- Silver has outperformed gold year-to-date on increasing demand.

- Short-term volatility is possible due to the US election and Federal Reserve meeting.

- Technically, silver is at a key support level; a close above 32.60 could signal renewed upward momentum.

Silver (XAG/USD) prices have continued to rally for the majority of this year. The metal has been overshadowed by Gold this year but has actually outperformed the precious metal. Silver’s YTD return sits at around 36%, while the precious metal is up around 32% over the same period.

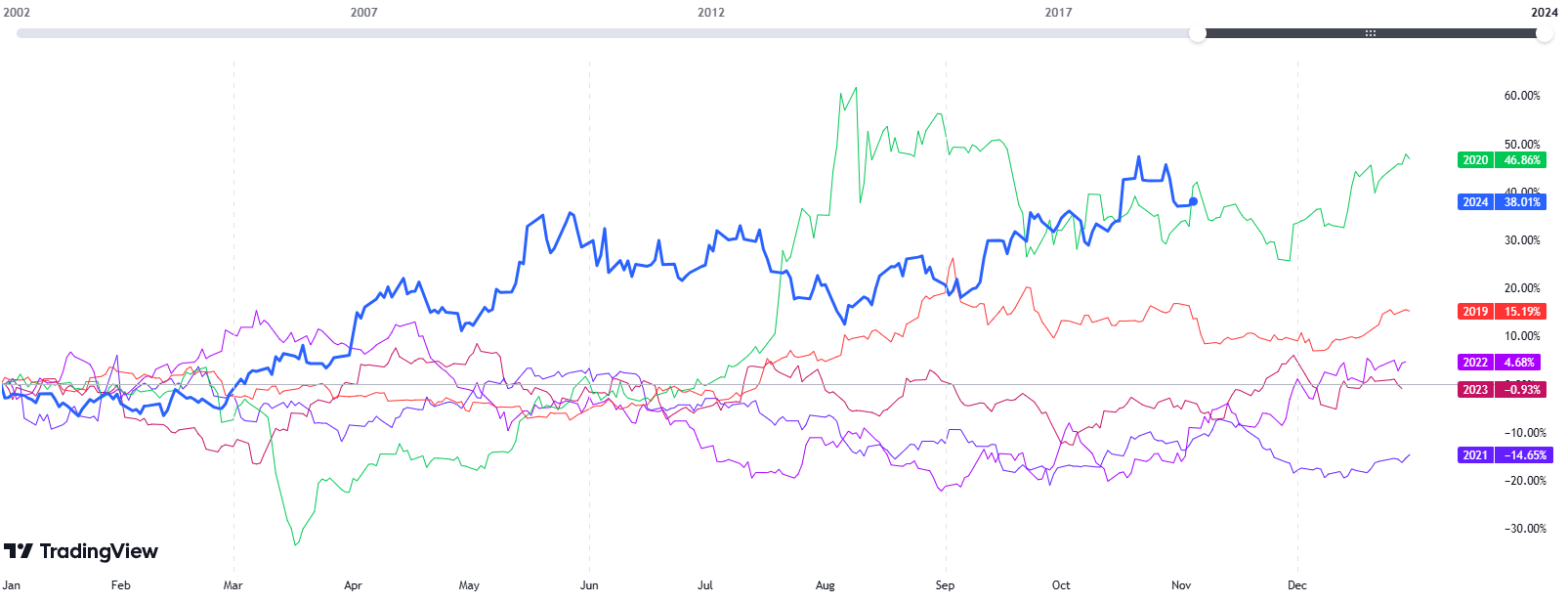

There has been growing interest in silver over the last few years as its use in technology production, EVs and renewable power solutions has driven up demand. This has resulted in tremendous gains for silver, with returns ranging from a low 4.68% in 2022 and a high of 46.86% in 2020. The losses in between saw a high print of -14.65% in 2021. Over the period between 2019 to date, Silver has risen 89% since 2019.

