On Wednesday, I asked a handful of bloggers and economic writers their estimate for first quarter GDP.

ZeroHedge was the only one willing to publicly take a stance. I told him my forecast on the same day, but I had already announced my forecast on live radio on Monday.

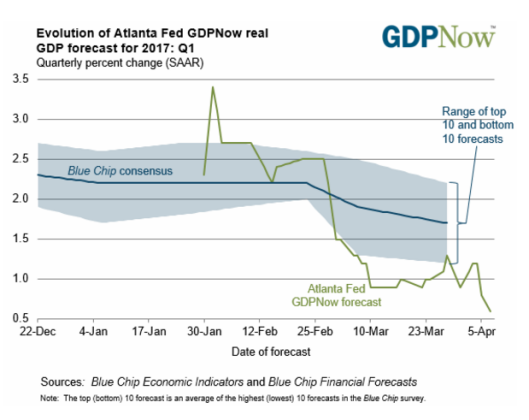

First, let’s look at the two most widely followed forecasts.

GDPNow Forecast: 0.6 Percent — April 7, 2017

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2017 is 0.6 percent on April 7, down from 1.2 percent on April 4. The forecast for first-quarter real GDP growth fell 0.4 percentage points after the light vehicle sales release from the U.S. Bureau of Economic Analysis and the ISM Non-Manufacturing Report On Business from the Institute for Supply Management on Wednesday and 0.2 percentage points after the employment release from the U.S. Bureau of Labor Statistics and the wholesale trade release from the U.S. Census Bureau this morning. Since April 4, the forecasts for first-quarter real consumer spending growth and real nonresidential equipment investment growth have fallen from 1.2 percent and 9.7 percent to 0.6 percent and 5.6 percent, respectively.

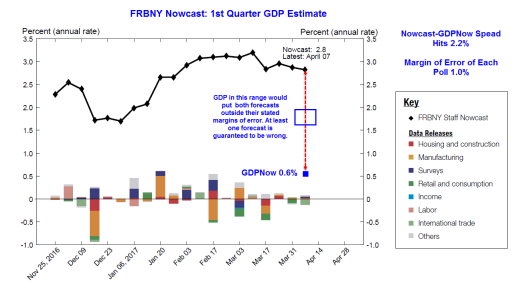

FRBNY Nowcast: 2.8 Percent — April 7, 2017

- The FRBNY Staff Nowcast stands at 2.8% for 2017:Q1 and 2.6% for 2017:Q2.

- News from this week’s data releases brought the nowcast for Q1 down 0.1 percentage point while the nowcast for Q2 was virtually unchanged.

- Negative contributions from both imports and exports as well as from today’s nonfarm payrolls offset the positive contribution from the ISM manufacturing employment index.

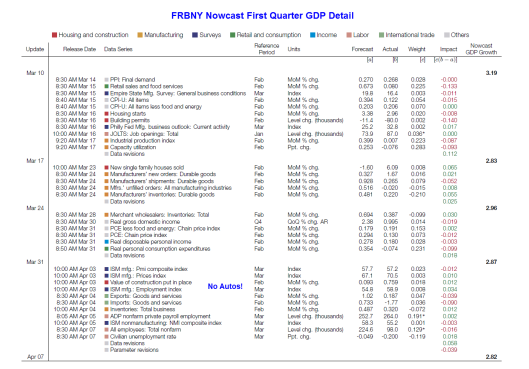

FRBNY Nowcast Details

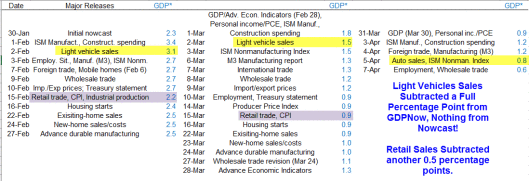

GDPNow Details

On April 7, GDPNow dropped 0.4 percentage points due to auto sales and ISM. I have a question into Pat Higgins at GDPNow for a breakdown.

If ISM had a positive impact, the amount of decrease attributable to autos is greater than 0.4 percentage points. My assumption is ISM did not change the numbers much.

Retail Sales Numbers

Nowcast may claim that the retail sales reports should pick up car sales, but retail sales lag car sales, they are subject to greater revisions, and skipping auto sales numbers also skips fleet sales and other commercial sales.

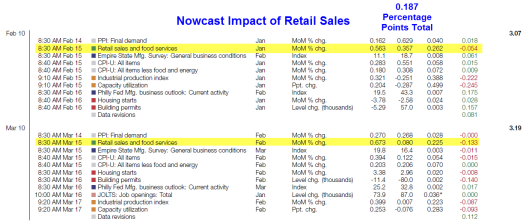

For the two dates applicable to both GDPNow and Nowcast, retail sales subtracted a total of 0.187 percentage points from Nowcast but 0.50 percentage points from GDPNow.

