It’s been another week of steady and slow decline for soft commodity prices in general with a combination of factors all helping to extend the bearish price action once again. Of these, it’s the supply-and-demand equation that is weighing heavily, and with benign weather conditions in the primary U.S. belts, and a bumper-crop forecast and now in harvest, there is little on the horizon to suggest a pause or change in the short term. In addition, with the U.S. Dollar continuing to remain firmly bullish, this too is adding its own weight to the move lower, and with the CRB index trading lower once again this morning at 280.94, down a further 1.1%, the outlook remains negative for commodities in general.

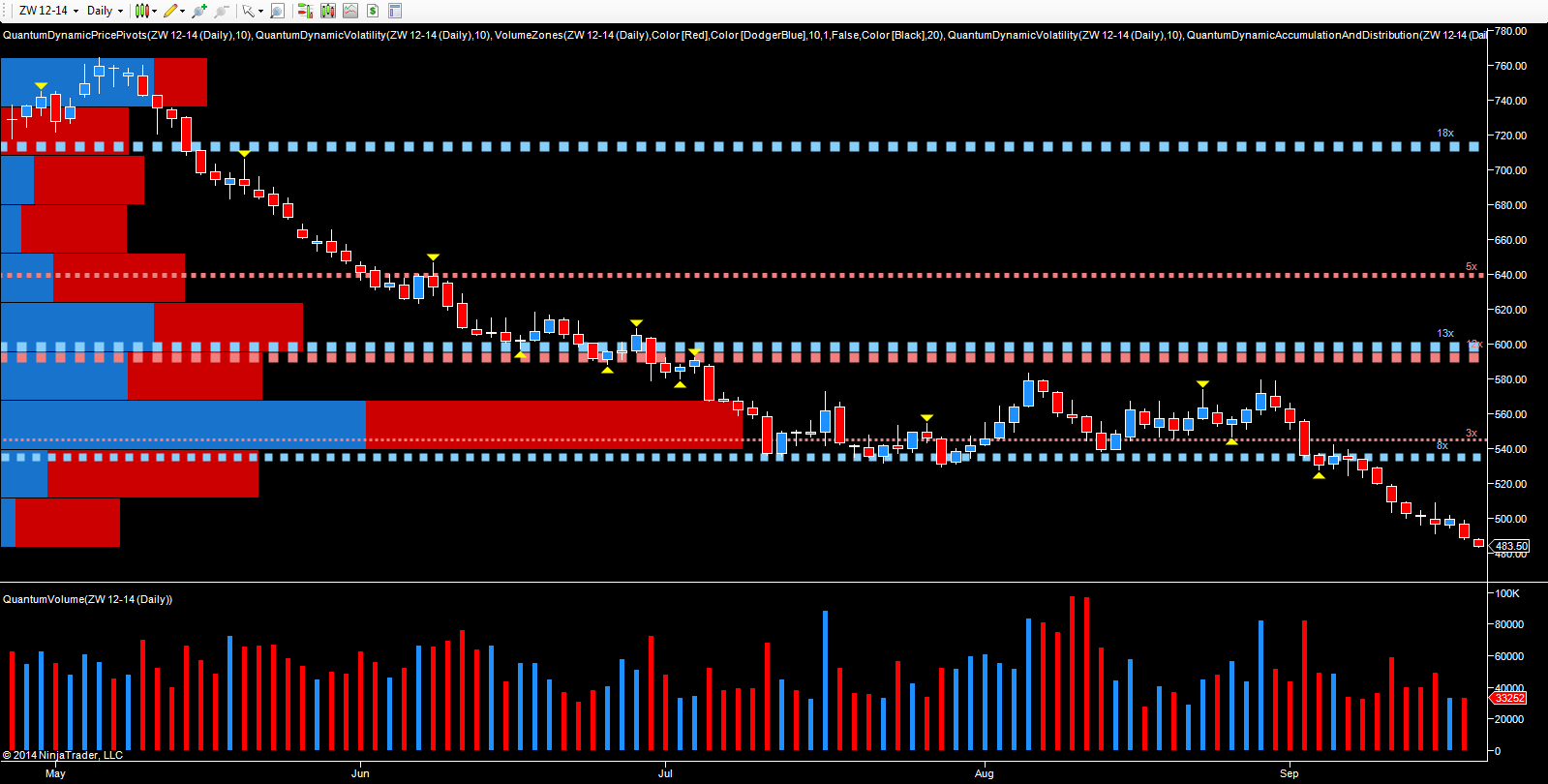

Starting with Wheat, and the December futures contract, the break below the congestion phase in the 535 per bushel region was significant, ending the extended phase of price congestion, and confirming the weak picture, with the market continuing to move lower to test the psychological 500 per bushel region, earlier in the week. This has duly been breached with wheat prices now trading at 484 per bushel. However, given the time of year, volumes here remain low, and coupled with the relatively narrow price spreads, are perhaps suggesting that the current trend is reaching an exhaustion point. However, for any confirmation, we will need to see a sustained increase in volume coupled with some signs of a buying climax in this time frame. The resistance level now overhead in the 540 to 550 area, and as defined on the volume at price histogram is significant, and for any recovery in the price of wheat, this region will need to be breached, which in turn will require sustained buying volumes on rising price action.

