High frequency economic releases have generally been coming in a bit on the soft side, but the signs point to a cautiously optimistic outlook for the American consumer. First, there is the improving employment picture. As well, falling gasoline prices should also provide a boost to consumer spending.

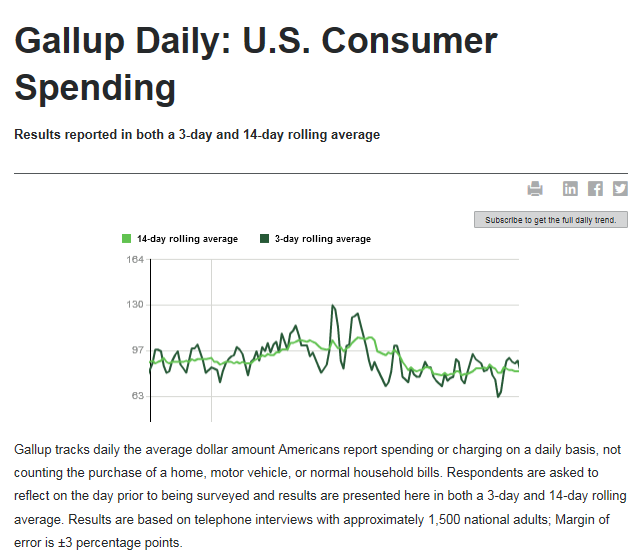

As a result, a number of analysts have been bullish on consumer spending. New Deal democrat got somewhat excited over the tick up in Gallup`s rolling poll.

As well, Doug Short has indicated that the recent disappointing retail sales figures may be attributable to winter weather. The Atlanta Fed has also suggested that we are seeing a bout of seasonal softness in the Q1 growth statistics.

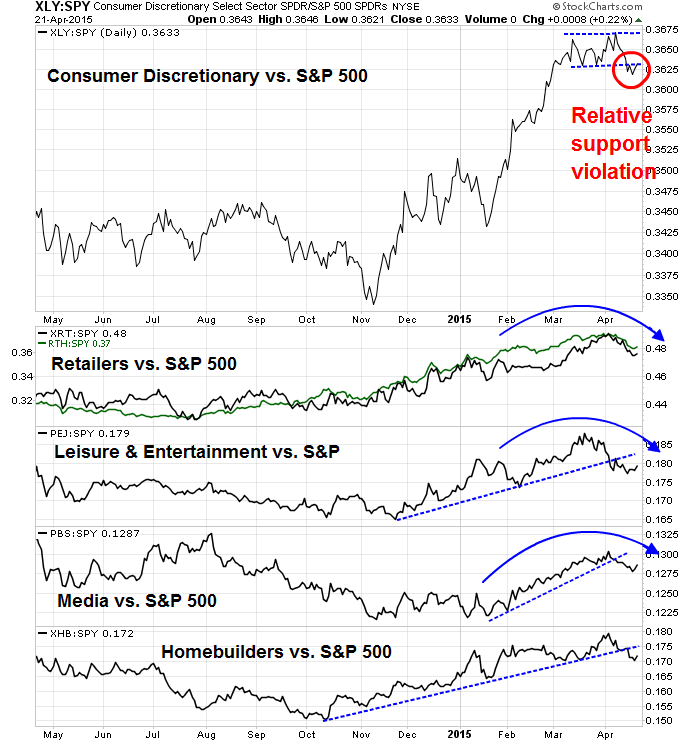

Mr. Market doesn't seem to be buying into the consumer revival theme. Here is a chart of the relative performance of consumer discretionary stocks (via Consumer Discretionary Select Sector SPDR (ARCA:XLY)) against the SPX (via the SPDR S&P 500 ETF (ARCA:SPY)), along with a number of key consumer spending related industries (via the SPDR S&P Retail ETF (NYSE:XRT), Market Vectors Retail ETF (NYSE:RTH), PowerShares Dynamic Leisure & Entertainment ETF (NYSE:PEJ), PowerShares Dynamic Media ETF (NYSE:PBS), SPDR S&P Homebuilders ETF (NYSE:XHB)). In all cases, relative performance seems to be rolling over and I see broken relative uptrends everywhere.

There is a disconnect here between macro and technical market expectations. Someone is going to be proven very wrong.

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.