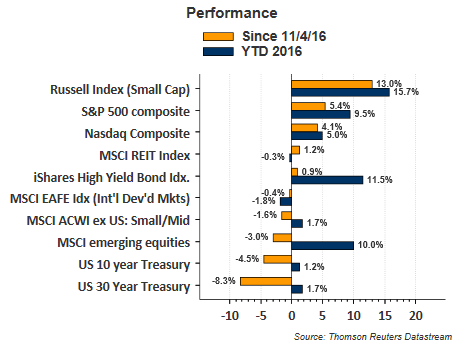

Subsequent to the election, the equity 'risk on' trade has been most evident in small company stocks with the S&P 600 Small Cap Index returning 13.0% since 11/4 versus a return of 5.4% for the S&P 500 Index.

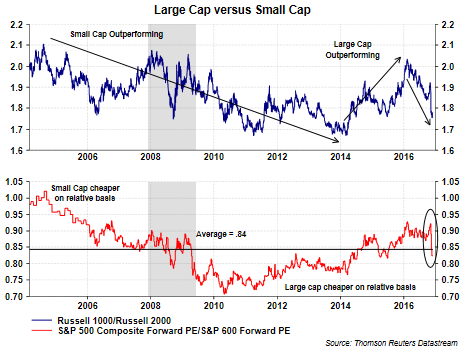

In fact, small cap stocks have been outperforming large caps since the market pullback in February of this year. Benefiting the return of small cap stocks is the fact, based on their respective P/Es, they were cheaper than large caps on a relative basis as can be seen in the below chart. However, this spike in return over the last four weeks has put the relative valuation of small caps below the average relative value going back to 2004.

Given small caps burst of outperformance over the last four weeks, a period of near term underperformance would not be surprising and would actually be healthy. One factor likely at play though is the anticipation that small cap earnings will begin to accelerate as occurring in the large cap space. The third quarter will market the end of the earnings recession with S&P 500 Q3 2016 earnings expected to be up 4.2% versus Q3 2015. Looking ahead, Thomson Reuters I/B/E/S is estimating earnings growth rates for the S&P 500 Index for Q4 2016 through Q3 2017 at 6.2%, 14.0%, 11.9%, and 9.8% respectively. This improvement in the earnings picture may serve as a floor against an extended equity market pullback.