US stock indices developed a strong rebound all last week. The S&P 500 spot index reached 4200, gaining more than 10% from the lows of May 20.

Is this a brief bear market rally, or have the markets bottomed out?. The situation looks like touching bear market territory was a red rag for the bulls, who have since turned aggressive. Fundamental factors are now on the side of the former, while technical analysis favours the latter scenario.

Authorities in the USA and other developed economies are increasing the pace of monetary policy tightening, focusing on fighting inflation rather than supporting economic growth. We continue to get bearish signals from this perspective, as the economy and markets have yet to feel the brunt of rates not seen in over ten years.

Meanwhile, inflation and a slowdown in consumer demand due to high rates promise to eat into real corporate profits in the coming months. The tipping point in consumer activity is unlikely to come before we hear from the Fed that there will be no further rate hikes.

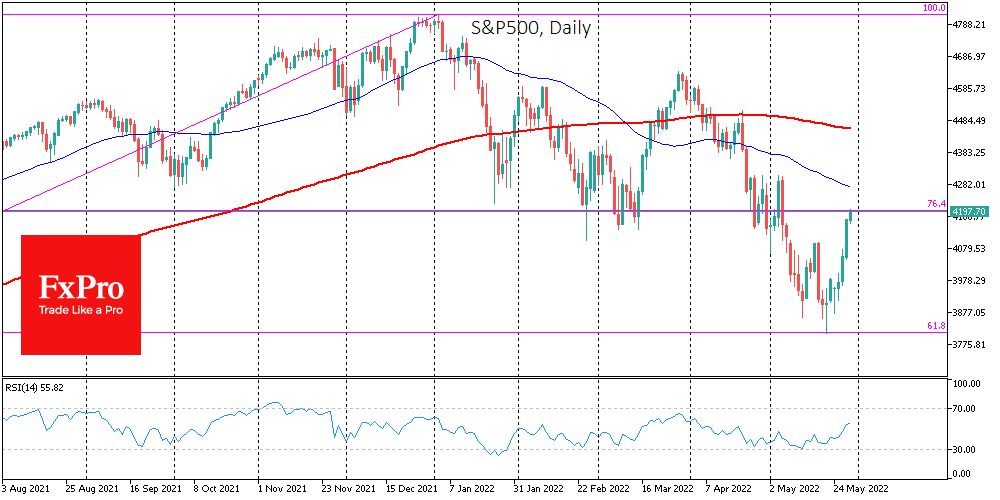

The S&P 500 index has touched 61.8% of the rally from the lows of March 2020 to January 2022. We have seen some rallies in a falling market during the five-month decline. But so far, touching the formal bear market area (20% decline from the peak) in the S&P 500 has attracted buyers.

Moreover, by the time the market touched the lows earlier this month, it was already oversold, but there were also signs of divergence between the RSI on the daily timeframes and the index level. This is a clear indication that the selling was not as fierce as before.

The very fact that the S&P 500 took a 7-week-long losing streak, one of the longest in history, and has now shown a sharp rebound, is setting a positive mood. The last time we saw such a bullish awakening was in November 2020, after which the stock market added for more than a year, even though there seemed to be no room for growth.