Silver has been trending lower under a bearish trendline that could be running out of steam. Silver has found some support thanks to the uncertainty in the global markets and a break through the trendline could be the result.

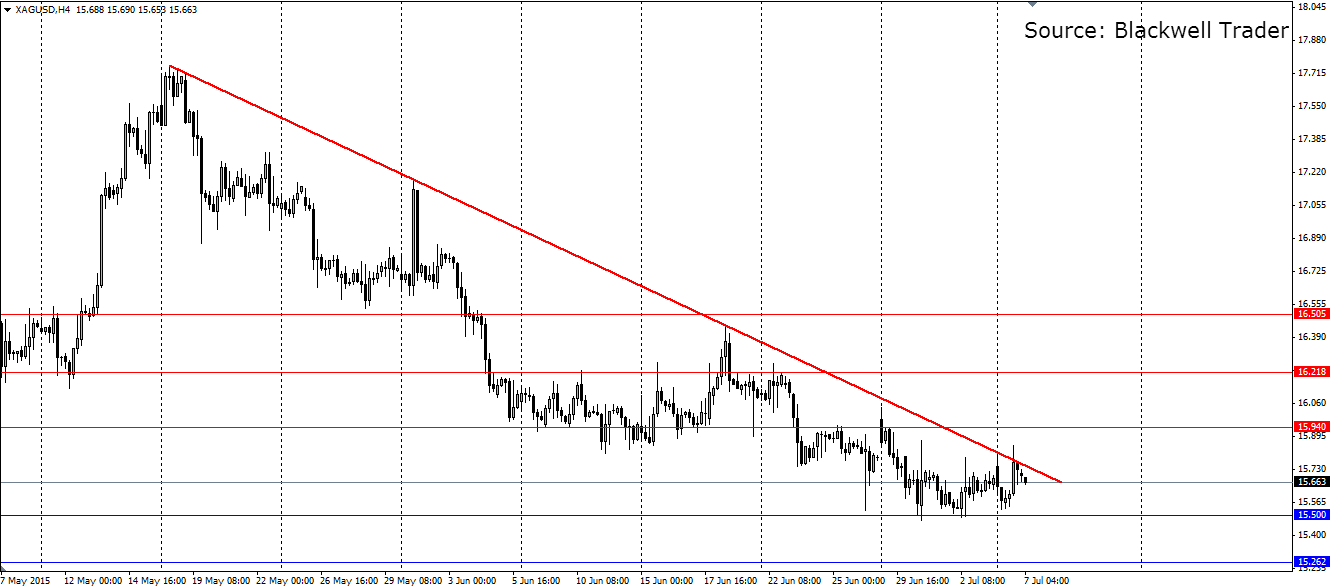

Since mid-May, silver has declined over $2 an ounce, from a high at $17.758 an ounce to its current level at $15.666. This is largely thanks to the expectation that the US will raise interest rates in September. The trend line it has been following has been tested on numerous occasions with only one false breakout coming recently, thanks to the Greek debt crisis.

The uncertainty in global markets could have a big effect on silver as investors seek safe haven assets. Greece has not yet exited the euro, but if they do the real fear is that contagion will spread to the other member states currently facing debt problems, namely Ireland, Portugal, Spain and Italy. This could seriously put the viability of the euro in jeopardy.

China is another source of uncertainty that could force large sums of money into silver. The Shanghai Composite has shed over 25% in the past month and there is some serious concern that China is staring down the barrel of a significant deterioration in domestic incomes and demand. The government has stepped in by announcing a large fund that will prop the equities market up (QE by any other name) which will likely see large amounts of cash finding its way into other markets including the silver market.

Looking at the H4 chart, we can clearly see the bearish trend in play. This downward trend has met some solid support at the $15.500 mark that has proven itself to be a swing point for previous bearish moves. Watch for the commodity to consolidate before a breakout, which is likely to be bullish given the uncertainty, but could prove to be a bearish continuation.

If the bearish trend line fails and we see a bullish breakout, watch for resistance to be met at 15.940, 16.218 and 16.505. If the opposite is true and the trend line holds, watch for support at 15.500, 15.262 and 15.047. Either way, silver is set to move.