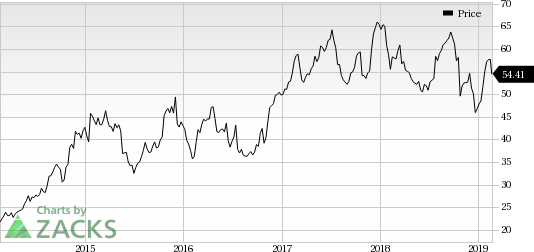

Southwest Airlines Co. (NYSE:LUV) has provided a bearish outlook on revenues and operating revenue per available seat mile (RASM: a key measure of unit revenues) for the first quarter of 2019 following the recent U.S. government shutdown. The company also stated that the loss of revenues due to the 35-day shutdown would be beyond what was earlier expected. Post this downbeat guidance, shares of the company declined more than 5% at the close of business on Feb 20.

The damage was not just limited to Southwest. Other notable industry players like Delta Air Lines (NYSE:DAL) , American Airlines (NASDAQ:AAL) and Spirit Airlines (NYSE:SAVE) also saw their shares take a hit.

The carrier now anticipates first-quarter revenues to suffer an adverse impact of $60 million. Previously, the airline predicted revenues to reduce by $10-$15 million pertaining to government shutdown. Although the government shutdown ended on Jan 25, the company continues to struggles with softness in bookings and passenger demand. There is also speculation of a second government shutdown, which is hurting demand. As a result of weak bookings, the airline now forecasts RASM to increase in the range of 3-4% compared with a rise of 4-5% expected earlier.

Apart from hampering sales, the shutdown has delayed the carrier’s plans to launch its Hawaii flights. The operations are now anticipated to begin next month. Previously, the carrier hoped to begin selling tickets for its new service by the end of 2018.

Operational Delays

This Zacks Rank # 2 (Buy) company has lately been going through turbulent times due to mechanical issues, which have rendered a large number of its aircraft unfit for flying. The disturbance has been causing large-scale flight cancellations since Feb 15, the day the carrier called for an ‘’operational emergency’’. Meanwhile, management stated that it would investigate the mechanical problems to check whether the ongoing negotiations with Aircraft Mechanics Fraternal Association (AMFA) are sparking the trouble. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Notably, the AMFA currently represents approximately 2,400 mechanics at Southwest. The airline has been negotiating with the union, mainly on pay-related issues for more than six years.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Spirit Airlines, Inc. (SAVE): Free Stock Analysis Report

American Airlines Group Inc. (AAL): Free Stock Analysis Report

Delta Air Lines, Inc. (DAL): Free Stock Analysis Report

Southwest Airlines Co. (LUV): Free Stock Analysis Report

Original post

Zacks Investment Research