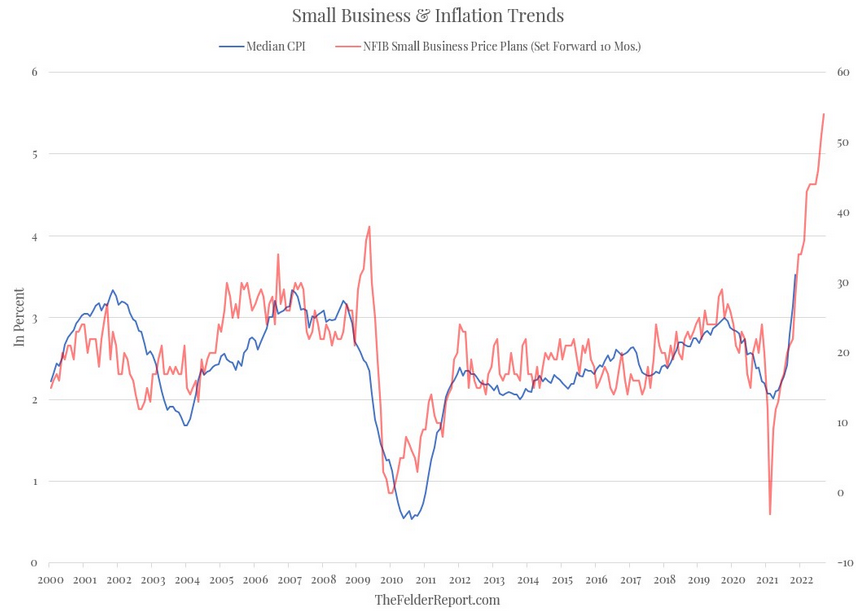

Earlier this week, the NFIB released the results of its November survey of small businesses. This report has important implications for investors for two reasons. First, small businesses are a very good leading indicator of inflation trends in the broadest sense.

The chart below (hat tip to the brilliant Julian Brigden) plots median CPI alongside small business price plans (set forward 10 months). Clearly, if anyone has their finger on the pulse of underlying inflation trends, it’s these guys and they are sending a very loud message that it is anything but transitory at this point.

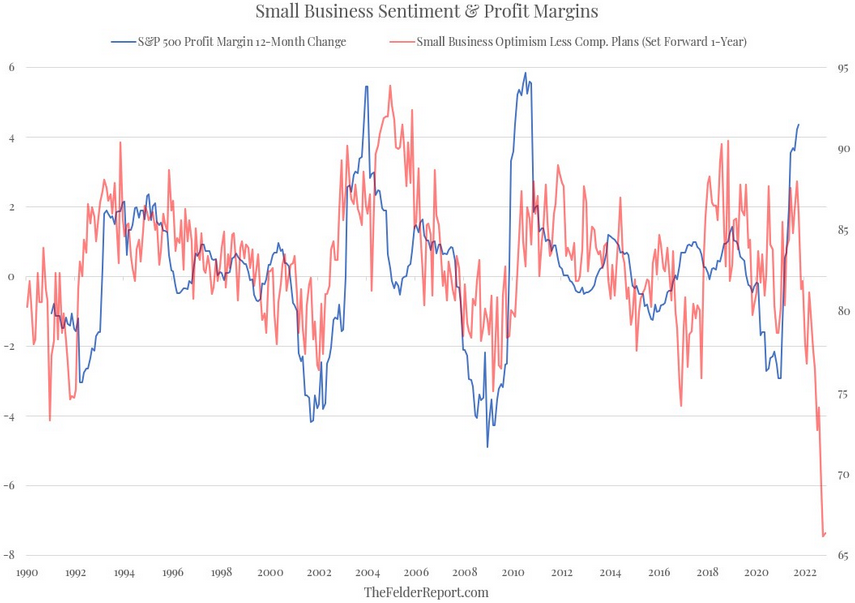

Second, small businesses are all also very good leading indicators of corporate profits margins in the broadest sense. The chart below (hat tip to the brilliant minds at Nordea) plots the 12-month change in S&P 500 profit margins alongside small business optimism less compensation plans (set forward 1-year).

Clearly, what small businesses see in terms of inflation trends going forward has them very concerned about their bottom lines over the next year. This sends a very loud message regarding the trend in corporate profits in a much wider sense.

Considering the fact that, even though Jay Powell has capitulated and deemed inflation trends more than transitory at this point, the majority of investors are still betting on a transitory outcome, there could be some fireworks in the asset markets should they eventually be forced into an inflationary epiphany. Furthermore, what may exacerbate those fireworks, particularly in the stock market, is an earnings recession amid the most extreme valuations in history. Happy New Year?