The word of the day is transitory. That’s my take on the release of the March 14-15 FOMC Minutes.

- The information reviewed for the March 14-15 meeting suggested that the labor market strengthened further in January and February and that real gross domestic product (GDP) was continuing to expand in the first quarter, albeit at a slower pace than in the fourth quarter, with some of the slowing likely reflecting transitory factors.

- Real GDP was expected to expand at a slower rate in the first quarter than in the fourth quarter, reflecting some data for January that were judged to be transitorily weak, but growth was projected to move back up in the second quarter.

- In their discussion of developments in the household sector, participants agreed that consumer spending was likely to contribute significantly to economic growth this year. Although motor vehicle sales had fallen early in the year and some other components of PCE had also declined, many participants suggested that the slowdown in consumer spending in January would likely be temporary.

- The slowing appeared to mainly reflect transitory factors like lower energy consumption induced by warm weather or delays in processing income tax refunds. In addition, conditions conducive to growth in consumer spending, such as a strong labor market or higher levels of household wealth, were expected to persist.

- A number of participants also cited buoyant consumer confidence as potentially supporting household expenditures, although some also mentioned that improved sentiment did not appear to have appreciably altered the trajectory of consumer spending so far.

- Participants generally agreed that recent momentum in the business sector had been sustained over the inter-meeting period. Many reported that manufacturing activity in their Districts had strengthened further, and reports from the service sector were positive. Business optimism remained elevated in a number of Districts.

- Members anticipated that inflation would stabilize around 2 percent over the medium term and commented that transitory deviations above and below 2 percent were to be expected.

- Partly in light of the likelihood that the recent higher readings on headline inflation had mostly reflected the temporary effect of increases in consumer energy prices, members agreed that the Committee would continue to carefully monitor actual and expected inflation developments relative to its inflation goal.

Balance Sheet Actions

- Survey results indicated that market participants saw a change in the FOMC’s policy of reinvesting principal payments on its securities holdings as most likely to be announced in late 2017 or the first half of 2018. Most market participants anticipated that, once a change to reinvestment policy was announced, reinvestments would most likely be phased out rather than stopped all at once.

- A number of participants indicated that the Committee should resume asset purchases only if substantially adverse economic circumstances warranted greater monetary policy accommodation than could be provided by lowering the federal funds rate to the effective lower bound.

- Several participants indicated that the timing should be based on a quantitative threshold or trigger tied to the target range for the federal funds rate. Some other participants expressed the view that the timing should depend on a qualitative judgment about economic and financial conditions.

- Nearly all participants agreed that the Committee’s intentions regarding reinvestment policy should be communicated to the public well in advance of an actual change. It was noted that the Committee would continue its deliberations on reinvestment policy during upcoming meetings and would release additional information as it becomes available.

Equity Prices

- Broad U.S. equity price indexes increased over the inter-meeting period, and some measures of valuations, such as price-to-earnings ratios, rose further above historical norms.

- A standard measure of the equity risk premium edged lower, declining into the lower quartile of its historical distribution of the previous three decades.

- Stock prices rose across most industries, and equity prices for financial firms outperformed broader indexes. Meanwhile, spreads of yields on bonds issued by nonfinancial corporations over those on comparable-maturity Treasury securities were little changed.

- Foreign equity prices increased, flows to emerging market mutual funds picked up, and emerging market bond spreads narrowed.

- The negative effect of this timing change on projected real GDP growth through 2019 was offset by a higher assumed path for equity prices and by a lower assumed path for the exchange value of the dollar.

- The staff continued to project that real GDP would expand at a modestly faster pace than potential output in 2017 through 2019.

- Many participants discussed the implications of the rise in equity prices over the past few months, with several of them citing it as contributing to an easing of financial conditions. A few participants attributed the recent equity price appreciation to expectations for corporate tax cuts or to increased risk tolerance among investors rather than to expectations of stronger economic growth.

- Some participants viewed equity prices as quite high relative to standard valuation measures. It was observed that prices of other risk assets, such as emerging market stocks, high-yield corporate bonds, and commercial real estate, had also risen significantly in recent months.

Cautiously Upbeat Fed

All in all, the Fed is cautiously upbeat.

Some bloggers thought the Fed was worried about asset bubbles, and perhaps a few of the participants are. But while “many” discussed equity prices, only “some“viewed equity prices as “quite high“.

Did anyone mention bubble? Nope. That word does not show up in the minutes.

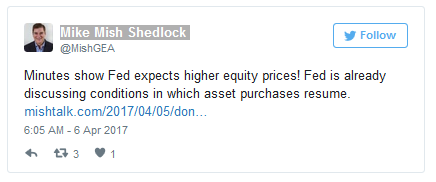

The thought that jumped at me is the Fed’s “higher assumed path for equity prices” is supposed to offset the effect of tapering.

So discussion of bubble did not seem to take place by any measure.

If the Fed was truly upbeat in its assessment it would have started tapering already. Instead, the FOMC opinions on the balance sheet run the entire gamut of possibilities.

Here’s my favorite quote “A number of participants indicated that the Committee should resume asset purchases only if substantially adverse economic circumstances warranted greater monetary policy accommodation than could be provided by lowering the federal funds rate to the effective lower bound.”

Don’t Worry!