- The year 2023 so far can be considered a successful year for stock markets

- And, forecasts for 2024 are moderately optimistic for risk assets

- From a technical standpoint, the S&P 500 could be heading toward all-time highs

- Missed out on Black Friday? Secure your up to 55% discount on InvestingPro subscriptions with our extended Cyber Monday sale

Despite the negative forecasts for equity markets at the beginning of 2023, the year has unfolded more favorably, defying the pessimistic scenario. Most indexes have demonstrated robust positive performance since January, with Nasdaq standing out with an impressive +36% gain so far.

Looking ahead to the next year, the forecasts indicate the bull market is likely to continue, potentially culminating in a rally toward all-time highs for stock indexes. But this scenario's probability hinges on avoiding a deep recession, a prospect that is not assured, especially in Europe, where the Eurozone is precariously poised on the brink of economic growth.

What Does the Macro Data Tell Us About Stock Market's Fate?

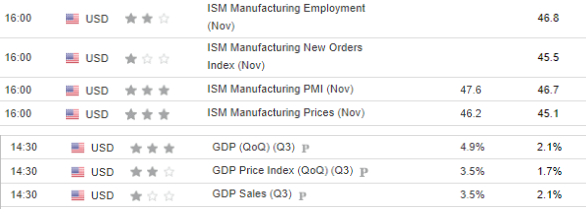

In the Eurozone, the data speak for themselves, clearly signaling an impending recession. Conversely, in the US, the latest GDP data showing a quarter-on-quarter growth of 4.9% significantly dismisses the recessionary scenario.

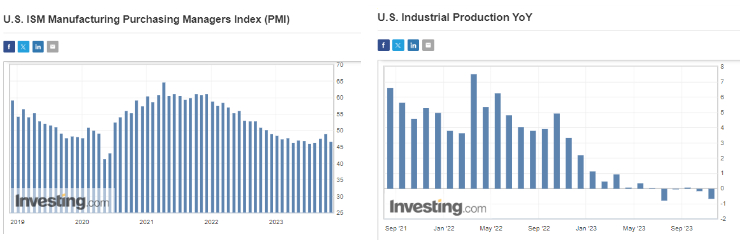

However, delving into other indicators related to economic growth paints a less optimistic picture. Notably, two indicators stand out: industrial production and manufacturing PMI, which have consistently lingered below the recession threshold for several months.

If we add to this the persistently inverted yield curve of US Treasury securities, the specter of recession in the United States still exists. Therefore, investors' attention should be focused this week on the next GDP and PMI readings, which will be published on Wednesday and Friday, respectively.

If GDP dynamics continue at relatively high levels along with continued disinflation, the stock market may not have an argument to make a deeper discount and continue to move northward.

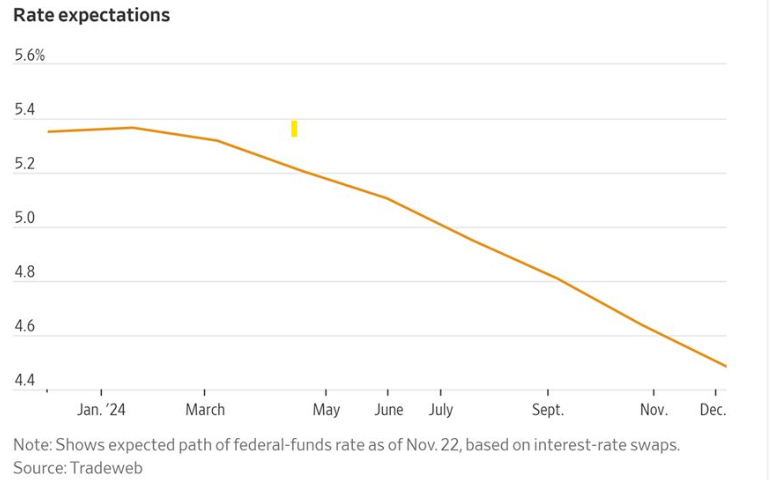

A Fed Pivot Is Coming

Despite the conservative statements of Federal Reserve officials, who avoid clear statements as to the first interest rate cuts, the market is already anticipating it. According to the current probability distribution, we can expect 4 rate cuts next year starting in May.

How will the stock markets react?

The current economic situation in the world's largest economy will be key. The Fed may start the rate-cutting cycle for two reasons: progressive disinflation or a significant weakening of the economy. For stock markets, by far the most optimistic scenario will be the former, where we reach the inflation target while avoiding a major recession.

S&P 500: The Last Resistance Awaits Before Historic Highs

The S&P 500's bull market has continued so far, as reflected in the form of a dynamic northward impulse. Currently, buyers are approaching a key resistance level located in the price area of 4600 points, which is also this year's high.

The basic scenario assumes that the indicated area will be broken out and the growth will continue, with the next target in the vicinity of the historical maxima at 4800 points. Market bulls are favored by statistics, which show that December in the pre-election year counting from 1950 in 70% ends on a positive note with an average return of 2.9%.

***

You can easily determine whether a company is suitable for your risk profile by conducting a detailed fundamental analysis on InvestingPro according to your own criteria. This way, you will get highly professional help in shaping your portfolio.

In addition, you can sign up for InvestingPro, one of the most comprehensive platforms in the market for portfolio management and fundamental analysis, much cheaper with the biggest discount of the year (up to 55%), by taking advantage of our extended Cyber Monday deal.

Disclosure: The author does not own any of the securities mentioned in this report.