Looking for outperforming dividend stocks to capitalize on rising interest rates? As it turns out, many regional and small bank stocks and ETFs have been outperforming the S&P 500 handily over the past month, and year-to-date.

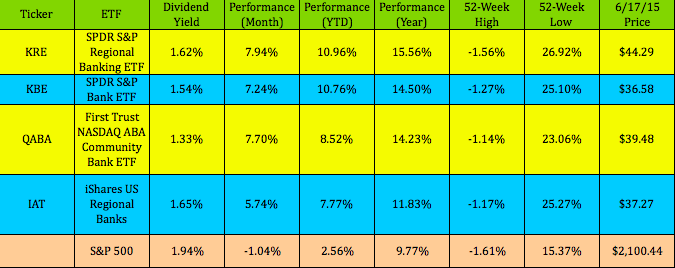

Here’s a look at how 4 of these ETFs (SPDR S&P Regional Banking (NYSE:KRE), SPDR S&P Bank (NYSE:KBE), First Trust NASDAQ ABA Community Bank (NASDAQ:QABA) and iShares US Regional Banks (NYSE:IAT)) have trumped the S&P 500 in these periods:

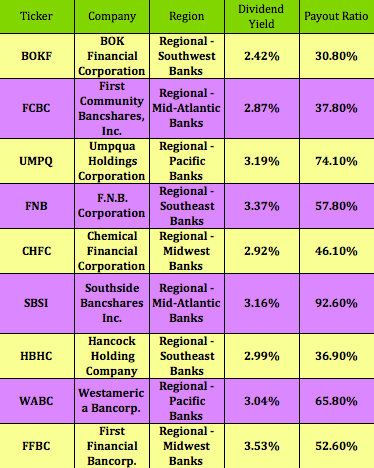

Digging down further, we culled out the stocks from the universe of outperforming small and regional banks, to find the high dividend stocks within this group. As you can see, these are a far cry from the 6% to 12% high yielding stocks which we usually write about, and also track in our High Dividend Stocks By Sector Tables.

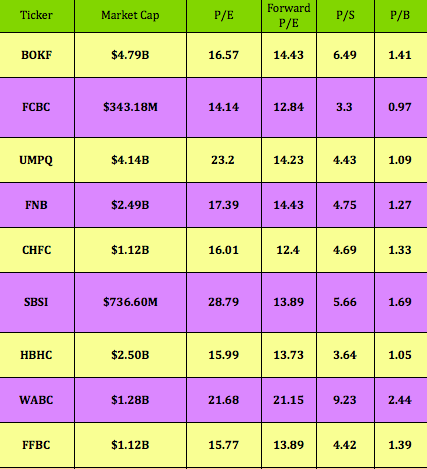

This group (BOK Financial Corporation (NASDAQ:BOKF), First Community Bancshares Inc (NASDAQ:FCBC), Umpqua Holdings Corporation (NASDAQ:UMPQ), FNB Corporation (NYSE:FNB), Chemical Financial Corporation (NASDAQ:CHFC), Southside Bancshares Inc (NASDAQ:SBSI), Hancock Holding Company (NASDAQ:HBHC), Westamerica Bancorporation (NASDAQ:WABC), First Financial Bancorp (NASDAQ:FFBC)) has a dividend yield range of 2.42% up to 3.53%, and its Dividend Payout Ratio range is quite wide, from a low of 30.80%, up to 92.60%:

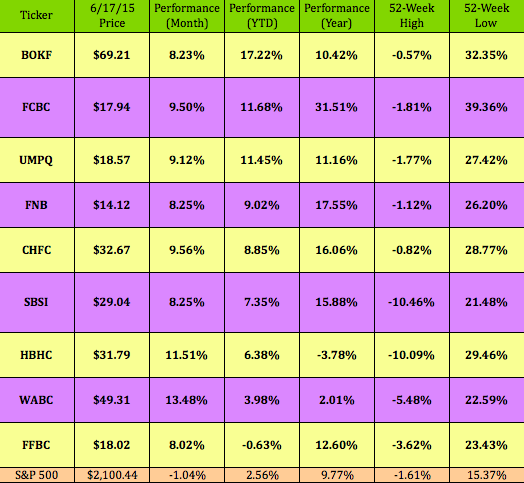

Performance: All of these small bank stocks have outperformed the S&P 500 over the past month, and the overwhelming majority have also outperformed over the past year and year to date:

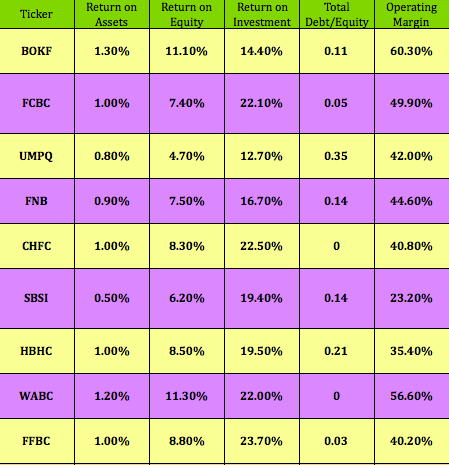

Financials: A common trait among these stocks is that they seem to be more conservative than the large mega banks – none of them has a large debt load – they’re all way below 1.00, and some of them have no debt at all. As a contrast, Citigroup (NYSE:C), JPMorgan Chase (NYSE:JPM), and Wells Fargo (NYSE:WFC) all have Debt/Equity loads of over 1.00. The smaller debt loads for these smaller banks may also be a by-product of increased bank regulation, but this trait is one we often hear about them – that they’re a more conservatively run group as a whole.

Valuations: Most of these banks’ Forward P/E valuations seem quite modest, in addition to some of them being much lower than their trailing P/E’s, which is also a positive sign that they are moving in the right direction.

Disclaimer: This article is written for informational purposes only, and isn’t intended as investment advice.

Disclosure: Author owned no shares in any of the stocks mentioned in this article at the time of this writing.

Copyright 2015 DeMar Marketing All Rights Reserved