Skyworks Solutions, Inc. (NASDAQ:SWKS) just released its fist-quarter 2018 financial results, posting adjusted earnings of $2.00 per share and revenues of $1.05 billion. Currently, Skyworks is a Zacks Rank #4 (Sell), but that could change based on today's results. The stock is up over 4% to $98.80 per share in after-hours trading shortly after its earnings report was released.

SWKS:

Beat earnings estimates. The company posted adjusted earnings of $2.00 per share, beating the Zacks Consensus Estimate of $1.91 per share.

Matched revenue estimates. The company saw revenue figures of $1.05 billion, matching our consensus estimate of $1.05 billion.

The high performance analog semiconductor company posted quarterly sales that climbed 15% year-over-year. Skyworks also reported adjusted operating income of $414.0 million, while its non-GAAP earnings surged 24% from the year ago-period.

On top of that, Skyworks’ Board of Directors has declared a cash dividend of $0.32 per share, payable on March 15 to stockholders of record at the close of business on Feb. 22. The board also authorized a new share repurchase plan of up to $1 billion of common stock prior to Jan. 31, 2020.

“As connectivity performance requirements intensify, Skyworks is leveraging our mixed signal expertise, scale and customer relationships to power the mobile economy and capitalize on several strategic growth catalysts,” CEO Liam K. Griffin said in a statement.

Looking ahead to the second-quarter, the company expects its revenues to climb between 6% and 8% year-over-year to a midpoint of $910 million. As far as the bottom-line is concerned, Skyworks projects it will post non-GAAP EPS of $1.60, which would mark a 10% gain.

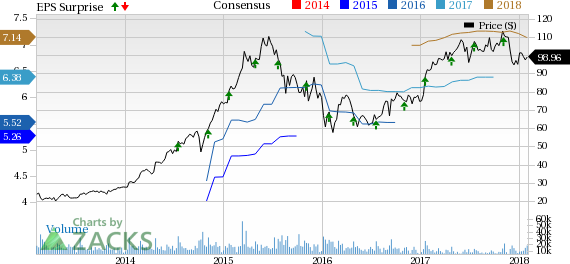

Here’s a graph that looks at SWKS’ Price, Consensus and EPS Surprise history:

Skyworks Solutions, Inc. is empowering the wireless networking revolution. Their highly innovative analog semiconductors are connecting people, places and things spanning a number of new and previously unimagined applications within the automotive, broadband, cellular infrastructure, connected home, industrial, medical, military, smartphone, tablet and wearable markets. Skyworks is a global company with engineering, marketing, operations, sales and support facilities located throughout Asia, Europe and North America and is a member of the S&P 500 and Nasdaq-100 market indices.

Check back later for our full analysis on SWKS’ earnings report!

Zacks Editor-in-Chief Goes "All In" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

Download it free >>

Skyworks Solutions, Inc. (SWKS): Free Stock Analysis Report

Original post

Zacks Investment Research