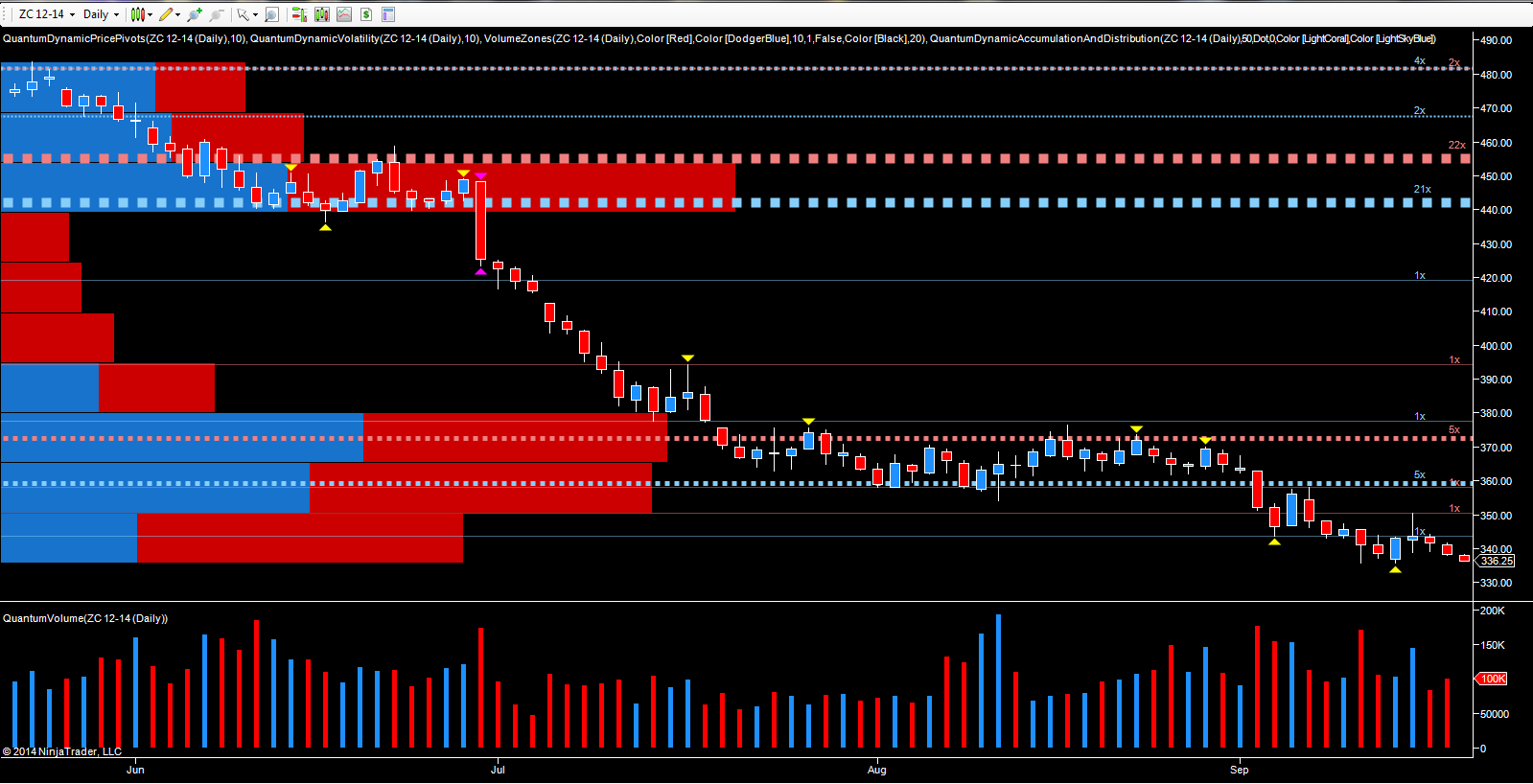

Corn, too, is mirroring the price action in wheat, with a long slow steady decline, with the deep area of price congestion in the 350 to 375 region adding further downwards pressure, presenting a very solid barrier to any move higher. This weakness in corn this week was signaled on Tuesday, with the market attempting to rally on high volume, and closing with a narrow body and deep upper wick. This weakness was duly validated both on Wednesday and Thursday with further moves lower, and with another this morning to 337. While volumes on Wednesday and Thursday were moderate, they were rising suggesting an increase in bearish momentum in the short term. As with wheat, any recovery will need to be preceded with rising and above average volumes coupled with a phase of price consolidation, before we are likely to see any reversal in the longer term trend.

