The silver miners’ stocks have rallied in recent months but are still underperforming gold stocks. Silver lagging gold is mostly responsible, driven by big stock-market down days dampening enthusiasm for speculation. But silver will ultimately mirror and amplify gold’s bull upleg, fueling strong leveraged gains in its miners’ stocks. Their just-finishing Q4’21 earnings season reveals they are faring well fundamentally.

With the subsequent Q1’22 ended, the prior quarter’s operational and financial reports seem dated. But because most companies run on calendar years, the Q4 reporting deadlines are extended. In the US companies don’t have to report full-year 10-K results until 60 days after quarter-ends, compared to 40 days for 10-Q quarterlies. In Canada, the epicenter of the silver-mining universe, year-ends extend to 90 days!

Since many of the major silver miners have primary stock listings in that Great White North, late March is about the earliest enough of them have reported analyzing their collective Q4 results. Soon after each quarterly earnings season, I dig into the latest reports from the top-15 component companies of the SIL Global X Silver Miners ETF. Despite just $1.1b in net assets, SIL remains the leading ETF in this small sector.

SIL’s lackluster performance recently reflects the ongoing apathy plaguing silver stocks. Between late January to early March, SIL rallied a solid 18.3%. But that proved poor relatively since silver marched 17.7% higher in roughly that same span. If silver miners’ stocks can’t leverage their metal’s upside, they aren’t worth the sizable additional risks they bear compared to silver. They must double to triple silver’s gains.

Silver has a long history of well-outperforming gold when sentiment is favorable. Yet that recent young 17.7% silver upleg wasn’t much better than gold’s parallel 14.6% surge. The seriously-weak stock markets were to blame. At worst, when gold was powering higher partially on safe-haven buying, the US flagship S&P 500 stock index plunged 9.1%! Silver tends to get sucked into material stock-market selling.

That’s because silver is far-more-speculative than gold, making it more susceptible to flaring fear when stock markets tumble. On days when the S&P 500 plunges yet gold rallies, silver tends to split the difference between them. But silver sentiment grows more favorable the longer gold climbs, unwinding much of that decoupling. Because silver lagged recently, SIL also way-underperformed the GDX (NYSE:GDX) gold-stock ETF.

That blasted 32.8% higher at best between late January to early March, amplifying gold’s gains by a solid 2.3x! That trounced the poor 1.0x SIL achieved relative to silver. So the silver-mining stocks sure haven’t been very popular lately. Nevertheless, their newest fundamentals from Q4’21 are important to consider for gaming this sector’s near-future direction. This is now my 23rd quarter in a row doing this SIL analysis.

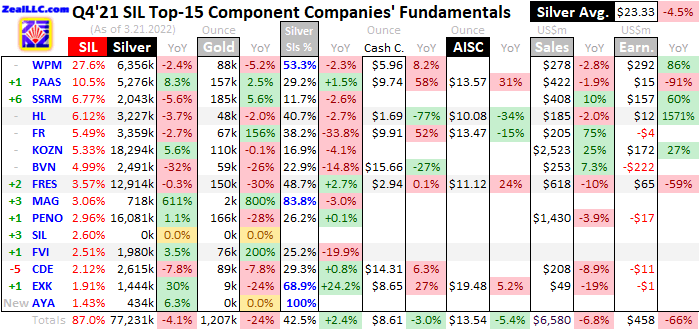

This table summarizes the operational and financial highlights from the SIL top 15 during Q4’21. These major silver miners’ stock symbols aren’t all US listings and are preceded by their ranking changes within SIL over this past year. The shuffling in their ETF weightings reflects shifting market caps, which reveal both outperformers and underperformers since Q4’20. Those symbols are followed by current SIL weightings.

Next comes these miners’ Q4’21 silver and gold production in ounces, along with their year-over-year changes from the comparable Q4’20. Output is the lifeblood of this industry, with investors generally prizing production growth above everything else. After that is a measure of silver miners’ relative purity, their percentage of quarterly sales actually derived from silver. Most silver miners also produce gold or base metals.

Generally, the more silver-centric a miner, the more responsive its stock price is to changing silver prices. So traders looking for leveraged silver exposure via its miners’ stocks should stick to the purer producers. Then the costs of wresting that silver from the bowels of the earth are shown in per-ounce terms, both cash costs and all-in sustaining costs. The latter subtracted from silver prices helps illuminate profitability.

