Something bullish appears to be developing in gold and we believe that it is indicative of the beginning of a breakdown in the confidence of government bond markets. Given the extremes to which government bond markets have been pushed, the upside in gold is likely to surprise even the most hardened gold bug.

To appreciate gold it does help to have “been there, done that”. When I was living in Johannesburg in the late 1990s, my friend invited me to come on an adventure. He was a mining engineer on one of the deepest mines in South Africa, just south of Johannesburg.

2.6 kilometers down towards the center of the earth. Yes, I have been down that deep before, and it really did feel like I was a lot closer to the center of the earth. The rock on the sides of the tunnel was too hot to hold your hand on for more than a few seconds. I reckon it must have been at least 50°C. The air temperature must have been about 30°C with a humidity factor from hell to boot.

To go that low you have to get into one of these things — a mine cage — together with a whole bunch of sweaty mine workers.

Then you drop at about 50km/h. Kind of scary when you are dropping that fast (not that I wanted to admit I was shitting my pants just a little).

Then on go the brakes as you approach the bottom, but it takes about a minute or so to stop bouncing up and down. I guess that is what happens when you are on the end of 1.6kms of wire cable?

We then got out of the cage, walked about 50 meters or so, and got into another cage and then dropped a further 1km.

At the bottom we got into an electric train (gas fumes would kill everyone down there) and traveled what felt like a couple of miles to get to the face where the miners are drilling away. I had a go on the drill for about 20 mins and it was the toughest workout of my life. Trying to drill with the incredible heat and cramped conditions and the noise (the noise is deafening). I tried not to think about the fact there was 2.6km of rock above me. My goodness, what a hell of a way to earn a crust!

It was so hot down there that even my little Canon APS camera stopped working (this was in 2000 before the days of digital).

Back on the surface I had the pleasure of seeing a line up of gold bars and holding a few in my hands, with a couple of heavily armed guards standing over my shoulder. This wasn’t the picture I took (my camera was dead from the mine now), but it was more or less the same thing.

Here at Capitalist Exploits we’re sympathetic to gold and no gold bugs, but something does descend upon you when holding a couple of gold bars in your hand — power, wealth, status. I’m not a poet and I don’t quite know how to explain the feeling. Perhaps it’s simply our history as mankind. Whatever it is, there is something quite special about it.

I was so grateful for my friend taking me on that tour, and while I don’t profess to have some guru knowledge of the metal I do feel that I appreciate gold way more than I did prior to that trip. That tour was back in early 2000 when the NASDAQ was peaking and folks were talking of gold as being a “relic of the past” or “having no place in the new economy”. Weren’t they in for a rude awakening?

As I said, I am no gold bug. I’m a deep value contrarian investor. I earn my crust by trading against extreme market situations globally.

As a reader of this blog you are probably aware we have been intrigued by the world bond market — or should I say the insatiable appetite from investors and speculators alike forcing sovereign bond yields down next to or below zero — over the last 5 years or so. Even certain corporate bonds dipped below zero a couple of years ago (Royal Dutch Shell (LON:RDSa) and Unilever (LON:ULVR))… and the Swiss 50-year treasury went negative in 2016.