Silver (XAG/USD) Performance 2019-2024 YTD

Source: TradingView

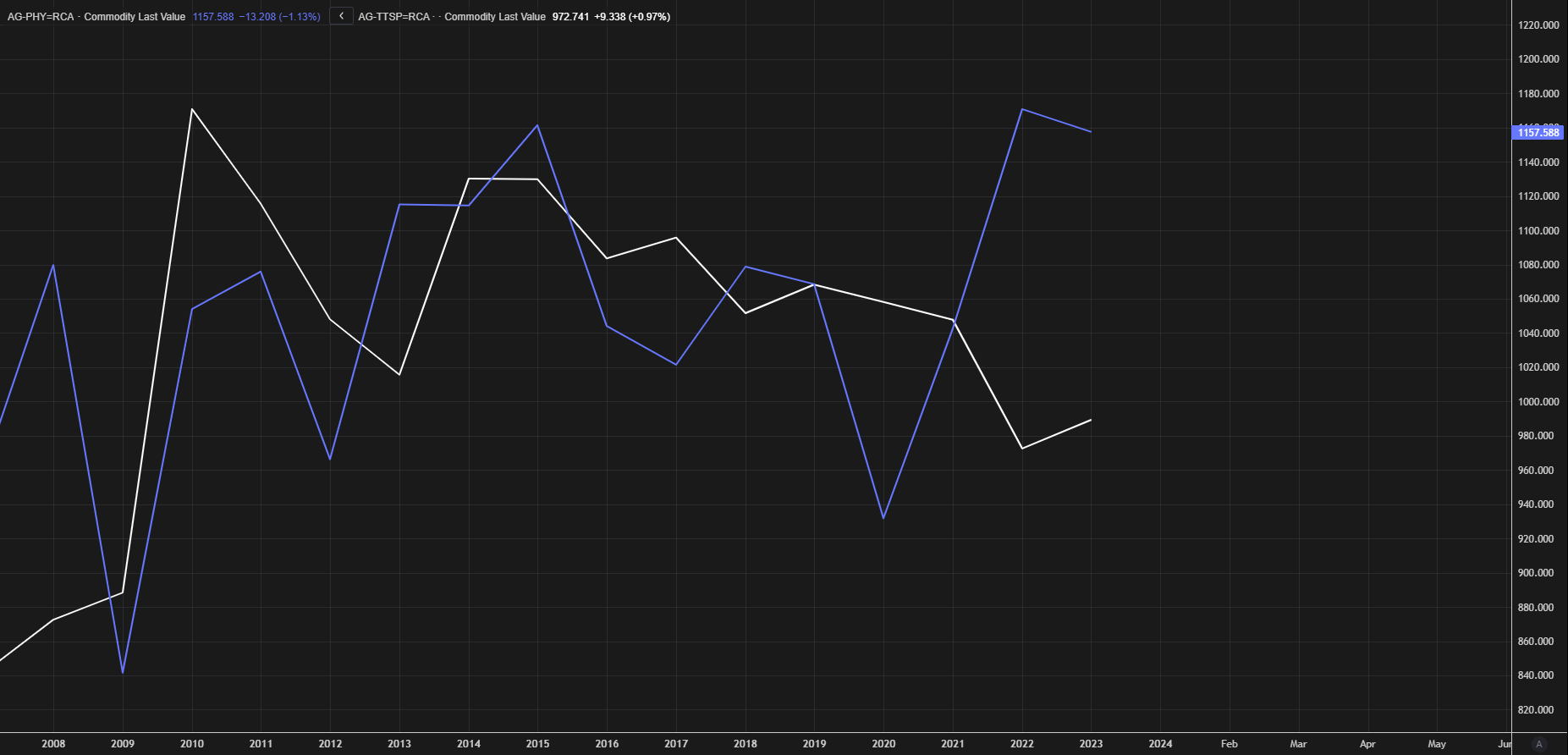

The fundamental picture is a positive one for silver with the gap between global supply and physical demand remaining wide. If demand continues to outpace supply as is expected, Silver should continue to rise.

Looking at the chart below, you can see the huge discrepancy between demand (blue line) and supply (white line) which I expect will underpin prices moving forward

.

Source: LSEG

Silver prices could face some short-term volatility over the next couple of days. The US election is underway which could have implications on the US Dollar, while the Federal Reserve meeting could lead to US Dollar weakness as market participants are pricing in a 25 bps cut from the Federal Reserve.

Technical Analysis Silver (XAG/USD)

From a technical analysis standpoint, Silver had a significant pullback last week as the US Dollar Index rose further. Since peaking around the 34.80 handle on October 22, silver has continued to print lower highs and lower lows, breaking below the 100-day MA and touching the long-term ascending trendline and 200-day MA.

This area around 32.20 is a key area of support and could see Silver push higher once more. On the H4 timeframe, Silver does need a four-hour candle close above the 32.60 handle. A close above 32.60 will result in a change of structure with the previous highs being taken out, a sign that momentum may be shifting once more.

Above the 32.60 handle there is further area of resistance at 33.01, before a bit of freedom which could see silver prices make a swift run toward the 34.00 handle.

Alternatively, a break below the ascending trendline and 200-day MA could see a retest of the 31.34 support handle and potentially the 30.65 mark if a deeper pullback gains momentum.

Silver (XAG/USD) Four-Hour (H4) Chart, November 5, 2024

Source: TradingView

Support

- 31.34

- 30.65

- 30.00

Resistance

- 32.60

- 33.01

- 34.00

Most Read: Brent Crude – Oil Prices Rise as OPEC + Extend Output Cuts