These miners’ hard quarterly revenues follow that, and earnings are reported to securities regulators. Blank data fields mean companies hadn’t reported that particular data as of late March, when Q4’s earnings season was winding down. The annual percentage changes are excluded if they would prove misleading, like comparing two negative numbers or data shifting from positive to negative or vice versa.

2021’s final quarter proved interesting for the major silver miners. They faced inflationary cost pressures and drifting-lower silver prices that squeezed profitability. Yet the SIL top 15’s average mining costs still retreated, keeping their collective per-ounce earnings strong! That proved much better fundamentally than the major gold miners of GDX and mid-tiers of Junior Gold Miners ETF (NYSE:GDXJ), which I analyzed in-depth in recent weeks’ essays.

Major silver miners have been increasingly diversifying into gold for many years now. The economics of mining the yellow metal have long proven superior to those of the white one and will stay that way unless silver soars to and sustains much-higher levels. Miners are adapting to that. Much to the chagrin of long-time silver-stock investors, primary silver miners are becoming ever-rarer and threatening to go extinct.

In Q4’21, these SIL-top-15 silver miners produced 77,231k ounces of their namesake metal. Although that slumped 4.1% year-over-year from Q4’20, it was still robust. During the past 23 quarters where I’ve been advancing this deep-research thread, the SIL top 15’s aggregate silver output ranged from 61,471k up to 84,962k ounces. The average was 73,455k, so this latest-reported quarter’s results proved better than typical.

Surprisingly these major silver miners’ total gold output crumbled 24.1% YoY to just 1,207k ounces in Q4’21! That was the biggest decline by far since at least Q2’16. Gold’s drop doesn’t reflect silver regaining managements’ favor from gold, but largely a key change in SIL’s component rankings recently. During the preceding four quarters, the SIL top 15’s gold mined had grown 3.7%, 8.3%, 20.2%, and 11.8% YoY.

For years one of SIL’s top components had been the Russian-owned UK-traded Polymetal International. It long commanded this ETF’s second-largest weighting. But since Russia invaded Ukraine, destroyed its cities, and slaughtered its people, all Russian stocks have been dumped like radioactive. Thus Polymetal’s market capitalization collapsed enough to hammer it from second to twentieth in SIL’s weightings!

This company is overwhelmingly a primary gold miner, which produced 322k ounces in Q4’20 and 399k in the preceding Q3’21. Polymetal was effectively replaced in the SIL top 15 by the small primary silver miner Aya Gold & Silver, which produced no gold in Q4’21. So if Polymetal’s gold and silver output is excluded from the comparable Q4’20, the SIL top 15 actually saw gold retreat just 4.8% while silver grew 1.4%.

SIL remained a primary gold miners’ ETF, with just 42.5% of its top-15 companies’ revenues that quarter actually derived from silver. That’s calculated by multiplying their Q4’21 silver production by that quarter’s average silver price, then dividing that by total sales. While 42.5% improved 2.4% YoY, it is skewed high. So the ongoing yellowing of the major silver miners didn’t slow much during 2021’s final quarter.

Polymetal’s percent of sales from silver in Q4’20 was just 12.7%. It really had no place in a silver miners’ ETF despite the 4,400k ounces of the white metal it mined. That super-low relative silver purity has been replaced with Aya’s running at 100%. But that small silver junior merely mined 434k ounces during that quarter, which is the lowest among the SIL-top-15 producers by far. Ex-Aya, the silver purity only ran 38.1%.

Just four of these silver miners qualified as primary silver producers in Q4’21, and their silver-purity percentages are highlighted in blue. But because ETF companies need more than a handful of stocks to create exchange-traded funds, they stuffed SIL with primary gold miners. But at least those are also all sizable-to-large silver miners. Still, their gold-centric output makes them more responsive to gold than silver.

While Wheaton Precious Metals (NYSE:WPM) and Pan American Silver (NASDAQ:PAAS) are great companies that I’ve owned and recommended in our newsletters for 13.4 and 19.7 years now, they aren’t primary silver miners. Even with Polymetal flushed down the toilet with the rest of the world’s Russian stocks, SIL remains very concentrated and risky. This ETF’s top-two holdings alone account for a staggering 38.1% of its total weighting!

