As anxiety grips the white metal, is a retest of the 2023 lows or highs more likely?

With the Fed’s hawkish crusade helping to suppress gold, silver, and mining stocks, the permabulls have gone from loud to quiet. Moreover, with resilient demand supporting inflation and keeping the pressure on the Fed, we warned on Mar. 31, 2022, that consumer spending would cause problems for the central bank. We wrote:

There is a misnomer in the financial markets that inflation is a supply-side phenomenon. In a nutshell: COVID-19 restrictions, labour shortages, and manufacturing disruptions are the reasons for inflation’s reign. As such, when these issues are no longer present, inflation will normalize and the U.S. economy will enjoy a “soft landing.”

However, investors’ faith in the narrative will likely lead to plenty of pain over the medium term….

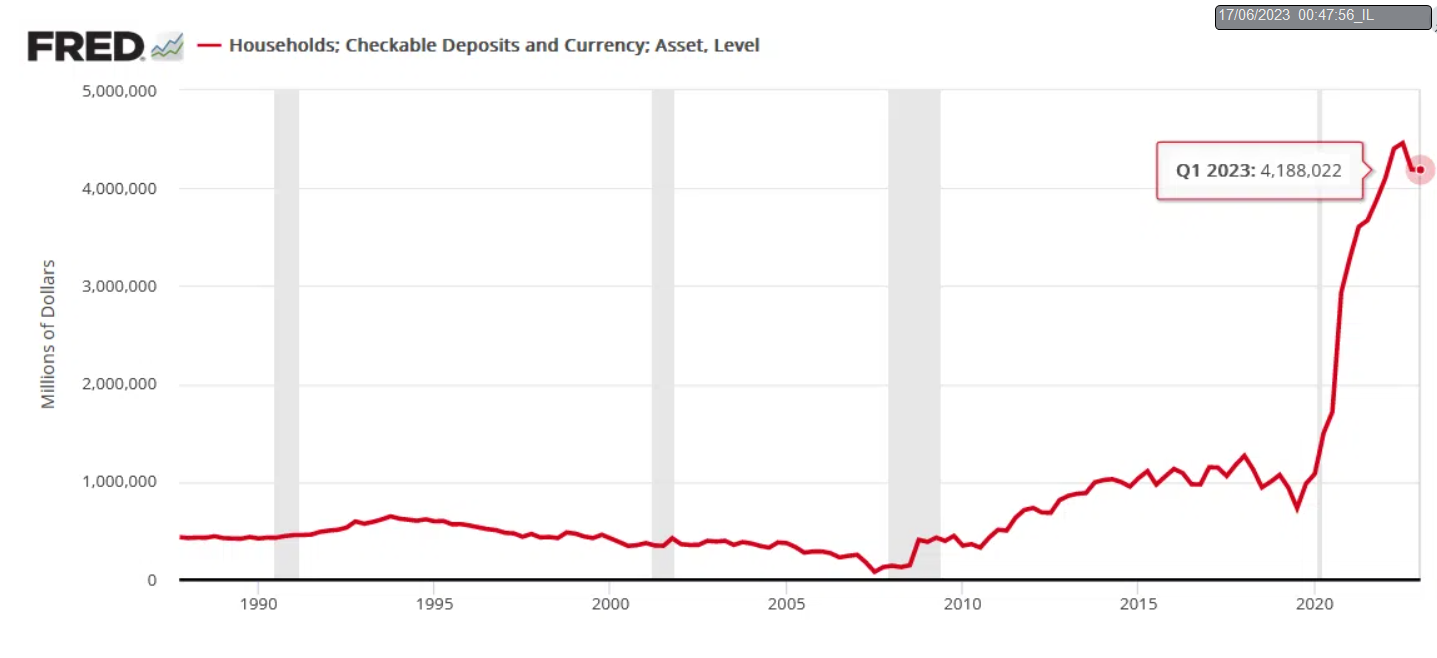

U.S. households have nearly $3.89 trillion in their checking accounts. For context, this is 288% more than Q4 2019 (pre-COVID-19). As a result, investors misunderstand the amount of demand that’s driving inflation.

To that point, the Fed updated the metric again on Jun. 8. And with household checkable deposits still highly elevated, Americans have more money now than they did then.

