US stock indices have rallied impressively in October and November, but the start of December is still heavy. And now is the right time to figure out whether the previous two months were a bear market rally or the beginning of a new bull market.

Right now, there is no answer to that question. It may not be until after the Fed meeting on Dec. 14, as the markets need a strong signal to move from the current point.

The stock market has been moving up in the last two months, initially due to a correction after oversold conditions and then on speculation that the Fed will slow the pace of policy tightening. We consider a further retreat in commodity prices to be another supportive factor that eases consumer and company spending burden.

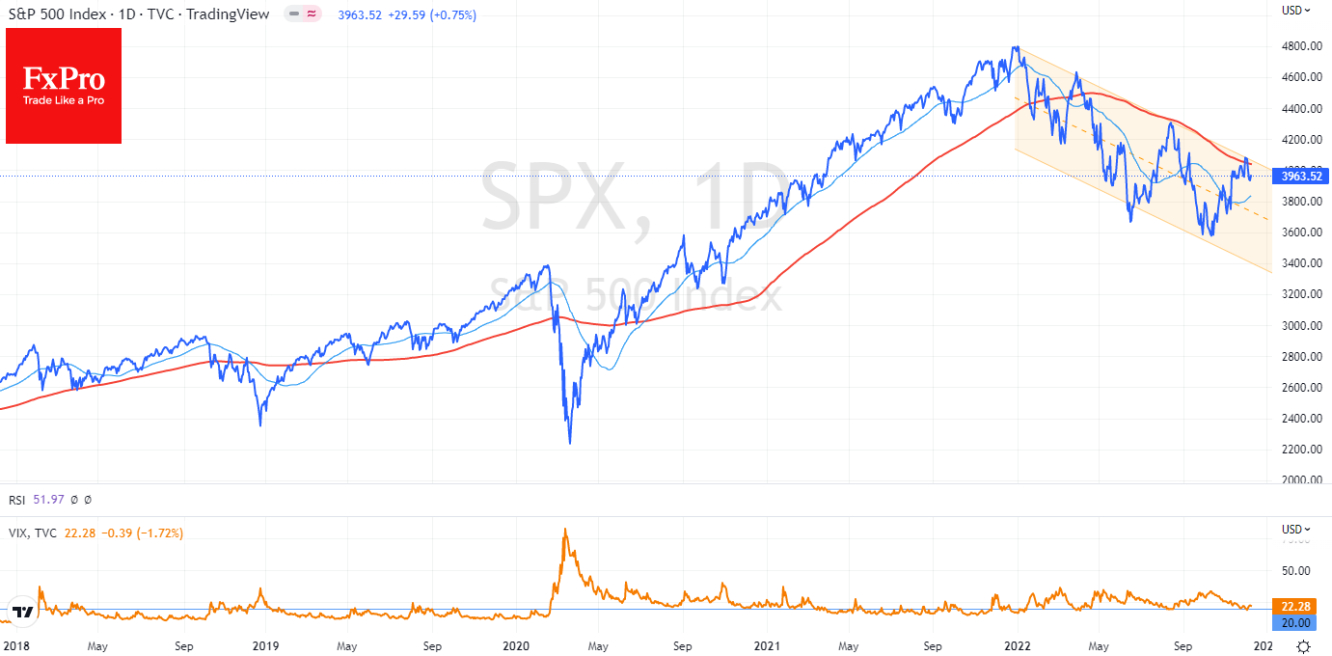

Nevertheless, the two-month rally in S&P 500 has stalled near the 200-day moving average. The close of October above this curve triggered a sell-off momentum from the first days of December. It would have looked like technical profit-taking if not for the disturbing analogies, as the market reversed from this line in April and August.

Another worrying signal is the performance of the VIX. It has reversed upwards twice since the beginning of the year from the 20 levels, almost coincidentally with the reversal of the S&P 500. By early December, this story repeats as the VIX have reversed to growth after briefly dipping below 20.

