Have you been eager to see how Southern Company (NYSE:SO) – one of the largest utilities in the U.S. – performed in Q3 in comparison with the market expectations? Let’s quickly scan through the key facts from this Atlanta, GA-based utility’s earnings release this morning:

About Southern Company: Through its eleven electric and natural gas distribution units in nine states, Southern Company serves approximately nine million customers. It boasts of a generating capacity of 44,000 megawatts, around 200,000 miles of electric transmission and distribution lines, and more than 80,000 miles of natural gas pipelines. Southern Company’s operations include wholesale electricity generation and natural gas services, retail energy services and natural gas storage operations throughout the country.

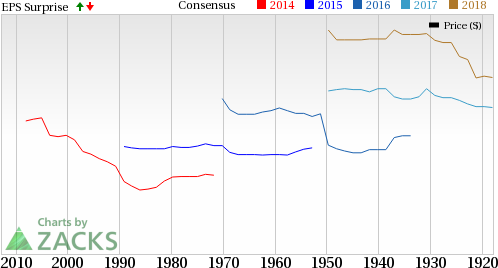

Zacks Rank & Surprise History: Currently, Southern Company has a Zacks Rank #4 (Sell) but that could change following its third-quarter 2017 earnings report which has just released. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Coming to earnings surprise history, the company has a good record: its beaten estimates in three of the last four quarters resulting in an average positive surprise of 0.86%.

Estimate Revision Trend: Investors should note that the earnings estimate revisions for Southern Company depicted pessimism prior to the earnings release. The Zacks Consensus Estimate fell 5.3% over the last 30 days.

We have highlighted some of the key details from the just-released announcement below:

A Higher-than-Expected Profit: Earnings per share (excluding certain one-time items) came in at $1.12, ahead of the Zacks Consensus Estimate of $1.08.

Revenue Came in Lower than Expected: Revenues of $6,201 million lagged the Zacks Consensus Estimate of $6,380 million.

Key Stats: Southern Company’s total retail sales fell 5.6%, with residential and commercial sales both deteriorating. This brought about a downward movement in overall electricity sales and usage. Total electricity sales during the third quarter edged down 0.6% from the same period last year. However, total wholesale sales jumped 19.4% year over year.

The power supplier’s operations and maintenance cost decreased 8.8% to $1,287 million, while the utility’s total operating expense for the period – at $4,156 million – was down 4.4% from the prior-year level.

Check back later for our full write up on this Southern Company earnings report later!

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Southern Company (The) (SO): Free Stock Analysis Report

Original post

Zacks Investment Research