Last month I told you about the upcoming rebalance of the hugely popular VanEck Vectors Junior Gold Miners ETF (NYSE:GDX), and how it would distress shares of junior, small-cap mining stocks.

I said then that the rebalance could create some excellent opportunities for astute investors to accumulate high-quality, well-managed producers at discount prices.

That day has finally arrived, bringing with it a tsunami in the junior resource space, as I told Collin Kettell on Palisade Radio the week before. It’s a buyer’s market—if you know what you’re looking for. The last time the GDXJ underwent a rebalance of this magnitude was in December 2014, so I see this as a rare event savvy investors shouldn’t miss out on.

But first a reminder of what’s been happening with the GDXJ. Basically, it had become too massive for its underlying index—composed mostly of Canadian junior gold producers—with assets rising close to $5.5 billion earlier this year, up from $1 billion only last year.

Mo Money Mo Problems

Normally this wouldn’t be such a concern. But the GDXJ was getting precariously close to owning a 20 percent share of several names in its index, which would have triggered all sorts of regulatory and tax conundrums in Canada and the U.S.

So the fund made several adjustments to its methodology, including raising the market cap threshold of allowable companies to $2.9 billion, up sharply from $1.6 billion. This means it can now hold large producers that don’t appear in its index, the MVIS Global Junior Gold Miners Index. It also means that a number of smaller constituents were down-weighted or divested altogether, giving investors less exposure to junior miners than what the fund’s name implies.

Before any of this took effect, though, many investors, hedge funds and other market participants acted on the rebalance news by indiscriminately selling down their junior mining assets. This introduced fresh volatility to underlying stocks and depreciated prices.

The selloff, I might add, was done mostly without regard for the phenomenal fundamentals and growth profiles some of these companies reported.

These Miners Get High Grades

Take one of our favorite names, Wesdome Gold Mines. The Toronto-based producer has been operating in Canada for 30 straight years as of 2017 and currently carries no debt. Two of its mines, Eagle River and Mishi, are among Canada’s highest-grade gold mines. Last summer, the company made headlines when it discovered gold at its Kiena property in Quebec, sending its stock up an amazing 49 percent to $2.24 on August 25.

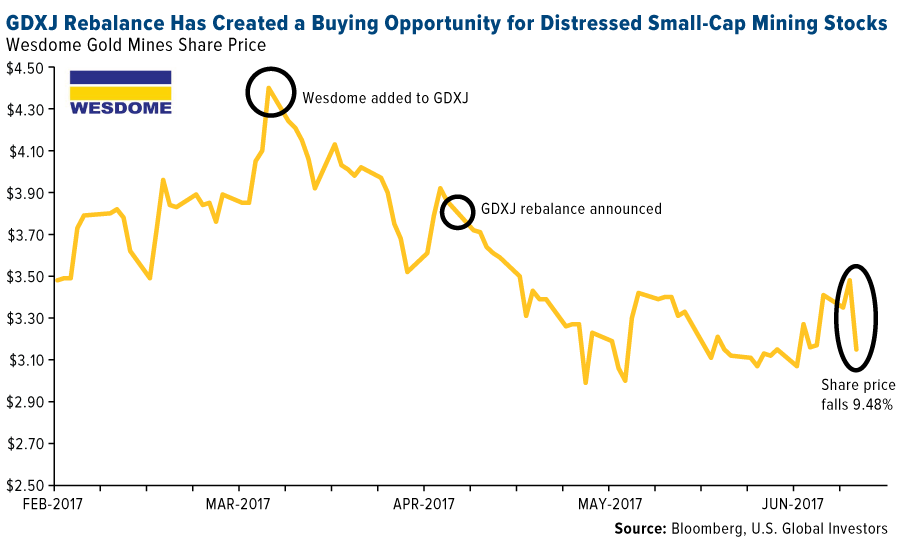

When Wesdome was added to the GDXJ in March, it cast newfound attention on the $417 million company. Only a month later, the rebalance was announced, and since then, its stock has eased about 19 percent.

I see this as a can’t-miss opportunity for retail and institutional investors to start nibbling on Wesdome and other junior miners that have been similarly knocked down only because of fund flows.

That includes Gran Colombia Gold Corp (TO:GCM), the largest gold and silver producer in Colombia, and Klondex Mines Ltd. (TO:KDX), whose Fire Creek Mine in Nevada was estimated to be the highest-grade underground gold mine in the world. (According to IntelligenceMine, Fire Creek averaged 44.1 grams per metric ton (g/t) in 2015, double the ore grade of the world’s number two project, Kirkland Lake Gold Ltd (BE:NGDA) Macassa Mine, at 22.2 g/t.)

Gran Colombia announced last week that it produced 15,444 ounces of gold in May, representing a new monthly record for the company. This brings the total amount for the first five months of the year to 68,783 ounces, an impressive 21 percent increase over the same period last year. The Canadian-based producer has a very attractive convertible bond that pays monthly.

I’ve frequently praised Klondex for its frugality, strong revenue growth and exceptional management team. The last time I visited Vancouver, I had the opportunity to chat one-on-one with its president and CEO, Paul Andre Hurt, who has 30 years of experience in high-grade mining. Not only is Paul a highly-respected chief executive in the mining space, he’s also a devoted father of five.

A Golden Opportunity

The GDXJ rebalance represents a rare opportunity to accumulate high-quality junior producers at discount prices. I always recommend a 10 percent weighting in gold—5 percent in gold stocks or mutual funds, 5 percent in bars, coins and jewelry.

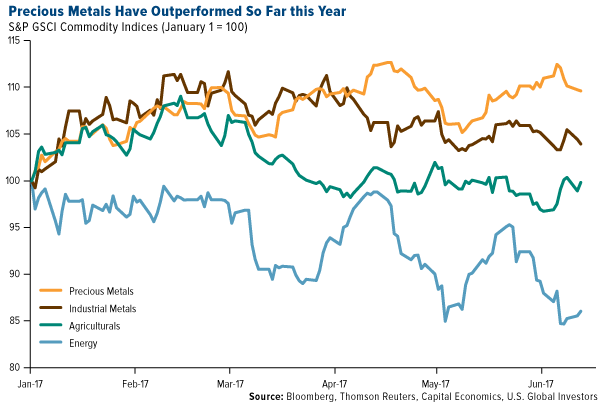

Commodity prices have lately underperformed equities mostly on subdued oil demand growth, with the S&P GSCI commodity index falling about 4 percent over the last month. If we separate the index components, however, we see that precious metals have posted positive gains year-to-date along with industrial metals.

As I mentioned recently, gold imports in China and India, the world’s top two consumers of the yellow metal, have advanced strongly this year on safe haven demand. China boosted its gold purchases from Hong Kong as much as 50 percent this year to 1,000 metric tons, the most since 2013. India’s imports rose fourfold in May compared to the same month last year as traders fear a higher tax rate on jewelry.

With the GDXJ down-weighting junior producers, investors might wonder how they can get broad exposure to small-cap mining stocks.

The VanEck Vectors Junior Gold Miners ETF was trading at $32.46 per share on Monday afternoon, down $0.54 (-1.64%). Year-to-date, GDXJ has gained 2.88%, versus a 9.45% rise in the benchmark S&P 500 index during the same period.

GDXJ currently has an ETF Daily News SMART Grade of C (Neutral), and is ranked #14 of 34 ETFs in the Precious Metals ETFs category.