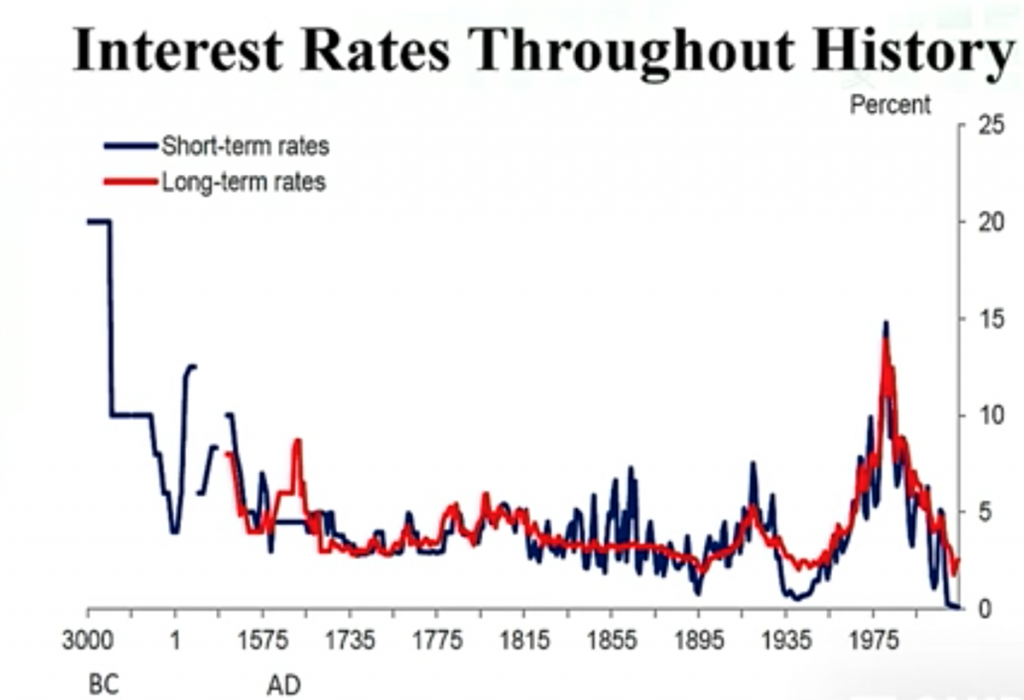

We (humans) have never seen the cost of capital/interest rates as low as they are today. Ever.

If this isn’t one of the greatest market extremes to have existed in “modern” times, then I will eat my hat. If it isn’t a market extreme, then capitalism is dead and we’re heading towards something else. We’ve tried many other methods and they don’t work particularly well, so that’s a worry.

I have been around long enough to observe that extremes in behavior in one direction will lead to equally, if not more, extreme behavior in the other direction.

It is too simple to say that ultra low interest rates will lead to ultra high interest rates rivaling the early 1980s, although this may well happen.

I approach it from a different perspective: what is implied by interest rates/bond yields being at around zero percent? My thinking, in no particular order:

- Absolute faith that governments will be able to repay those debts.

- Absolute faith that there will never be inflation again, albeit in our lifetimes.

- No faith that publicly traded companies will be able to generate profits and payout dividends. Or should I say, no faith in the sustainability of the current profitability of companies.

- Or could I go further and say that within a few years all companies will be making losses and forced into bankruptcy and the state will take over the functions of publicly owned companies and obviously stock exchanges will close? In other words, capitalism is about to be taken over by communism or some variation of it.

I could go on, but isn’t this the essence of what the government bond market is implying?

I don’t believe in any of these notions. It is as absurd as what we were being led to believe by the average village idiot and highly paid strategist back in 2000 (“this is the new economy, the old economy is dead”).

But what happens if the crowd is wrong, and they start to lose faith in the government bond market?

Yes, it is easy to see interest rates/bond yields being materially higher a couple of years from now. But positioning for interest rates to move materially higher is really tricky if you are not wanting to trade the futures.

But don’t worry. There is probably a way easier way to profit from the crowd losing faith in the bond market and that is via “second order” effects?

Gold — the one currency that’s isn’t government backed. It goes up in value when investors lose faith in the value of a government backed currency or currencies. One of the big reasons is that it is very difficult (costly and time consuming) to increase production (i.e. it is supply constrained).

For a while now we have suspected that gold will ultimately do very well as bond yields rise and the crowd loses faith in paper currencies and debt.

It isn’t often that you see gold rise in multi-currency terms, but that is exactly what it is doing.

Too many folks, Americans in particular, look at gold in US dollars where it is still in a trading range.

But gold in non-USD terms, it starts to take on an appearance that few seem aware of.

Gold in AUD

Gold in JPY

Gold in SEK

Gold in RMB

It seems to my technical eye that gold is on the verge of breaking out of a 6 to 8-year trading range in non-USD terms. Given how long it has been in a trading range the magnitude of the breakout may surprise everybody.

It just so helps that the average gold miner is still down some 80% from its 2011 highs — that’s an 8-year old bear market. It also appears that the average gold stock has been hammering out a long-term bottom over the last few years.

Is this bullish build up in gold and gold stocks indicative of a breakdown in confidence with government backed currency/debt? Or is it just pure coincidental?

We believe it is more likely the former. But of course we don’t know for sure. Either which way, something very bullish is building in gold and few appear to be taking any notice of it.