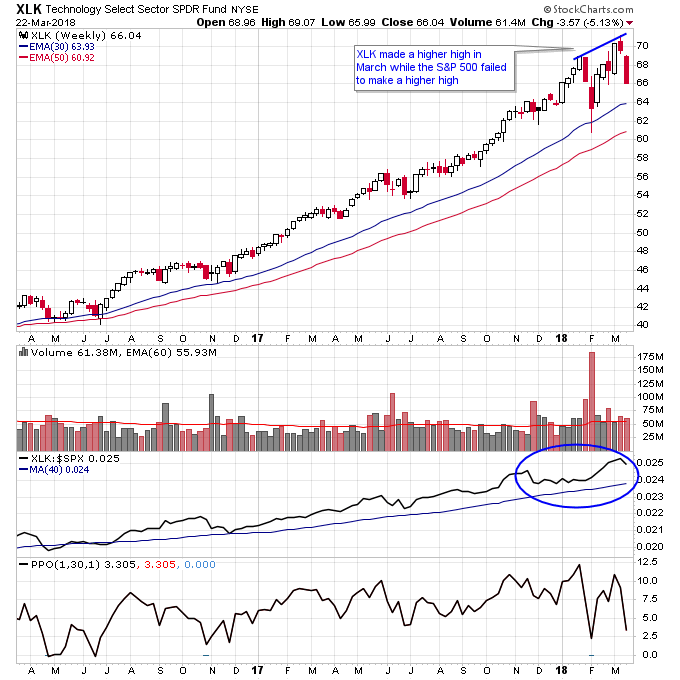

Stocks that hold up during a market downturn tend to be the next leaders when pressure on the market alleviates. That’s why it’s important to pay close attention to the market when the market is under pressure. Of the major market sectors Technology is performing the best since the market has been under pressure since late January. The Technology Select Sector SPDR (NYSE:XLK) ETF made a higher high in March while the S&P 500 failed to make a higher high, which means Technology is outperforming the rest of the stock market.

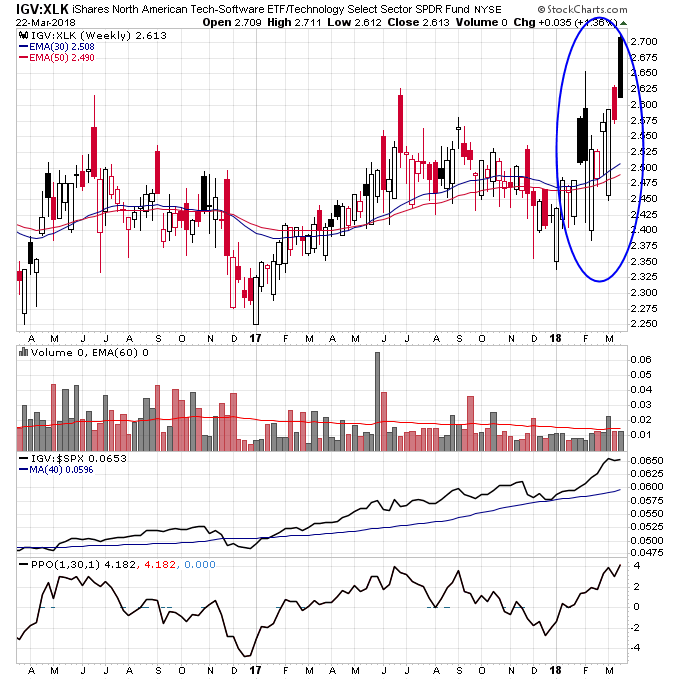

Within the Technology sector, Software has been particularly strong this year. In the chart below notice how the iShares North American Tech-Software (NYSE:IGV) ETF (which is one of the largest ETFs comprised of software companies) has been outperforming XLK. It’s starting to break out of a range where previously it was only keeping pace with the rest of the Technology sector, but now it is outperforming.

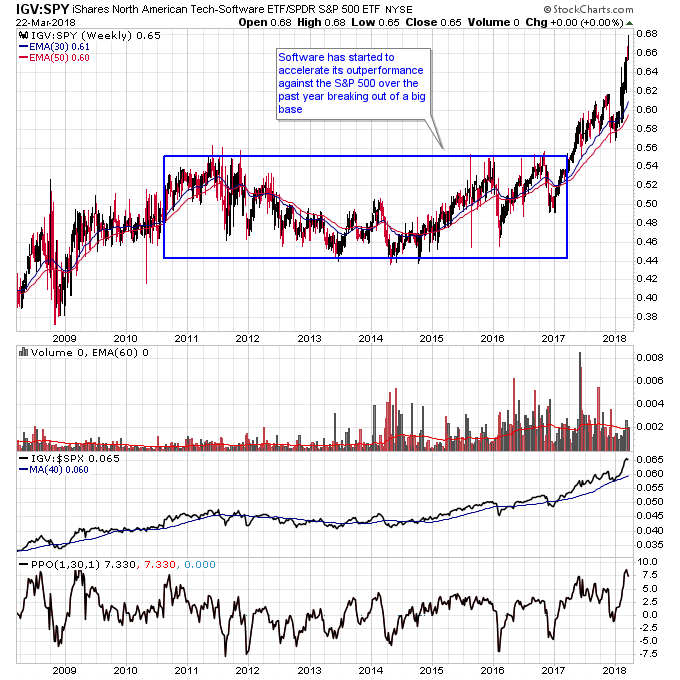

Finally if we plot the IGV ETF against the S&P 500 you can see that software stocks are starting to really break out against the S&P 500 after a long term base. This is a very bullish chart for Software stocks since we know that the bigger the base the bigger the subsequent uptrend.