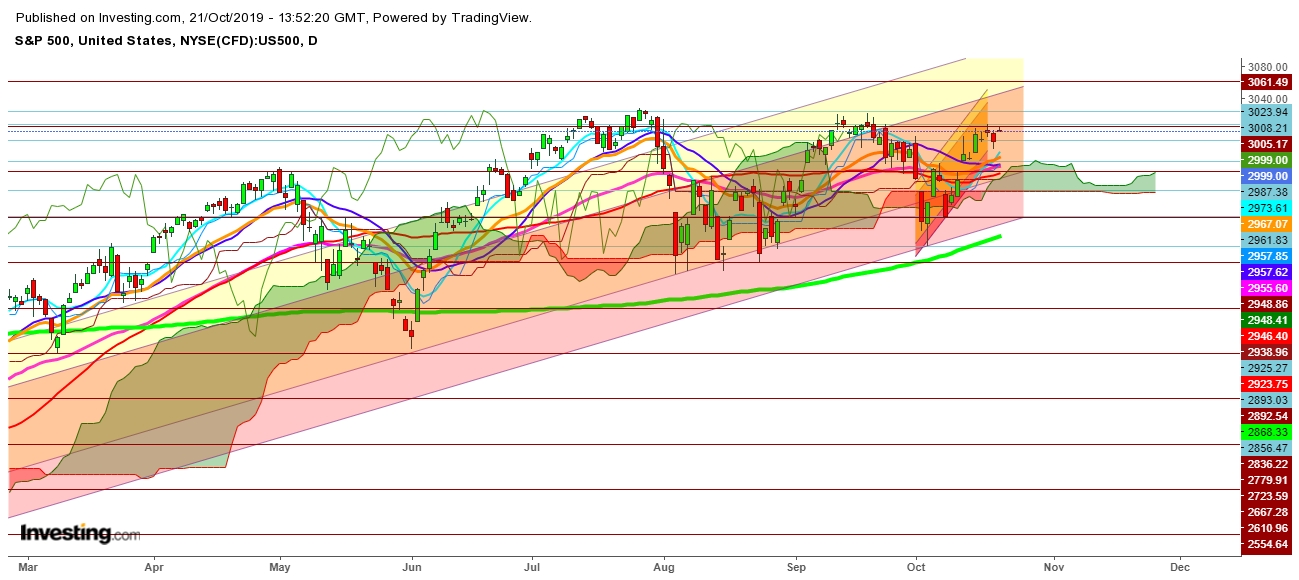

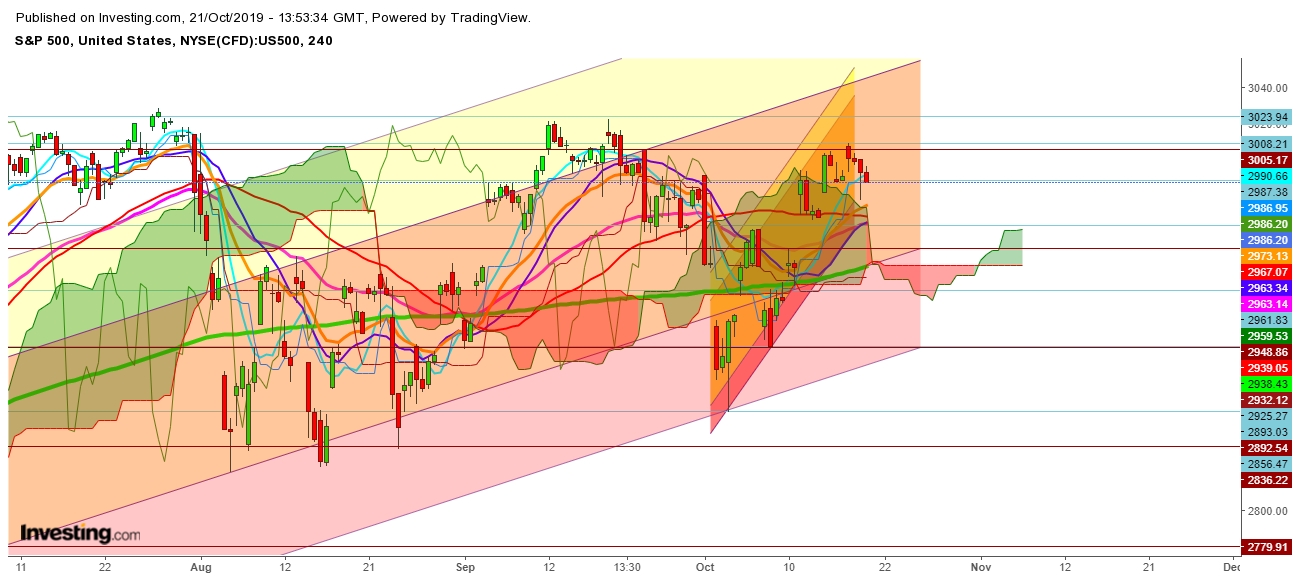

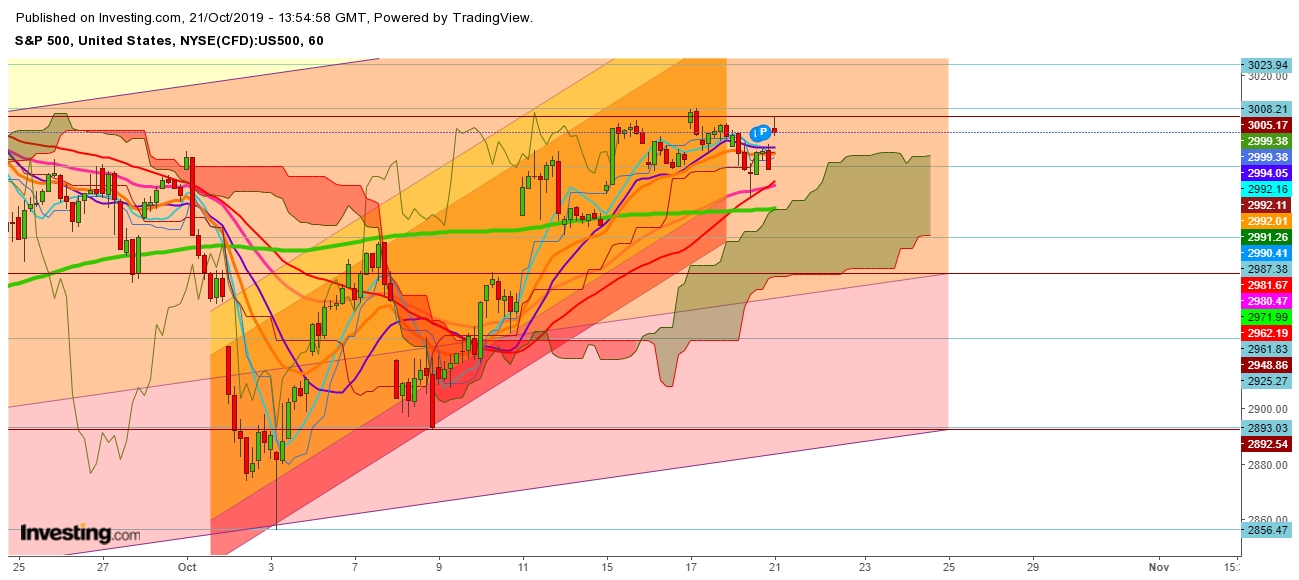

On analysis of the movements of S&P 500, in different time frames, I find that the S&P 500 may see extending exhaustion amid growing global uncertainty due to changing dimensions of different deals.

Brexit Deal

British Prime Minister Boris Johnson will again try to put his Brexit deal to a vote in parliament on Monday after he was forced by his opponents to send a letter seeking a delay from the European Union. I find that the global equity markets may face tough time if, there is a hard Brexit—meaning leaving without a deal—could have severe repercussions for global risk markets.

Sino-U.S. Tariff Trade Deal

I find that despite of the plethora of promises, made during these formal meets; look evident enough to extend exhaustion in global equity markets as same as the Sino-U.S. tariff trade issue turned in to tussle in October 2018; and continue to damage global economies. No doubt that during the formal meets between the two major economies of the world, only partial deal remained the final outcome, which may enhance the current uncertainty for even longer duration in near future; as China has started to look toward India as one of the major destinations to keep its own economy after locking its final deal on Sino-U.S. front.

Finally, I conclude that the steady Gold futures around $1500 look evident enough to show the quantum of prevailing weakness in global equity markets; which may extend exhaustion any time as the global equity markets still tend to face sharp volatile moves till November 17th, 2019. To wy videos on S&P 500 subscribe to my YouTube Channel ‘SS Analysis’ https://www.youtube.com/channel/UCnsjgic3owWKZtx1wbTbKLQ

No doubt that despite a slightly higher opening bell on Monday, as chatter continued over the U.S. and China making a temporary trade deal; S&P 500 looks ready to take a steep downward move after facing stiff resistance at 3003.

Disclaimer

1. This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.