Q2 ’24 SP earnings will start in the next two weeks – the big banks should start reporting by Friday, July 12th, ’24.

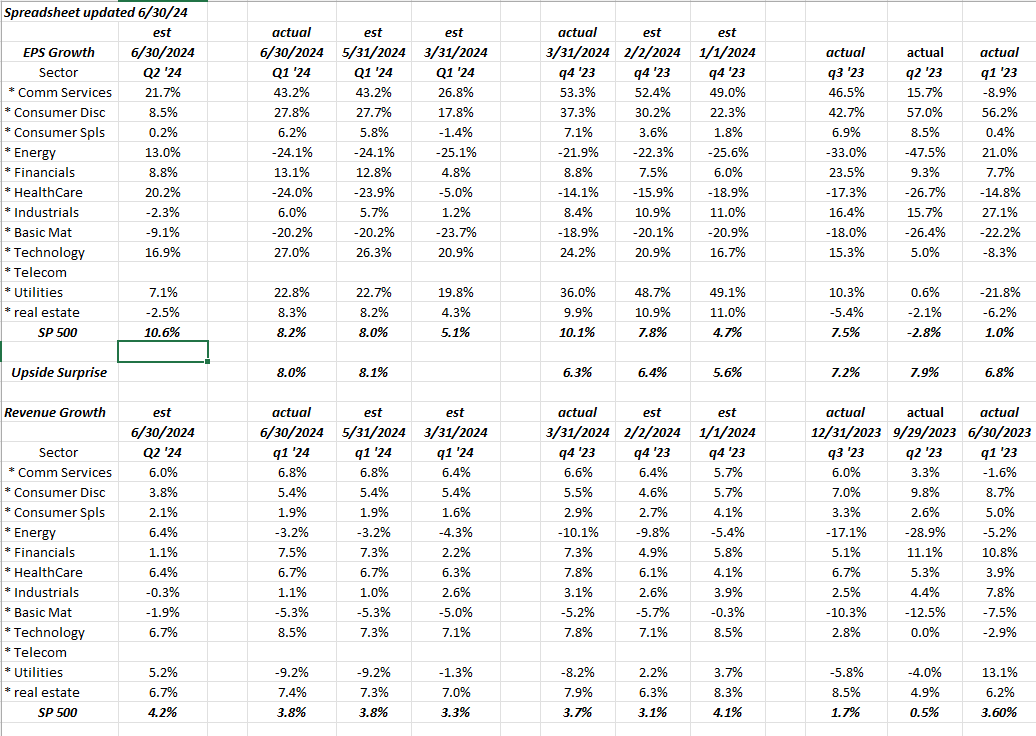

The above table reflects the historical trends in S&P 500 EPS and revenue growth, starting with Q1 ’23, and for the last two quarters shows how the estimates changed during the Q4 ’23 reporting period and then again for Q1 ’24’s reporting period.

Data source: LSEG (formerly IBES data by Refinitiv)

Here’s what jumped out in looking at this table:

1.) The technology sector still faces a very weak comp in Q2 ’24, versus the Q2 ’23 numbers: tech sector EPS grew only 5% on flat revenue in Q2 ’23. Today, the tech sector EPS is expected to grow 16.9% in Q2 ’24, on revenue growth of 6.7% y-o-y.

More importantly, readers should look at the technology EPS line in Q1 ’23 and then read across (right to left) and note where tech sector EPS growth estimates started in Q4 ’23 and Q1 ’24 and then ended 12 weeks later. Tech sector revenue was pretty much unchanged (no real trend in revenue growth) the last two quarters.

2.) Energy sector: energy sector growth has been negative the last 4 quarters but is expected it improve sharply in Q2 ’24. Same with energy revenue growth, but revenue has been negative the last 5 quarters, i.e. Q1 ’23 through Q1 ’24, but is expected to be +6.4% in Q2 ’24.

3.) Communication services: look at the trend improvement in EPS in Q1 ’24 for Comm Services (i.e. META (NASDAQ:META) and Google (NASDAQ:GOOGL) is the lion’s share of the sector). META is now facing tough comps since the stock bottomed in Q3 ’23, and margin grew sharply from there. The easy money may have been made for META, to this point, which is not to say the stock goes down, but META’s operating margin did grow sharply in ’23 and Q1 ’24.

4.) The capital tests for the bank led to a number of buybacks and dividend increases for the big banks on Friday night, June 28, ’24. Let’s see if the financial sector EPS gets a bump into the month of July ’24, as I’m expecting it to do. Capital markets activity, like bond issuance, should still be fairly healthy, although the IPO market seems quiet.

5.) Finally the healthcare sector is expecting it’s best EPS growth since Q1 ’22 in Q2 ’24 at +20.2%. It’s had a horrid string of negative y-o-y growth EPS quarters since Q4 ’22. Healthcare revenue growth is rock solid. Hasn’t wavered much at all although it was mid-teens growth in ’21 and ’22, that has tapered down to mid-single-digits in ’23 and now ’24 no doubt as the Covid vaccines have faded. GLP-1 drugs have really helped growth – even Pfizer (NYSE:PFE) says they are experimenting with one, although they are well behind the curve.

If readers own just the 5 sectors mentioned that is 70% of the S&P 500’s market cap as of this weekend. No mention was made of consumer discretionary since EPS slowed down from 40% – 50%+ growth in ’23 to 20% – 30% in Q4 ’23 and Q1 ’24, while revenue growth slowed from high-single-digits to mid-single-digits from ’23 into ’24. Tesla’s slowdown in revenue and EPS growth has had to hurt the sector, although Amazon (NASDAQ:AMZN) remains pretty stable. (Amazon and Tesla (NASDAQ:TSLA) were the two biggest sector weights in early ’23.)

Conclusion:

These historical sectors EPS and revenue growth (estimate vs actual) go all the way back to 2010 and 2011, but that data really isn’t relevant today. I started logging the values just to see what was “high, average and low” growth rates, but Covid really skewed the data, resulting in exceptionally high and low figures.

Q2 ’21 saw 96% EPS growth for the S&P 500 on 25% revenue growth. Obviously, that’s not anything near normal.

Q2 ’22 S&P 500 EPS growth is expected at +10.6%, the best quarter of EPS growth since Q1 ’22, while expected revenue growth at +4.2% is the strongest quarter expected since Q1 ’23’s +5.6% actual growth.

Disclosure: Anyway, none of this is advice or a recommendation, but rather an opinion. The goal through the summer will be to see how revenue and EPS growth by sector track versus the starting estimates on June 30 ’24. Past performance is no guarantee of future results. Investing can involve the loss of principal, even for short periods of time. All EPS and revenue data is sourced from the London Stock Exchange Group (www.LON:LSEG.com).

Thanks for reading.