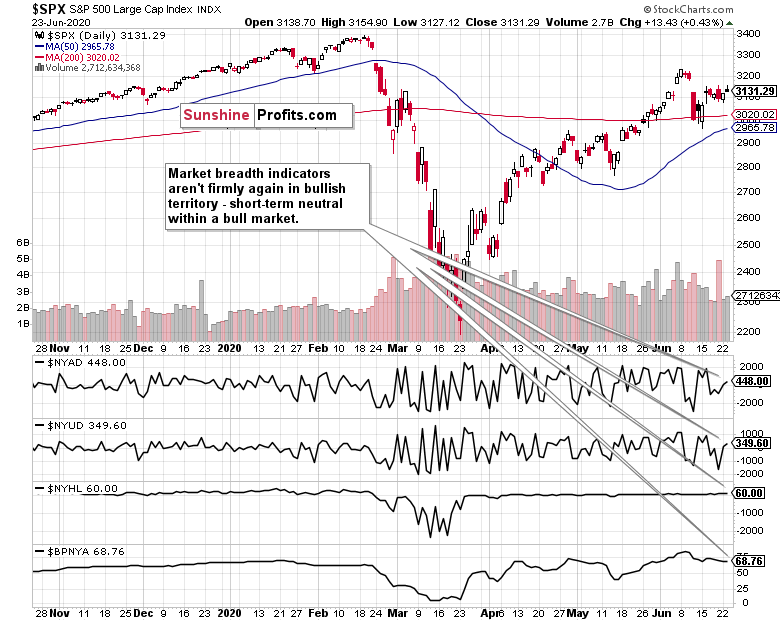

The market breadth indicators also paint a picture of the bulls not being at their strongest this very moment. The bullish percent index is declining, which shows bullish juices on the wane.

Summary

Summing up, the risk-on sentiment went on reasserting itself yesterday, but hasn't really changed anything in terms of outlook. On the other hand, the warning signs of a sizable move ahead are mounting, and they spell caution for the bulls. The S&P 500 remains vulnerable to a short-term steep slump as we've seen late on Monday and in today's premarket. The $VIX reveals that volatility might not have calmed down just yet, and the prospect of a more bumpier ride ahead for the bulls over the summer, remains on. Time to continuously assess whether stocks are or aren't getting ahead of themselves relatively speaking, and expect more risk-off environment in the weeks ahead. Right now, they are again very short-term extended.