To explain, the figure is north of $4 trillion as of Q1 2023, and only a mild drawdown from the all-time high has been realized. Consequently, there is still too much cash out there to suppress demand enough to normalize inflation.

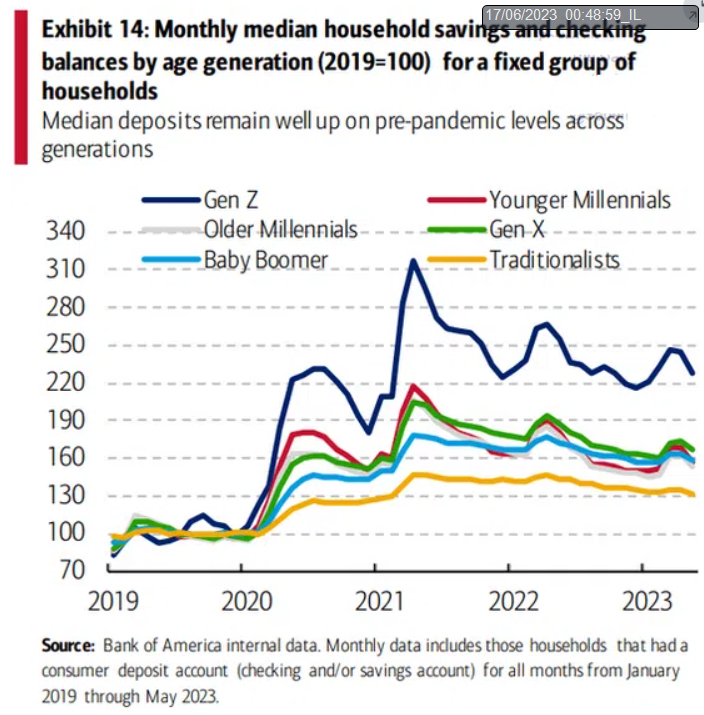

As further evidence, Bank of America highlighted the phenomenon recently. Please see below:

To explain, BofA broke down its deposit data across different age cohorts. And the results showed that household savings and checking account balances remain well above their pre-pandemic baseline (100), with Gen Z sporting the largest increase. So, while we warned 12+ months ago that Americans were flush with cash, there is still plenty of money out there.