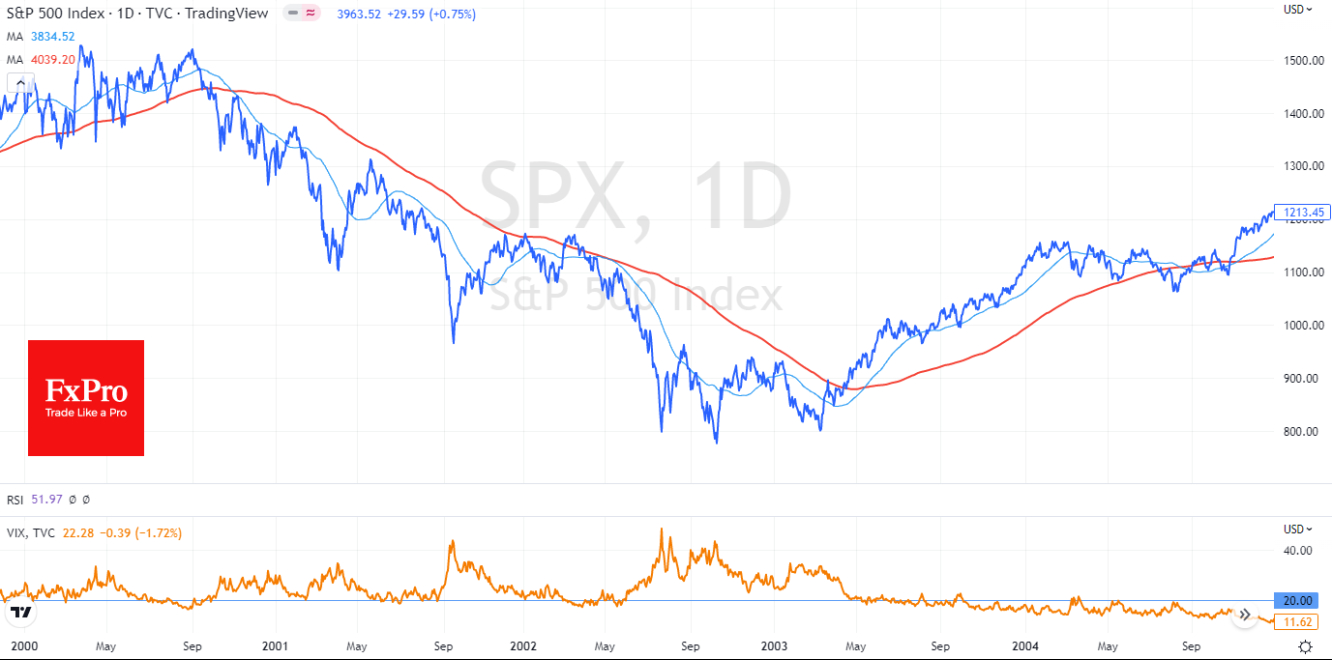

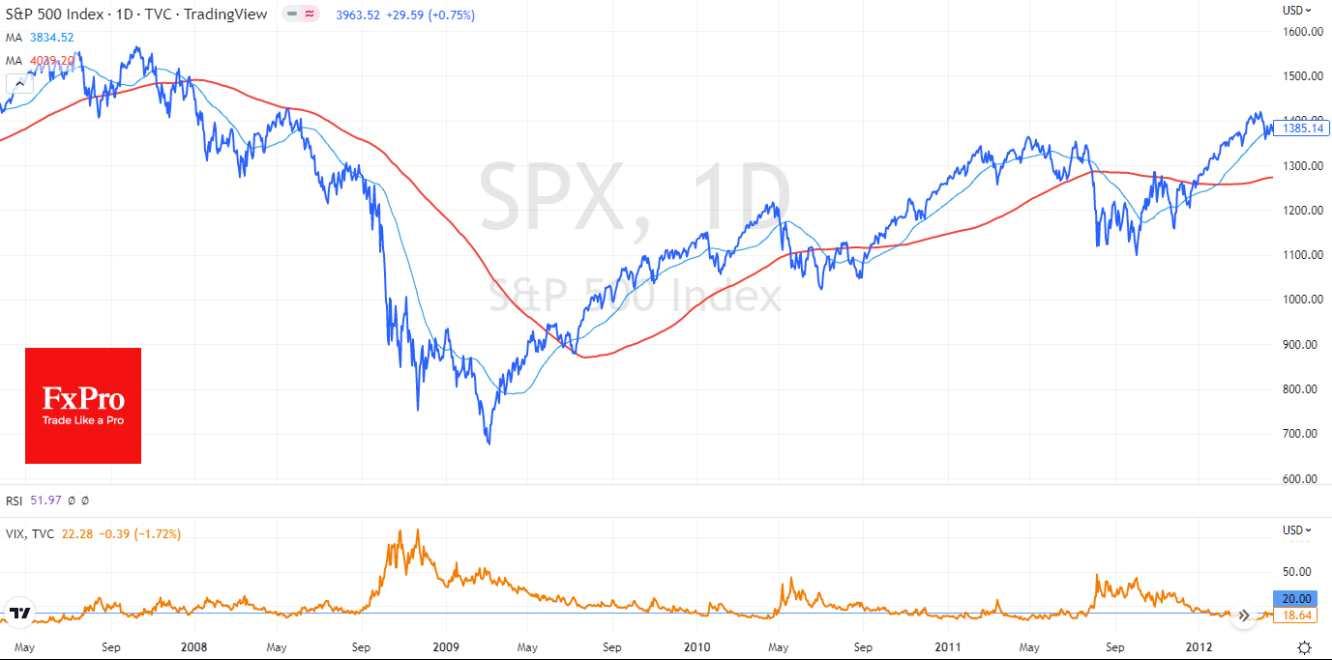

During the 2000-2003 bear market, to which we often compare the current situation, it was prudent to remain bearish while the index was steadily below its 200-day average and the VIX fear index bounced back from 20.

These correlations could still work now, although they give a buy signal with an impressive delay. It is also important to note that after the volatility of 2008, the buy signal from the VIX came a year late after the market bottomed in March 2009. This is understandable, as the Fed’s QE supported the market and suffered another three years of sharp corrections.

Our days, market participants may postpone the decision about the future market regime until the Fed's official comments and press conference next Wednesday. Further assurances from the world's biggest central bank that the decline in inflation is sustainable and a slower rate hike is to be expected further, despite indications that the economy and labor market are still better than market expectations, will be required for continued gains in equities.

However, when the market is determined, we may see a strong trend in one direction within a few weeks, so remember the importance of the current momentum. Looking at the market levels, an S&P 500 rally above 4050 would open the way to 4300 within 4-6 weeks and to 4600 by the middle of next year.

If the bears prevail, the S&P 500 could make a new local low around 3600 before the end of January, and it will start making regular lows in the first quarter of next year.