WALL STREET WAS stunned Friday morning by the strength of the jobs market. While technology company layoffs have lately hijacked the fear-mongering media’s narrative, the truth is that the employment picture is quite strong.

With a 517,000 gain in net employment last month, along with ebbing wage growth, the “soft landing” crowd is one big step closer to winning the battle against the recession prognosticators. True, January’s job jolt is merely one data point. What’s maybe more impressive is that there have been 10 straight better-than-expected monthly payroll reports. That trend is a job seeker’s friend.

Something would have to be truly wonky for the U.S. economy to be in a recession right now.

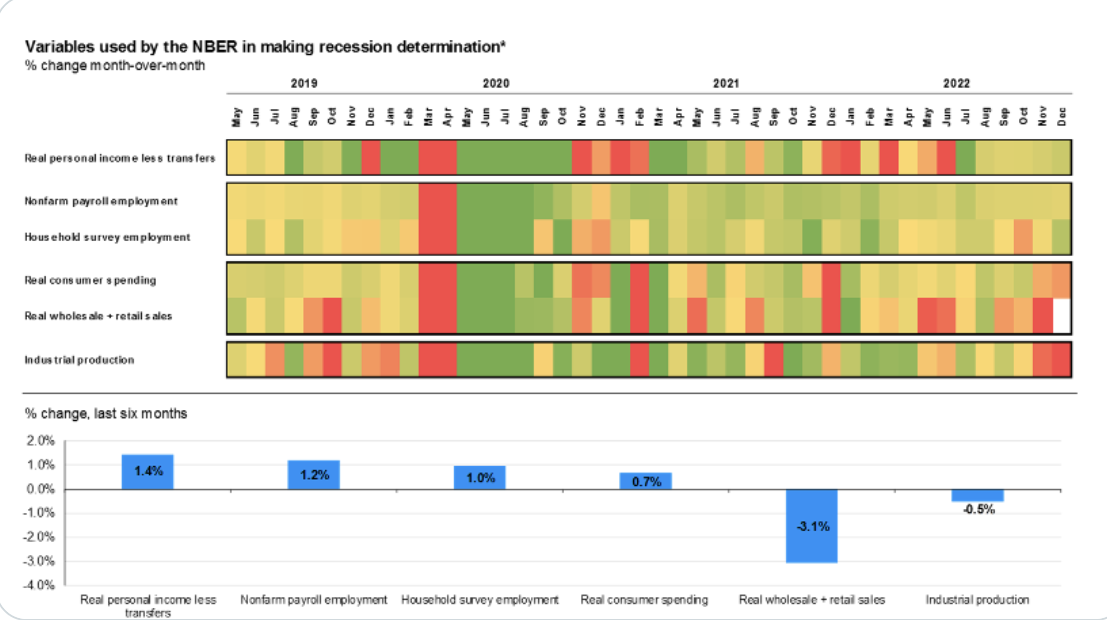

There’s a revealing chart from J.P. Morgan Asset Management that illustrates the point. Variables such as industrial production, and wholesale and retail sales data, suggest modest economic weakness. But inflation-adjusted personal income, growth in payrolls, and real consumer spending, all indicate the economy is in decent shape.

Source: J.P. Morgan Asset Management

Even more encouraging for investors is that the global economic tide may be turning for the better. Consider that there have been significant upward revisions to GDP growth forecasts in Europe and Asia over the past two months. A mild winter across the euro area has sent energy prices plunging, while China’s swift reopening is a demand driver for the world.

Does all this sanguine news justify current stock market levels? That’s always hard to determine. The S&P 500 now trades at a somewhat elevated 18.4 times forward earnings, according to FactSet.

What’s more, value stocks and some European indexes are already at all-time highs. The recent good news may bolster investor confidence. But this doesn’t seem like a time to be making radical portfolio changes.

***

This article was first published on The Humble Dollar