Packaging company, Sonoco Products Company (NYSE:SON) , has signed a definitive agreement to acquire 100% stake of Clear Lam Packaging, Inc. for around $170 million. The buyout will significantly expand Sonoco’s Flexible Packaging and Thermoforming Plastics operations.

Based in Elk Grove Village, IL, Clear Lam is a technology leader in the development, production and conversion of high barrier flexible and forming films. With nearly 400 employees, the company has developed a new portion control condiment packaging in recent years.

The company’s reputation for driving high-barrier film packaging innovations was the latest attraction for Sonoco. Clear Lam provides significant technology advantages and can drive synergies through the internalization of materials for Sonoco’s existing flexible and thermoforming customers.

The acquisition will assist Sonoco to offer fast-growing perimeter of grocery and retail food stores. Sonoco will now be able to develop, produce and convert high barrier flexible and forming film structures to package fresh and prepared food products.

The transaction is subject to normal regulatory review and is expected to close in the third quarter of 2017.

Throughout 2017, Sonoco will remain focused on accelerating organic growth, improving manufacturing productivity and using the company's strong financial position to make strategic acquisitions. The company is actively pursuing rational, strategic acquisitions in this regard.

In Mar 2017, Sonoco acquired thermoformer Peninsula Packaging Company. This deal will nearly double the company’s thermoforming business and comes at an opportune time when the perimeter of grocery stores is gaining consumer popularity.

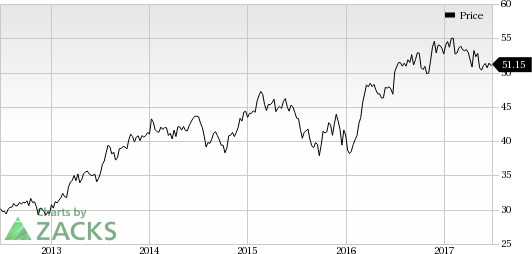

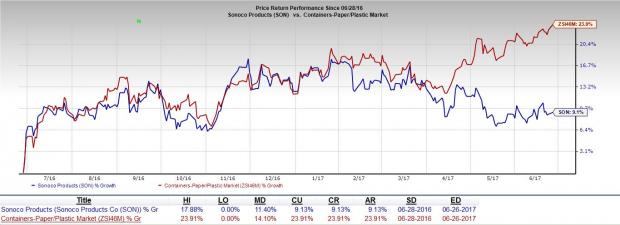

The company also remains focused on gaining market share by introducing commercial products and achieving new customer awards. However, Sonoco has underperformed the Zacks classified Containers-Paper/Plastic sub-industry in the last one year, mainly due to stronger dollar and higher input costs. The stock gained around 9.1%, while the industry gained 23.9% over the said time frame.

Sonoco currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the same space include AGCO Corporation (NYSE:AGCO) , Altra Industrial Motion Corp. (NASDAQ:AIMC) and AptarGroup, Inc. (NYSE:ATR) . All the three stocks sport a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

AGCO has an average positive earnings surprise of 40.39% in the trailing four quarters.

Altra Industrial Motion generated an average positive earnings surprise of 15.93% in the past four quarters.

AptarGroup has an average positive earnings surprise of 1.78% in the last four quarters.

Sell These Stocks. Now.

Just released, today's 220 Zacks Rank #5 Strong Sells demand urgent attention. If any are lurking in your portfolio or Watch List, they should be removed immediately. These are sinister companies because many appear to be sound investments. However, from 1988 through 2016, stocks from our Strong Sell list have actually performed 6X worse than the S&P 500.

See today's Zacks "Strong Sells" absolutely free >>.

Sonoco Products Company (SON): Free Stock Analysis Report

AptarGroup, Inc. (ATR): Free Stock Analysis Report

AGCO Corporation (AGCO): Free Stock Analysis Report

Altra Industrial Motion Corp. (AIMC): Free Stock Analysis Report

Original post