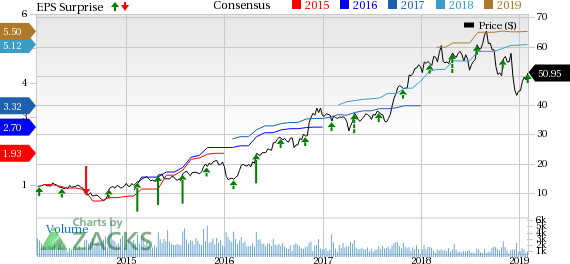

SkyWest, Inc. (NASDAQ:SKYW) delivered better-than-expected results in the fourth quarter of 2018. The company’s earnings of $1.28 per share, surpassed the Zacks Consensus Estimate of $1.09. Also, the bottom line improved 58% on a year-over-year basis. Results benefited from the company’s fleet transition initiatives.

Quarterly revenues came in at $803.5 million, beating the Zacks Consensus Estimate of $789.6 million. Moreover, the top line rose year over year on the company’s improved fleet mix.

In fact, SkyWest’s efforts to modernize its fleet and streamline operations are very impressive. The company aims to reduce the 50-seat jets from its fleet and add new E175 aircraft. To this end, this St. George, UT-based carrier reported a 3.7% decrease in block hours (a measure of aircraft utilization) during the fourth quarter of 2018.

In a bid to upgrade its fleet, the carrier has added 39 E175 planes and five CRJ900 aircraft to its fleet and removed multiple unproductive/less-profitable aircraft from its fleet since the fourth quarter of 2017. During the fourth quarter of 2018, SkyWest took delivery of eight E175 aircraft under an existing agreement with Delta Air Lines (NYSE:DAL) . Additionally, the company is set to take delivery of three new E175 aircraft in 2021 under an agreement with Alaska Airlines, the subsidiary of Alaska Air Group (NYSE:ALK) .

Operating expenses rose slightly to $682 million due to high fuel and labor costs. Average fuel cost per gallon climbed 18.2% year over year to $2.66.

The company exited the reported quarter with cash and marketable securities of $689 million, down 2.3% sequentially. Total debt increased to $3.2 billion from $3.1 billion in the third quarter of 2018.

Some Key Developments

SkyWest has entered into an agreement with Delta to acquire nine E175s and operate the aircraft for a period of nine years. Under this deal, SkyWest will take delivery of five E175 aircraft during the first half of 2019. Meanwhile, four of the same family of aircraft are set to be delivered in 2020. With the delivery of these aircraft, the company expects to remove some of its used CRJ200 aircraft from the contract with Delta. Additionally, the company signed an extended multi-year pact with Delta on 32 CRJ aircraft.

This January, SkyWest completed the sale of ExpressJet to ManaAir, LLC. Per the agreement, SkyWest retained control over 30 CRJ700 aircraft, previously utilized by ExpressJet.

Zacks Rank & Key Pick

SkyWest flaunts a Zacks Rank #1 (Strong Buy). Another top-ranked stock in the same space is Azul S.A. (NYSE:AZUL) , which has the same top Zacks Rank as SkyWest. Shares of Azul have soared more than 60% in the past six months. You can see the complete list of today's Zacks #1 Rank stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Alaska Air Group, Inc. (ALK): Free Stock Analysis Report

SkyWest, Inc. (SKYW): Free Stock Analysis Report

Delta Air Lines, Inc. (DAL): Free Stock Analysis Report

AZUL SA (AZUL): Free Stock Analysis Report

Original post

Zacks Investment Research