Per a Business Insider report, Snap Inc.’s (NYSE:SNAP) partnership with Comedy Central for Snapchat Discover channel is coming to an end on Sep 30. Reportedly, the popular brand in comedy owned by Viacom has decided against the renewal of the contract with Snapchat and will thus stop producing “daily customized content” for the Discover channel.

Reportedly, the channel for every edition produces five to six stories, including content from franchises in the likes of The Daily Show with Trevor Noah, Key & Peele and Broad City.

However, per reports, both the companies are now “contemplating” producing TV like content. A Comedy Central spokesperson was quoted by Business Insider saying "We have loved our collaboration with Snapchat and look forward to continuing our conversations with them about producing Snap Shows for the platform."

Their association dates back to January 2015 when Discover Comedy Central was launched on Snapchat. Following that, Comedy Central expanded its offerings a number of times and went on to become one of the popular channels on the platform.

Earlier this year, Snapchat suffered a similar brief setback when CNN discontinued the Snapchat Discover magazine. However, last month, to provide more videos to the young audience CNN started a daily news show on the platform called The Update.

Snapchat Discover feature has enhanced its picture and video library, thereby attracting more and more advertisers. The feature also allowed the company to partner with major events like the Oscars and Super Bowl. Discover has been a key driver of the company’s advertising revenues since its launch in 2015.

Per eMarketer, in fiscal 2016, advertising revenues from the Discover section accounted for nearly half of Snapchat’s total revenue. The firm predicts Snapchat’s advertising revenues from Discover to increase 62.3% year over year to $243.2 million in 2017. However, it expects Snapchat’s Stories section to outperform the Discover section this year.

Moreover, earlier this month, Snap allowed a few publishers of college newspapers to add their content to the company's Discover section of Snapchat app in a bid to attract millennials.

However, Comedy Central’s recent move is a real blow to Snapchat at a time when the media platform is experiencing a slowdown in its user base and revenue growth rates. A decline in user growth may look unattractive to advertisers, the primary source of revenues for Snap, and thereby dampen its growth opportunities. Besides, the company also lost a number of viewers in Saudi Arabia with the closure of its Al Jazeera Discover Publisher Channel in the country.

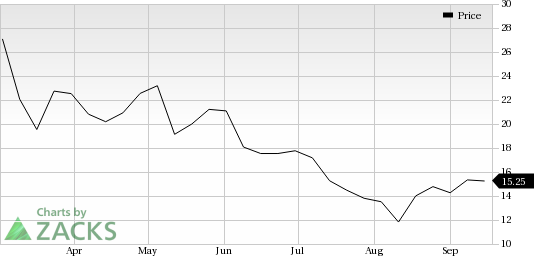

Notably, Snap shares have lost 37.7% of their value since its listing on Mar 2, 2017 against 8.7% growth of its industry.

Further, the company is aggressively ramping up its original content efforts in a bid to establish itself in the fiercely competitive video streaming market. The company faces stiff competition from the likes of Amazon (NASDAQ:AMZN) Prime, Netflix (NASDAQ:NFLX) , Facebook (NASDAQ:FB) , Apple (NASDAQ:AAPL) Hulu and Time Warner’s HBO.

Zacks Rank

Snap has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

New Report: An Investor’s Guide to Cybersecurity

Cyberattacks have become more frequent and destructive than ever. In fact, they’re expected to cause $6 trillion per year in damage by 2020.

The cybersecurity industry is expanding quickly in response to these threats. In fact, a projected $170 billion per year will be spent to protect consumer and corporate assets. Zacks has just released Cybersecurity: An Investor’s Guide to Locking Down Profits which reveals 4 promising investment candidates.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Netflix, Inc. (NFLX): Free Stock Analysis Report

Facebook, Inc. (FB): Free Stock Analysis Report

Snap Inc. (SNAP): Free Stock Analysis Report

Original post