I think the two-word phrase that captures 2016 for the bears is “disappointingly brief.” Disappointing because all attempts to drive the market lower are aborted. Brief because the attempts to do so often last only a day, or a tiny bit more. 2009-2016 has been awful for the bears, but 2016 has simply been awful in a different way.

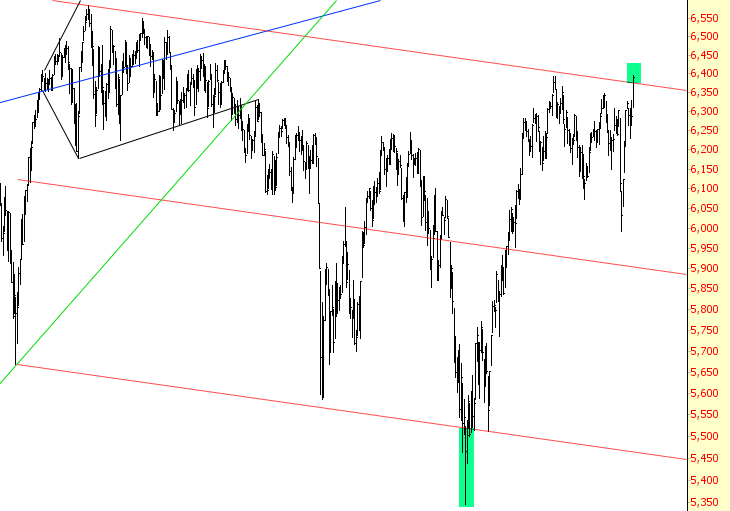

Let’s take a look at how the bulls seem to have finally clinched real power: first, the Dow Jones Composite has had its channel violated. Before we all kill ourselves, I just want to point out that this same channel was violated to the downside briefly (see both tinted areas), so it’s not a totally lost cause.

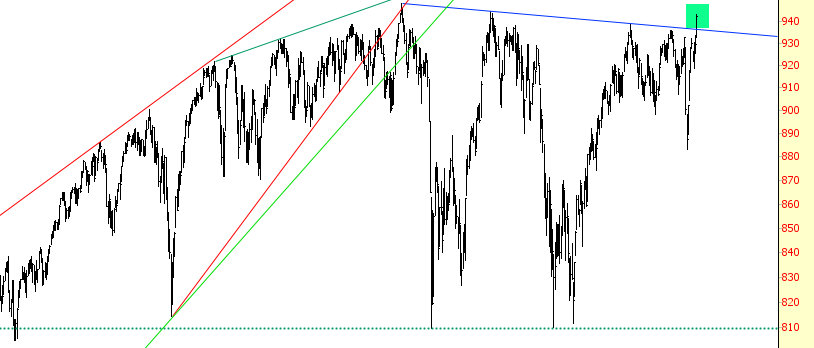

Similarly, the S&P 100 (OEX) has pushed above its trendline, which is a real shame because, my Lord, this was (past tense) a fantastic and huge topping pattern.

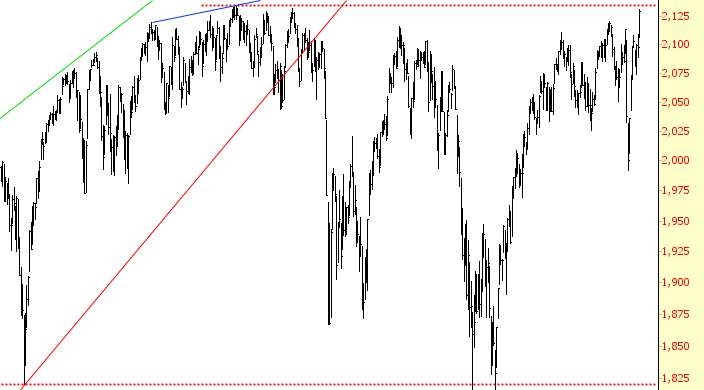

And then, as widely reported, the S&P 500 reached its highest close in the history of the universe, with absolutely nothing holding it back from breaking out Monday to new lifetime highs:

At this point, the bears have only a couple of hopes.

One is earnings. Of course, in quarters past, “good enough” earnings seemed adequate. It’s been nearly a decade since earnings have been genuinely disappointing to anyone. But we are entering the thick of earnings season in the coming weeks (of course, this could just as easily supercharge the bull market if companies appear to be strengthening).

The second hope, which I’ve pointed out to the catcalls and egg-throwing of readers here, is crude oil, which could, at a minimum, create terrific short profits in the energy sector.

So for the week, Tuesday was fantastic whereas Wednesday and Thursday were both “meh, hey, it’ll work out OK” days. Friday, however, was a heartbreaker, and judging from the cavalcade of emails and tweets I received, a lot of other folks were beaten up as well, spirits broken, hopes smashed.

Here's to a new week.