Wheaton is actually a silver-and-gold streamer, a mine-finance business. It helps other companies build silver and gold mines by pre-purchasing fractions of their future silver or gold outputs. In return for big upfront capital payments used to construct those mines, WPM gets later to buy parts of their production for low per-ounce payments. These streaming deals have proven a fantastic very-profitable business model.

Silver streaming was Wheaton’s original focus, but it changed its name from Silver Wheaton to Wheaton Precious Metals in May 2017 to reflect its increasing reliance on gold deals. Silver streams are still easier to procure, though, as nearly 3/4ths of all the silver mined globally is a byproduct of base metals and gold mines! Companies are more willing to pre-sell byproduct metals than their primary ones.

Meanwhile, Pan American Silver’s increasingly-heavy focus on gold will likely necessitate its own name change sooner or later. Just 29.2% of PAAS’s Q4’21 revenues came from silver, on the lower side for SIL-top-15 stocks. SIL’s third-largest component, SSR Mining (NASDAQ:SSRM), has diversified even more aggressively into gold in recent years, driving down its latest-reported quarterly silver purity to an utterly-gold-dominated 11.7%!

Given prevailing gold and silver prices and mining economics, this yellowing of silver miners makes good sense. Augmenting major silver production with increasing gold output greatly boosts these companies’ operating-cash-flow generation and profits. But becoming more gold-centric leaves their stock prices less responsive to silver, making it more difficult to get purer leveraged silver exposure through mining stocks.

Long-term silver-stock price levels ultimately depend on miners’ profitability, which is directly driven by the difference between prevailing silver prices and silver-mining costs. In unit terms, these are generally inversely proportional to silver production. That’s because silver mines’ total operating costs are largely fixed during the planning stages. Their designed throughputs limit the amounts of silver-bearing ore they can process.

That doesn’t change quarter to quarter and requires about the same levels of infrastructure, equipment, and employees. The only real variable is the ore grades run through the fixed-capacity mills. Richer ores yield more silver ounces to spread the high fixed costs of mining across, lowering unit costs which boost profitability. The SIL top 15’s lower silver output should’ve driven modestly-higher costs in Q4’21, yet they fell!

Cash costs are the classic measure of silver-mining costs, including all cash expenses necessary to mine each ounce of silver. But they are misleading as a true cost measure, excluding the big capital needed to explore for silver deposits and build mines. So cash costs are best viewed as survivability acid-test levels for the major silver miners. They illuminate the minimum silver prices required to keep the mines running.

Rather impressively, the SIL top 15’s average cash costs in Q4’21 retreated 3.0% YoY to merely $8.61 per ounce. That proved a huge 18.0% sequential drop from the preceding quarter’s $10.50! The primary driver of these lower silver-mining cash costs was Hecla Mining’s collapsing 77.1% YoY to just $1.69. Huge byproduct credits drove that super-low result from lead and zinc mined along with the silver.

Despite the SIL silver stocks’ performances really lagging the GDX gold stocks’ lately, these elite major silver miners fared much better fundamentally on the cost front. The SIL top 15’s cash costs retreating 3.0% YoY were far better than the GDX-top-25 major gold miners’ soaring 21.8% YoY while the GDXJ-top-25 mid-tiers surged 9.2% YoY! This surprising cost dichotomy persisted through broader measures.

All-in sustaining costs are far superior to cash costs and were introduced by the World Gold Council in June 2013. They add on to cash costs everything else that is necessary to maintain and replenish silver-mining operations at current output tempos. AISCs give a much better understanding of what it really costs to maintain silver mines as ongoing concerns and reveal the major silver miners’ true operating profitability.

These elite major silver miners of the SIL top 15 reporting AISCs for Q4’21 averaged $13.54 per ounce, which declined an even-better 5.4% YoY. Those also collapsed 14.2% quarter-on-quarter from Q3’21, a heck of an improvement! The comparable GDX- and GDXJ-top-25-component average AISCs climbed 14.5% and 8.7% YoY. It’s rare to see the elite silver miners report better fundamental progress than gold miners.

And silver AISCs could’ve been better. The Chinese silver and base-metals miner Silvercorp Metals (NYSE:SVM) often oscillates between the 15th- and 16th-largest holding of SIL. It barely missed the cut for Q4’21 results, with Aya muscling its way in. Had Silvercorp taken its place, its very-low $8.82 AISCs driven by massive lead and zinc byproducts would’ve dragged the SIL top 15’s average AISCs down to $12.76 per ounce in Q4’21.