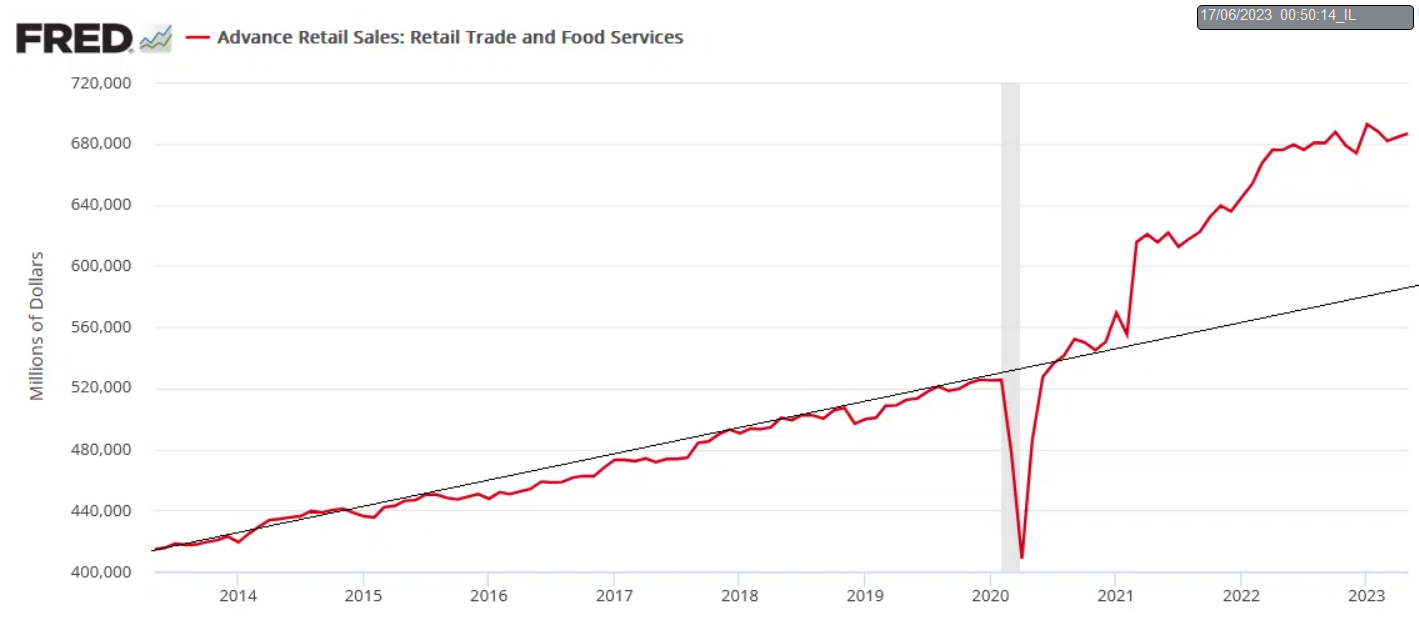

In addition, retail sales are on the rise again, and the metric outperformed expectations on Jun. 15. Moreover, if this continues, it's bad news for silver.

To explain, retail sales are still materially outpacing their 10-year trend, as resilient wage inflation and buoyant deposit balances keep consumer spending elevated. Therefore, we still believe that interest rates are too low to provoke the demand destruction necessary to tame inflation.

Small Signals

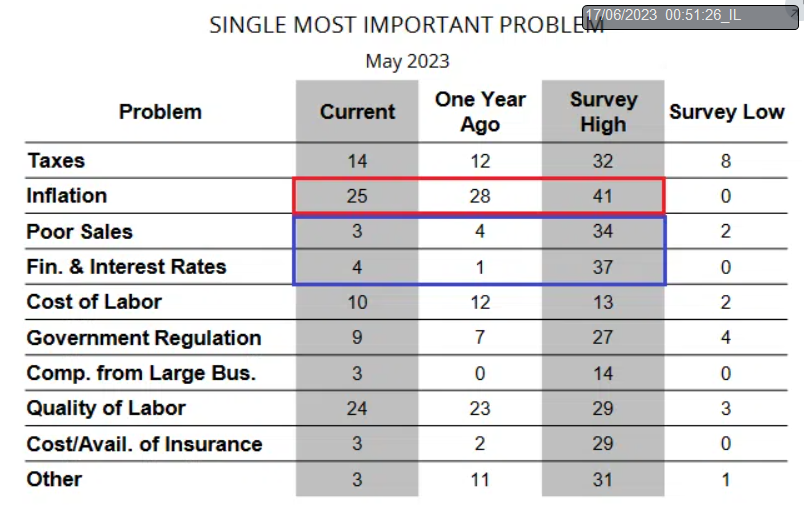

The NFIB released its Small Business Optimism Index on Jun. 13. The headline index increased from 89 in April to 89.4 in May. More importantly, respondents still cite inflation as their “single most important problem.”

To explain, the red rectangle above shows how 25% of respondents cited inflation as their most pressing issue. And while the metric declined by three points from the May 2022 reading and is materially below the record high, it’s still too high for comfort.

Furthermore, the implications of the blue rectangle are equally important. Only 3% of respondents cited poor sales as their most important problem, which is less than the May 2022 reading, well below the survey high, and only one point above the survey low. As a result, demand destruction is absent right now.

Likewise, while those citing the impact of interest rates rose by three points, the current 4% reading is well below the survey high of 37%. Thus, with poor sales and interest rates considered largely immaterial while inflation remains highly problematic, they indicate why long-term rates need to rise to match the FFR’s ascent.

Overall, the S&P 500 remains in la-la land, as investors assume that a fairytale ending is on the horizon. However, since 1948, six of the last seven times the headline CPI rose above 5% YoY, recessions followed. And with the imbalances much greater this time around, in our opinion, a soft landing is extremely unrealistic.

In reality, recession fears reduced oil prices, and base effects provided similar support to the headline CPI. Yet, those benefits end when June’s data is released in July, and we have been consistent in our thesis that interest rates are too low to cause a recession. As such, the Fed should have to do more, and few expect or are positioned for this outcome.

Why have the PMs been so weak while the S&P 500 has been so strong?