Combined, the effect is 1.31 percentage points.

Model Flaws

- Nowcast uses no hard auto data: This is a serious error. Autos account for 20% of retail sales and fleet sales are also very important.

- Incorrect reliance on unemployment rate: People dropping out of the labor force and actual employment rising can both move the number in the same direction. Both things cannot mean the same thing.

- ISM vs PMI: Both reports measure the same thing, yet those reports signal very different things. At least one of them is wrong. GDPNow and Nowcast both rely on ISM even though the PMI reports have been more accurate, at least recently.

- The GDPNow and Nowcast models both suffer from an inability to think. The weather provides a nice example. In December, the weather was unusually cold, causing Industrial Production numbers to soar (heat and electric production), for the entire upcoming quarter. I estimated in advance, January would take away those numbers. My assertion played out, at least for GDPNow. I still cannot account for Nowcast.

ISM vs PMI

I discussed the difference between ISM and Markit’s PMI estimates recently, for both manufacturing and non-manufacturing (services).

- April 3: Markit PMI vs. ISM Fantasyland GDP Projection: Stagflation Lite?

- April 5: Another ISM/PMI Divergence: Non-Manufacturing

On April 3, the ISM made this statement: “The past relationship between the PMI® and the overall economy indicates that the average PMI® for January through March (57 percent) corresponds to a 4.3 percent increase in real gross domestic product on an annualized basis.”

On March 24, Chris Williamson, Markit Chief Business Economist, stated ”The survey readings are consistent with annualized GDP growth of 1.7% in the first quarter, down from 1.9% in the final quarter of last year.”

On April 5, Williamson reiterated “The surveys of manufacturing and services are running at levels consistent with GDP expanding by 1.7% in the first quarter.”

ZeroHedge April 5 Estimate

On April 5, ZeroHedge replied to my request for a number with “Call it 1.3%“. He provided no further explanation, but I did not ask for any.

Mish April 3 Estimate

On Monday April 3, on Coast-to-Coast, live syndicated talk radio, I told George Noory I expected GDP would be 0.6%.

I am frequently on just after 12:00 Midnight, for a few minutes, before regular guests, giving brief economic updates.

I mentioned autos and all of the other numbers in play at the time (GGPNow was 1.2% then, so I was well under the then lowest estimate).

On April 5, I responded back to ZeroHedge “Thanks. You can change it later. I will post 0.6%”

My intent was to write this piece Thursday night ahead of the GDP reports but the unexpected action in Syria got in the way.

On Saturday, I decided to dig deeper into the differences between GDPNow and Nowcast. The result is a more detailed report today.

Word About Oil, Jobs, Upcoming Forecasts

In addition to autos rolling over, and general hard data weakness all around, inflation comes into play.

I expected energy prices would head lower. They haven’t, at least yet. A rise in inflation (the BEA use the PCE deflator not CPI) will subtract from real spending and real GDP. Inflation was part of my downgrade to a 0.6% estimate.

The jobs report did not change my estimate.

Next Friday, we have a trifecta of CPI, Retail Sales, and Business Inventories. Those reports can easily combine to move my forecast down to zero or back above one percent.

My guess now is that something on the order of 0.5% is baked in the cake.

What About Rate Hikes?

Whether this is yet another “transitory” period remains to be seen, but one of these downturns will stick.

Three hikes may not sound like much, but there is over a trillion dollars worth of debt that needs to roll over soon, at increasing rates, at a time when consumers are gasping and minimum wages hikes are in play.

The market expects another hike in June and still more hikes later in the year. I sure don’t.

GDP Predictions

- Mish April 3: 0.6%

- ISM April 3: 4.3%

- ZeroHedge April 5: 1.3%

- Markit April 5: 1.7%

- GDPNow April 7: 0.6%

- FRBNY Nowcast April 7: 2.8%

The “advance” GDP number for the first quarter comes out on April 28.

For a look at how the weather impacted factory utilization and thus GDP estimates, please consider Formulas Don’t Think: Investigating Weather-Related GDP.

In that article, I commented on cold weather in December followed by warmer than usual weather in January.

For reasons I do not understand, GDPNow followed my model of unwinding the weather-related effects, but Nowcast didn’t.

Meanwhile, Don’t Worry Weakness is Transitory: Fed Expects a Second Quarter Rebound, Higher Equity Prices.