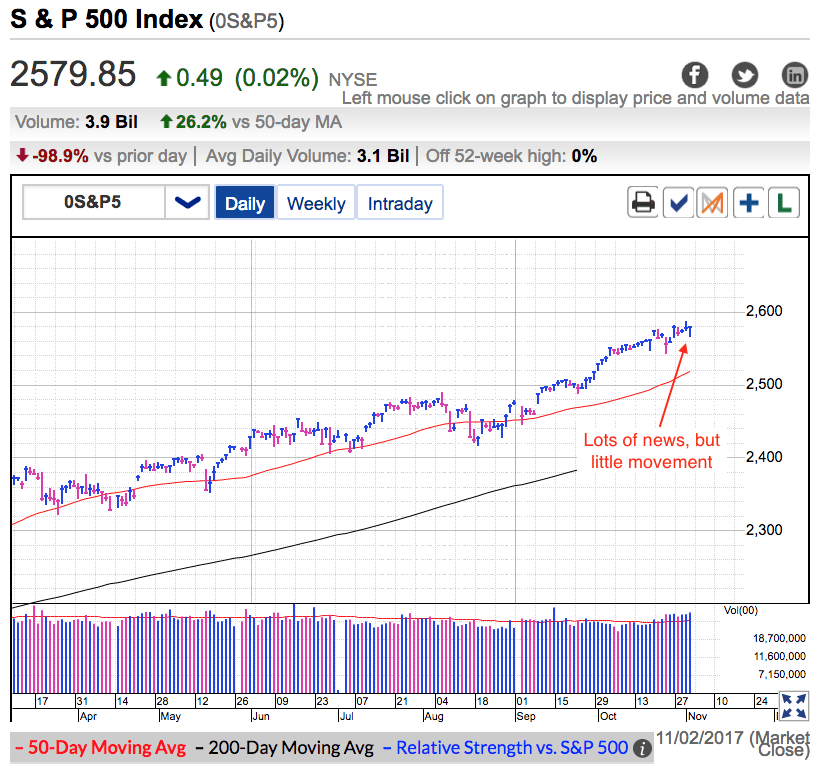

The S&P 500 finished Thursday flat after spending most of the day in the red. Republicans unveiled their Tax Reform proposal and traders chose to sell the news. But “sell” is an over-statement since we were only down a fraction of a percent in midday trade. The tax plan was everything the leaks told us it would be, so there was little to get excited or disappointed over. Exactly as expected resulted in a mostly flat day.

I’ve been wary of this market for a few weeks, but it held up surprisingly well. My biggest concern was how traders would react to infighting within the Republican party. But so far the market has tolerated criticism from Trump and 21 Republicans voting against the budget. If infighting was going to spook the market, it would have shown up in the price-action already. Without a doubt volatility has picked up, but the slow climb higher is still on track.

A few weeks ago I said this was a better place to be selling stocks than buying them. And I stand by that statement. Just because the market continued creeping higher doesn’t mean betting on the continued rally was the smart trade. Long-term success is about managing risk and sticking with high-probability, high-reward trades. Trades will always go against us, that is simply the nature of this game. It is no different than inventory expense for a retailer. But just because a trade lost money doesn’t mean it was a bad trade, and just because a trade makes money doesn’t mean it was a good trade. Success isn’t measured over how this trade or the next trade does, but how all of our trades do.

My reluctance to trust this market was largely built on the the size of the rally since August’s lows and the looming battle over Tax Reform. So far my concerns have been unnecessary. If we were going to pullback because of Tax Reform infighting, it would have happened by now. If the market isn’t worried about infighting, then we don’t have to worry about it.

That said, the risks are still elevated and buying up here is definitely not a low-risk, high-reward trade. The market will likely keep creeping higher over coming weeks, but creeping higher is not a great reward given the risk underneath us. Long-term investors should keep holding, but traders can wait for a better risk/reward. The higher this market goes without resting, the harder we fall when it eventually happens.