On Aug 17, we issued an updated research report on Woburn, MA-based, Skyworks Solutions Inc. (NASDAQ:SWKS) , a leading provider of radio frequency (RF) and semiconductor system solutions.

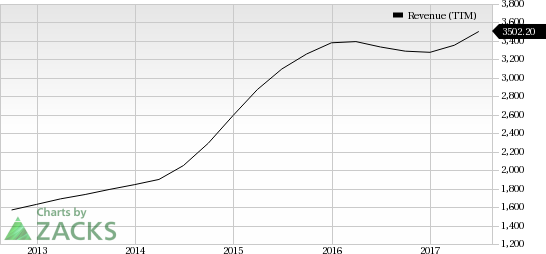

The company recently reported strong fiscal third-quarter 2017 results. Both the top- as well as the bottom line surpassed the respective Zacks Consensus Estimate and improved significantly year over year. Notably, the company has beaten the Zacks Consensus Estimate in each of the trailing four quarters, with an average positive surprise of 3.05%.

Management also provided optimistic guidance for the fourth quarter. We believe that the impressive results and the guidance will help sustain the stock’s momentum in the rest of 2017 and beyond.

Notably, shares of Skyworks gained 36.9% year-to-date, outperforming the industry’s 31.7% rally.

Fundamentals Driving Growth

Skywork has gained traction following strong demand for Wi-Fi, Zigbee and LTE solutions. The company’s products have been selected by the likes of Amazon (NASDAQ:AMZN) in recent times.

Moreover, IoT remains a significant growth segment for the company. IoT volumes per industry projections are anticipated to reach 75 billion units by 2025, driven by robust demand for connected home, smart grid and virtual assistants.

Skywork’s strength is further intensified by increased demand for highly integrated solutions as customers implement the next level of functionality for higher bandwidth.

With a customer base comprising the likes of Cisco (NASDAQ:CSCO) in MIMO gateways, Nintendo in its Switch Gaming console, Fitbit, Garmin and LG, the company is on a strong growth trajectory. Notably, the upcoming 5G upgrade cycle is also a major positive for the company.

Late iPhone 8 Launch a Headwind

Reportedly, Apple (NASDAQ:AAPL) , which contributes around 40% of Skyworks’s revenues, is delaying the launch of iPhone 8. This is expected to keep the company’s top line under pressure. Moreover, the weakness in China due to piled up inventory is another headwind for the company.

Additionally, heavy investments in R&D are escalating operating expenses, which is affecting margins. Significant pricing pressure, technological obsolescence and high concentration risks are other concerns.

Zacks Rank

Skyworks currently carries Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

4 Surprising Tech Stocks to Keep an Eye on

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

Cisco Systems, Inc. (CSCO): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Skyworks Solutions, Inc. (SWKS): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Applied Optoelectronics, Inc. (AAOI): Free Stock Analysis Report

Original post

Zacks Investment Research