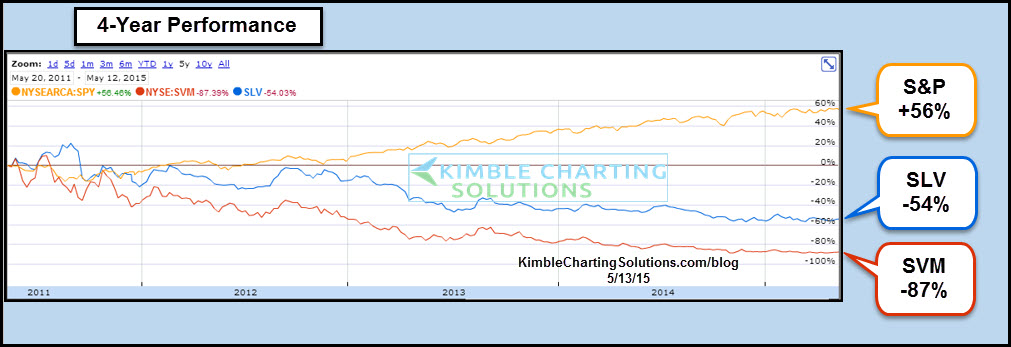

Do you like the idea of buying low and selling higher? When it comes to something that's low in price, silver and Silvercorp Metals (NYSE:SVM) don’t have much to brag about in the past 4 years.

The chart below compares the performance of the S&P 500 to Silver and SVM over the past 4 years. As you can see, the spread between the S&P 500 and SLV is 100% over the past 4 years. SVM lost 87% of its value during that time.

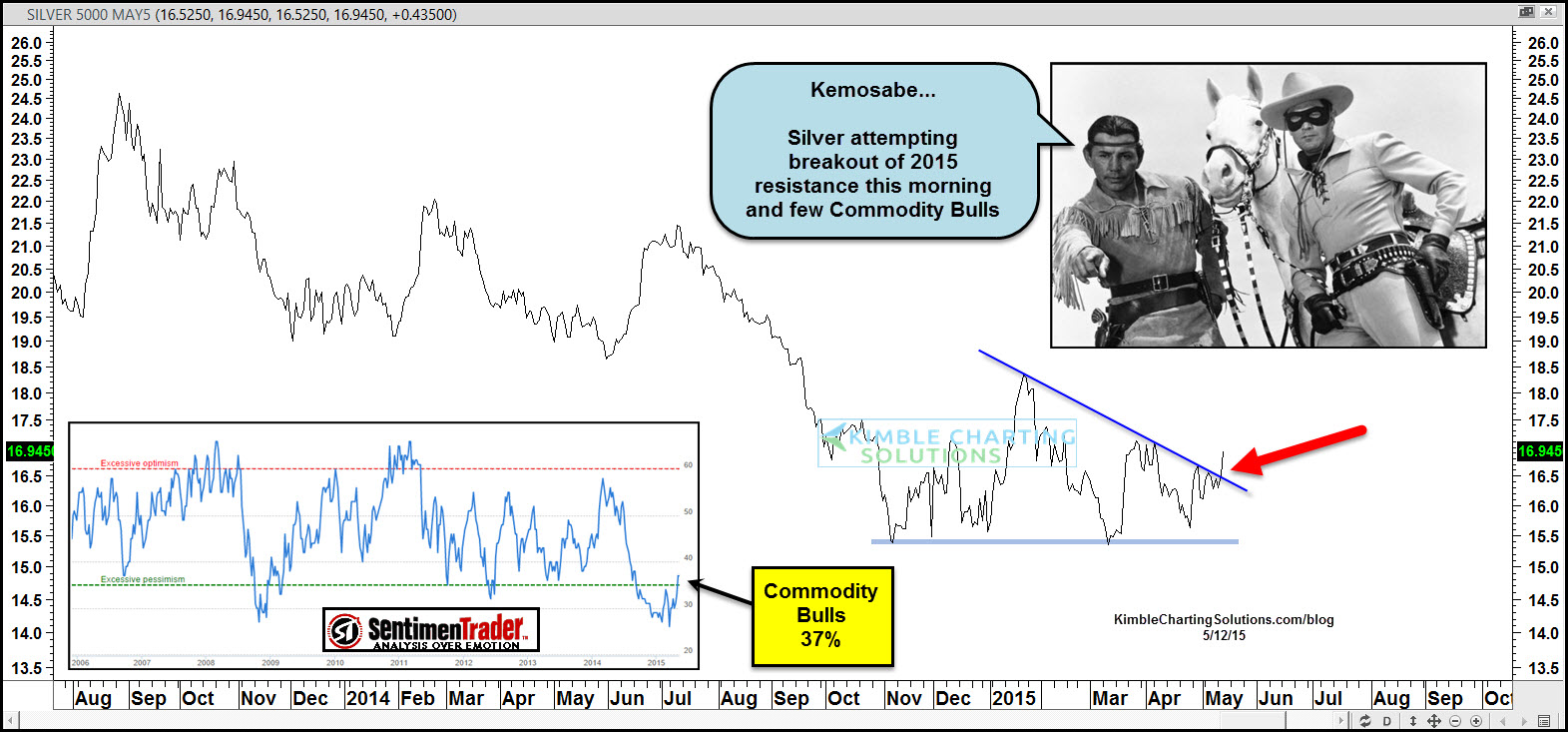

The chart below looks at silver futures of the past few years and sentiment for the Commodities complex from Sentiment Trader.com.

On a short-term basis, silver is working on a breakout of 2015 resistance after potentially putting in a base over the past 6 months.

Should the (GDXJ)/(GDX) and silver/gold ratio both turn up, it would be a positive sign for this very hard-hit sector.

Premium and Metals members are long positions in the Gold, Silver and Mining sector.