- OPEC+ extends oil production cuts, leading to Brent Crude prices above $75 per barrel.

- OPEC Secretary General expressed optimism about oil demand despite challenges.

- Technical analysis suggests Brent Crude faces resistance at $76.35, with support around $72.39.

Oil prices opened $1 higher following the weekend to trade at $73.80 a barrel when markets opened. Gain continued in both the Asian and early European sessions to reach a high of $75.30 before the US open.

On Sunday, OPEC+, which is made up of the Organization of the Petroleum Exporting Countries, Russia, and other partners, announced they would continue cutting Crude Oil WTI Futures production by 2.2 million barrels per day for December. They delayed increasing production from October due to lower prices and weak demand and this looks set to continue.

OPEC and Saudi Arabia have repeatedly said they do not target a certain price and make decisions based on market fundamentals and in the interest of balancing supply and demand. However, based on data and rumors it is more beneficial for OPEC countries to have a higher oil price which leads to higher profit margins. A low oil price at times weighs on OPEC countries as the costs involved continue to rise.

OPEC General Secretary Haitham Al Ghais said on Monday (NASDAQ:MNDY) that OPEC is very positive on demand for Oil in both the short and long-term. This comes after OPEC have downgraded their recent forecasts slightly which is interesting. Al Ghais went on to say that there are a host of challenges facing the group and markets as a whole but it is not all bad. Al Ghais said that China growing 5% is not bad at all while the strength of the US economy is another positive.

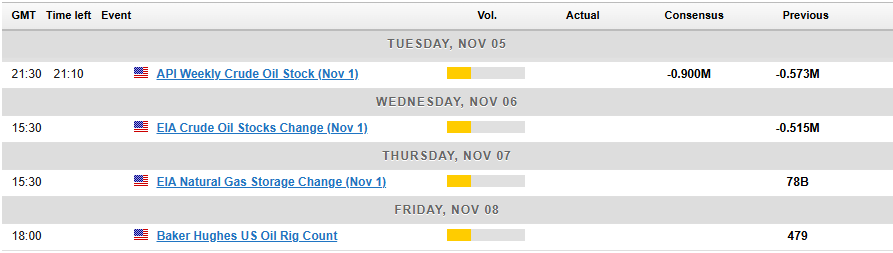

The week ahead could be a very volatile one when it comes to Oil prices. There are all the data releases together with Central Bank meetings, US elections and of course a potential strike by Iran on Israel. Also, a potential victory for Donald Trump in the US election could see Oil prices rise as rumors persist that Trump may sanction a potential attack on Iranian nuclear facilities. Something to bear in mind as election results come through.

Technical Analysis

From a technical perspective, Oil prices gapped higher for the second consecutive week. Concerns around Geopolitics and this week’s OPEC decision were the main reasons driving this jump in Oil prices.

It will be interesting to see how markets gauge the impact of the US Presidential Elections, especially if Donald Trump wins. As things stand, oil prices face a significant hurdle at $76.35 if the recovery is going to continue.

A move beyond the $76.35 handle opens up a run toward the 100-day MA around the $79.00 handle and then, of course, the psychological $80.00 a barrel mark.

Currently, the daily candle is showing signs of bearish pressure having retreated from the daily high around $75.77 to trade at $75.06 a barrel. Further downside and a bearish daily candle close could open up a retest of support at $72.39 and the most recent swing lows around $71.00.

Brent Crude Oil Daily Chart, November 4, 2024

Source: TradingView

Support

- 72.39

- 71.00

- 70.00 (psychological level)

Resistance

- 76.35

- 79.00

- 80.00

Most Read: Markets Weekly Outlook – US Elections and Central Banks Lead the Way