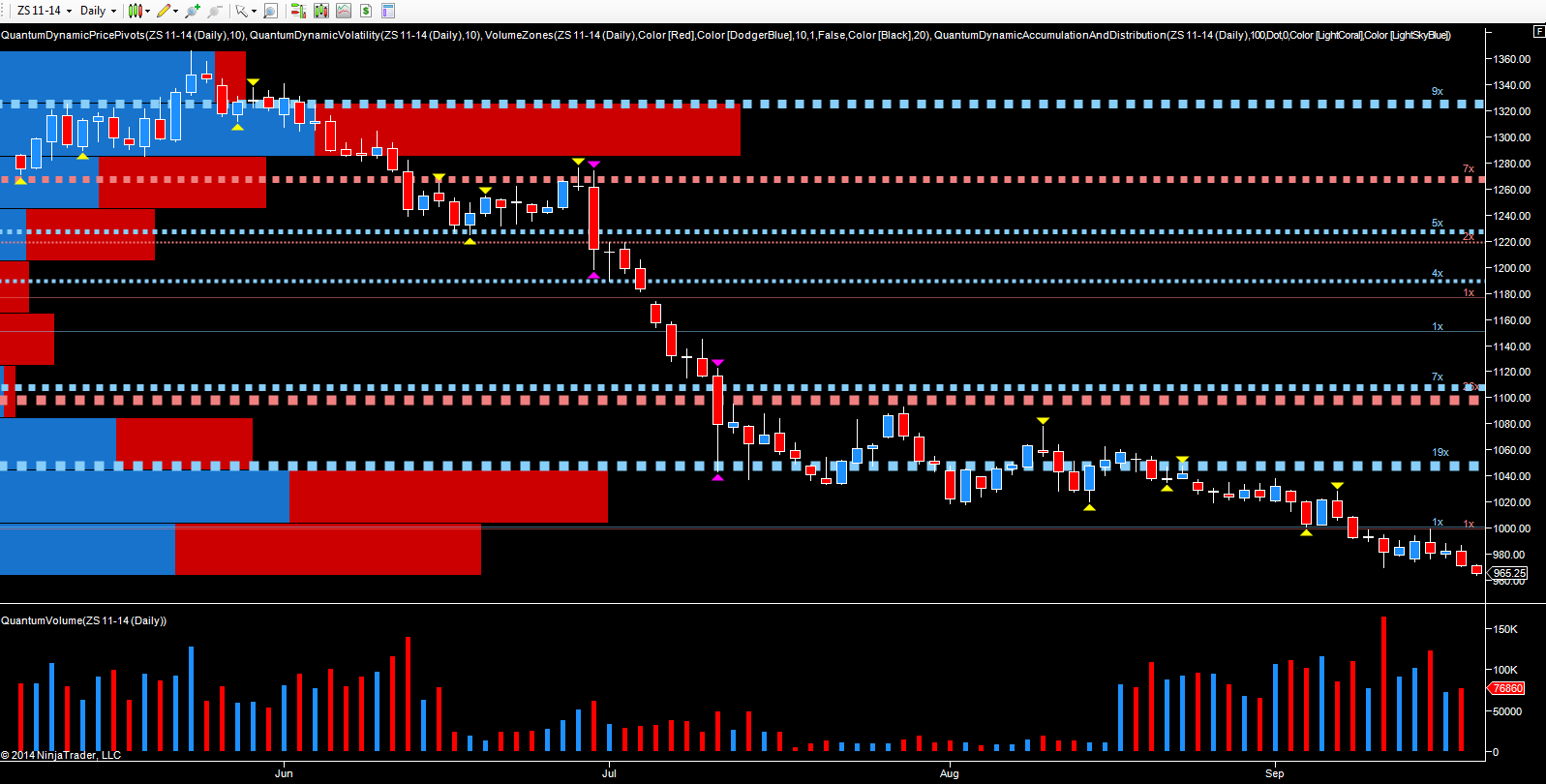

Finally to Soybeans. Once again, the long-term downward trend remains firmly dominant and having moved through the psychological 1000 price point, with a congestion phase over the last few days, this morning’s price action is once again moving lower to trade at 965.25, and breaking below the floor of potential support.

Today also sees the rebalancing of the S&P 500 coupled with quadruple witching, so we can expect to see some unusual and volatile price action during the trading session as another trading week draws to a close.