On a day with almost no economic news, Thursday will be more technical than anything else. However, there is an interest rate decision out of Switzerland, and that could of course have some kind of ripple effect on the forex markets if they surprise yet again. Barring that, we look at the charts…

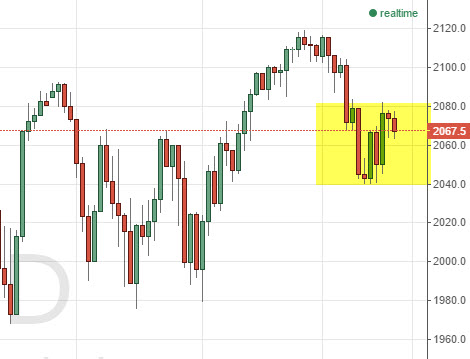

The S&P 500 dropped a bit during trading on Wednesday, but in the end remains well withing the consolidation area that we have been in for some time. The 2040 level below is supportive, while the 2080 level above is resistive. We think that the only play is to buy calls, on either a break above the top, or supportive action near the bottom of that range. The market should eventually reclaim the upside again, as the uptrend has been so strong.

S&P 500

The silver markets continue to respect the $15.50 level as the beginning of serious support, which we assume extends all the way down to the $15.00 handle. The market will eventually offer buying (calls) opportunities in the future, but in the mean time all we can do is patiently wait for that move. We would be bearish below $15 though.

The EUR/USD pair continues to sit still near the 1.06 level, with a downward bias overall. The pair should continue lower, but will have to break below the 1.05 level in order to continue the run down to the parity level, which is our longer-term target. We believe that short-term rallies offer put buying opportunities as well.