Silver prices averaged $23.33 in that final quarter of last year, slumping 4.5% YoY. That was in line with average gold prices losing 4.3% YoY. Subtracting the SIL-top-15 average AISCs from the same quarter’s average silver price is a great proxy for sector unit profitability. These elite silver miners earned a hefty $9.79 per ounce in Q4’21 by that metric, which only retreated a slight 3.3% YoY. Again silver stocks outperformed.

The top-25 gold miners of GDX and GDXJ saw their sector per-ounce earnings plunge 27.5% and 21.9% YoY that quarter. So the SIL top 15’s really stand out. $9.79 unit profits are high absolutely too, the fifth-best seen out of at least the last 23 quarters. The major silver miners only did better between Q3’20 to Q2’21, where unit earnings averaged $12.75. That was vastly better than the $3.82 in the preceding 12 quarters.

So despite being out of favor with investors because silver has lagged behind gold’s recent geopolitical surge on Russia’s invasion of Ukraine, the major silver miners are faring really well operationally. Sooner or later, traders will realize this and start flocking back. Silver better-leveraging gold’s accruing gains in its young upleg would accelerate that essential sentiment shift. The longer gold climbs, the more silver joins it.

The SIL top 15’s hard financial results under Generally Accepted Accounting Principles, or other countries’ equivalents looked less impressive than sector unit earnings. But Polymetal’s plummeting from grace was a big driver of that. These elite silver majors collectively reported $6,580m in revenues in 2021’s final quarter, which drooped 6.8% YoY. But if Polymetal is removed from the comparable Q4’20, they grew 5.9%.

Bottom-line earnings plunged an ugly 66.1% YoY to $458m, or down 54.2% if Polymetal is excluded. But as is typical in precious-metals mining, some companies reported large unusual one-time items skewing this comparison. Netting those out would boost Q4’21 SIL-top-15 profits to $523m, which fell 47.7% YoY without Polymetal. That’s sure not good, but it is in line with GDX and GDXJ gold miners’ -47.8% and -67.2%.

These earnings fueled sky-high traditional trailing-twelve-month price-to-earnings ratios averaging 120.9x for these SIL-top-15 silver stocks! But extreme P/Es from long-time explorer MAG Silver (NYSE:MAG) transitioning into an actual miner and junior miner Aya Gold & Silver heavily distorted that average. The rest of the SIL top 15 averaged more-reasonable-yet-still-not-cheap 42.5x TTM P/Es, excluding those two little companies.

Operating cash flows are often a better measure of how miners are actually doing than accounting profits since way-fewer estimates feed into them. While not included in this table, during Q4’21, these elite major silver miners reported total operating cash flows of $1,483m. While down 22.9% YoY, they actually grew a slight 0.3% if Polymetal is again excluded from the comparable Q4’20. Strong OCFs fed nice treasuries.

As last year wound down, these SIL-top-15 silver miners collectively held $7,361m in cash. That actually grew 8.8% YoY even with Polymetal and surged 15.4% YoY without it! Bigger cash hoards mean more capital available to invest in growing production, including expanding existing mines, developing new ones, and buying other mines and mining companies. Output growth attracts investors to bid stock prices higher.

There are still big gains to be won in silver stocks as their metal powers are higher with gold in coming years. But traders have to be selective, picking the best fundamentally-superior silver miners. We currently own just six of these SIL-top-15 stocks in our newsletters. Six others I wouldn’t touch with a ten-foot pole due to various operational challenges. A carefully-handpicked subset of SIL stocks is far better than this whole ETF!

The bottom line is that the major silver miners reported a surprisingly-good fourth quarter. Lower mining costs bucking inflationary pressures offset lower average silver prices, keeping sector unit profits strong. That enabled the silver miners to fundamentally outperform the gold miners in Q4’21, which is unusual. Yet because silver has lagged gold in recent months, silver-stock sentiment has languished in worse shape.

Recent big stock-market down days tarnished traders’ interest in silver, but that will improve the longer gold’s upleg powers higher on balance. Increasing capital inflows will drive silver higher, with that upside momentum feeding on itself as traders chase gains. Higher silver prices amplifying gold’s advance will entice speculators and investors back into silver-mining stocks, which have a long way to rally to catch up.