Market Brief

Here we are, on Thursday the ECB is expected to take action by increasing its support to the economy. Mario Draghi has plenty of tool to do it but we anticipate that the ECB will cut in the deposit rate as well as an increase of the size of the bond purchase programme and an extension of the QE. The decision is due on Wednesday. Meanwhile, we believe that the increase/extension of the stimulus has already be priced in, both in the equity and FX markets, which means that if Draghi does not deliver it will most likely cause a sell-off in equities and an adjustment of the EUR complex. EUR/USD continues to move lower even though the negative momentum is losing steam ahead of the decision. The key level at 1.0458 (March 16th low) will continue support the pair while on the upside the strongest resistance area lies at around 1.11. The single currency is currently treading water between 1.0570 and 1.06.

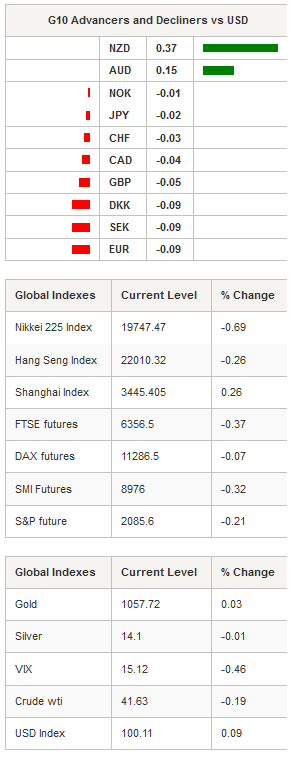

In Australia, inflation data released earlier this morning showed that prices level remained stable in October as the economy adjusts to the low commodity prices environment. TD securities inflation printed flat 1.8%y/y in November while on a month-over-month basis the gauge rose 0.1% compared to a flat reading in October. Separately company operating profit climbed 1.3%q/q in the September quarter, beating market expectations of 1% and upwardly revised contraction of -0.5% in the previous quarter. As a result the Aussie got a little boost following the release of the data with AUD/USD rising above the 0.72 threshold. With the RBA willing to stay on the sidelines for now and with the Aussie economy stabilising, we believe that there is room for further AUD appreciation, especially given the fact that the upcoming lift-off by the Federal Reserves is almost completely priced in.

In South Korea, both the equity market and the won got hammered amid disappointing data from the industrial sector. Industrial output contracted 1.4%m/m (s.a.), well below median forecast of -0.9% and previous month’s upward revision of 2.2%. On a year-over-year basis, industrial production expanded 1.5% versus 2.2% consensus. Consequently the KOSPI was sold-off in the Asian session and dropped 1.82% while the local currency retreated -0.45% against the greenback.

NZD/USD is among the biggest winner for now as the Kiwi surged 0.35% against the US dollar on better-than-expected as business confidence climbed to 14.6 versus 10.5 in the previous, the highest reading since May this year, as companies regain confidence and start looking positively toward the future. NZD/USD rose as much as 0.75% in the Asian session and is back above 0.6550, confirming the trend reversal initiated a couple of weeks ago. A first resistance can be found at 0.6567 (Fib. 50% on September-October rally) while on the downside a support can be found at 0.6430 (low from November 18th).

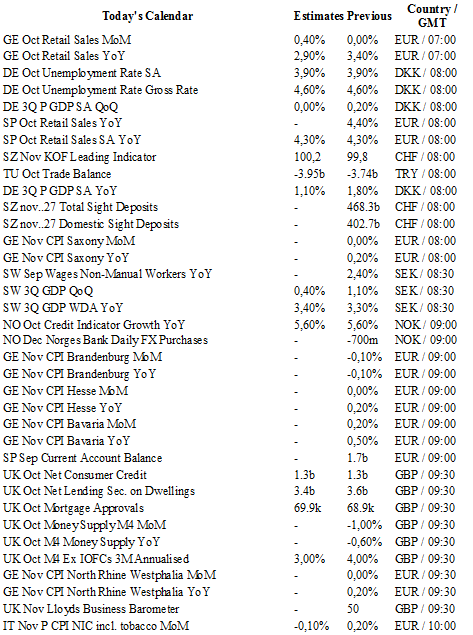

Today traders will be watching GDP from Sweden; mortgage approval from the UK; inflation data from Italy; trade balance from South Africa; budget balance from Brazil; CPI from Germany; Chicago purchasing manager index, pending home sales and Dallas Fed manufacturing activity index from the US.

Currency Tech

EUR/USD

R 2: 1.1387

R 1: 1.1095

CURRENT: 1.0590

S 1: 1.0458

S 2: 1.0000

GBP/USD

R 2: 1.5659

R 1: 1.5529

CURRENT: 1.5033

S 1: 1.4857

S 2: 1.4566

USD/JPY

R 2: 135.15

R 1: 125.86

CURRENT: 122.83

S 1: 120.07

S 2: 118.07

USD/CHF

R 2: 1.1138

R 1: 1.0676

CURRENT: 1.0301

S 1: 0.9739

S 2: 0.9476