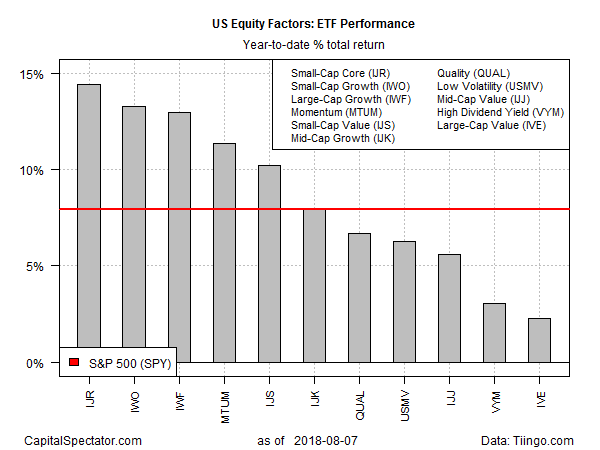

After a volatile start to the year, the US stock market has recovered its bullish edge and is currently dispensing strong results. Carving equities up into so-called factor buckets reveals that small-cap firms are leading the field year to date, based on a set of proxy ETFs.

The core small-cap factor is currently dispensing the number-one factor performance in 2018 through Tuesday’s close (August 7). The iShares Core S&P Small-Cap (NYSE:IJR) is up 14.4% so far this year. Nipping at IJR’s heels is the small-cap growth factor via iShares Russell 2000 Growth (NYSE:IWO), which is sitting on a 13.3% return year to date.

Worries about an escalating trade war between the US and China is helping to drive small-cap prices higher this year. Many investors see small caps as relatively insulated from any troubles in the global economy via a tighter focus on the US marketplace. But some analysts have become cautious on this slice of the equity market after the recent rally.

“Buyer beware – given that valuations in small-cap equities have risen substantially following the release of the new corporate tax rate and the notion of further trade protectionism,” says Edison Byzyka, chief investment officer of Credent Wealth Management. “As such rhetoric has expanded over the past 12 months, the flows and upside in small caps has been impressive, especially year-to-date when compared to broad large-cap indices.”

The weakest factor performance in the US equity space this year: large-cap value stocks. The iShares S&P 500 Value (NYSE:IVE) is up a relatively mild 2.3% in 2018 through yesterday’s close.

The broad market benchmark — SPDR S&P 500 (NYSE:SPY)) – is posting a solid a solid 7.9% return year to date. The S&P’s healthy gain this year is a reminder that old-fashioned beta is helping lift all factor boats.

Despite any number of risk factors bubbling, the US equity market appears unconcerned with the current outlook. A strong macro wind is a key driver. “Ongoing economic growth has overwhelmingly favored positive equity returns in the past, with high odds of positive returns and low odds of large losses,” notes Goldman Sachs (NYSE:GS) Investment Management in a recent report via CNBC. “In fact, only one quarter of US bear markets have occurred during expansions. Moreover, equity returns have remained favorable until about five months prior to the onset of an economic contraction, highlighting the penalty for prematurely exiting the market in the absence of elevated recession risks.”