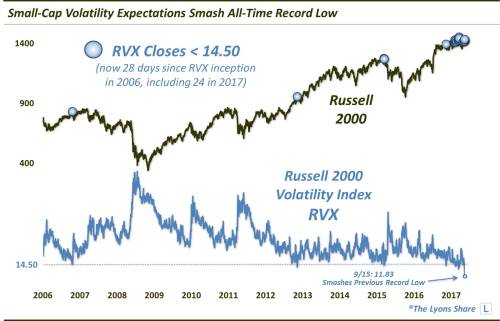

From Dana Lyons: Small-Cap volatility expectations just smashed their previous record lows.

We’ve written a fair amount lately on various themes related to volatility expectations in the stock market. Many of these posts focused on the behavior of volatility expectations relative to their underlying stock indices, including one last week on the “stand-off” between the Russell 2000 Small-Cap Index and the RUT Volatility Index. Today, we look simply at the level of the RVX itself. Why is that alone worthy of a post? Because the Russell 2000 Volatility Index just dropped to the lowest level in its history – by a long shot.

Specifically, the RVX closed last Friday at 11.83. That was 6.5% below its previous low close (12.65) from last Wednesday. Furthermore, prior to June, there had been exactly 1 close ever below 14 (3/14/2013) – that’s nearly 20% higher than Friday’s new record low.

Now, low volatility expectations aren’t necessarily a bad thing for stocks. In fact, stocks tend to do better when volatility expectations are low – to a point. However, as the chart shows, when the RVX has gotten to an extreme low level, e.g., less than 14.50 in this case, the RUT has typically struggled to sustain gains. For example, 1 month after the RVX’s previous 22 closes below 14.50, the Russell 2000 was higher just 4 times (several occurrences are too recent to register a 1-month reading). So it’s OK for small-cap investors to get comfortable – just don’t fall asleep.

In a premium post at The Lyons Share, we break down all of the results following the prior low RVX readings shown on the chart, in an attempt to discern whether or not the comfort level is indeed too low at the moment. We also take a quantitative look at an extremely rare signal generated today involving the Russell 2000 and the RVX – and one that has led to some very interesting results in the past.

The iShares Russell 2000 Index ETF (NYSE:IWM) rose $0.25 (+0.17%) in premarket trading Tuesday. Year-to-date, IWM has gained 7.28%, versus a 12.85% rise in the benchmark S&P 500 index during the same period.

IWM currently has an ETF Daily News SMART Grade of A (Strong Buy), and is ranked #1 of 36 ETFs in the Small Cap Blend ETFs category.