After a brief consolidation in March, the silver broke below its 200-day MA. Is this the second act?

While silver has declined sharply from its 2023 highs, it remains anchored by its 200-day moving average. However, as the liquidity fundamentals continue to deteriorate, we expect a breakdown to occur over the medium term.

As evidence, while ADP’s private payrolls smashed expectations on Jul. 6, U.S. nonfarm payrolls underperformed on Jul. 7. Yet, average hourly earnings (AHE) came in hot and do not support a dovish pivot anytime soon.

Please see below:

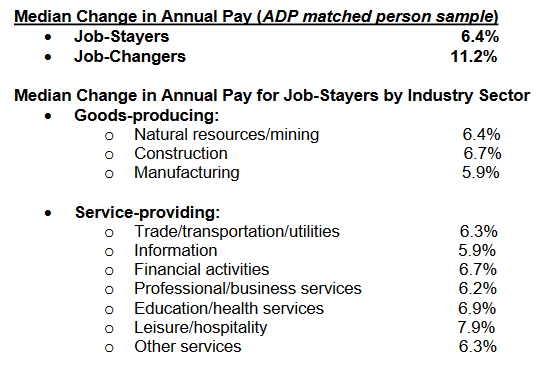

To explain, the MoM and YoY metrics outperformed expectations, highlighting how wage inflation remains highly problematic. To that point, ADP’s Employment Report paints an even more ominous portrait.

Please see below:

To explain, ADP’s data shows that wage inflation remains at ~6% or higher across all sectors. Moreover, job changers are still experiencing double-digit wage inflation, which only incentivizes them to change positions continuously. As such, this backdrop is not conducive to the Fed achieving its goals, and demand-driven inflation is bearish for gold and other precious metals.

Remember, we warned this would occur on Apr. 6. We wrote:

Households’ checkable deposits have only declined slightly from their 2022 peak and are 362% above their Q4 2019 comparison. When you combine this much cash with near-record-low unemployment and near-record-high wage inflation, investors are kidding themselves if they think demand destruction has arrived.

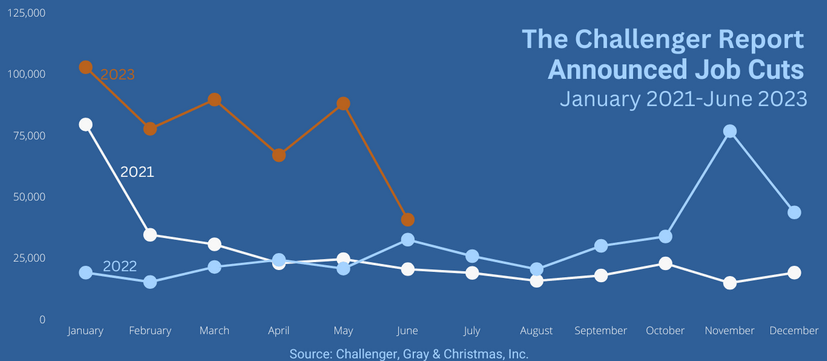

Likewise, Challenger, Gray, and Christmas, Inc. released its job cuts report on Jul. 6. An excerpt read:

“U.S.-based employers announced 40,709 cuts in June, down 49% from the 80,089 cuts announced in May.”

Andrew Challenger, Senior Vice President of Challenger, Gray, & Christmas, Inc. added:

“The drop in cuts is not unusual for the summer months. In fact, June is historically the slowest month on average for announcements. It is also possible that the deep job losses predicted due to inflation and interest rates will not come to pass, particularly as the Fed holds rates.”

Thus, while we repeatedly warned that the U.S. labor market was resilient and that demand-driven inflation would reign, little has changed. Consequently, the Fed needs to do more to suppress the U.S. economy, and that’s bullish for the US Dollar Index and real yields.

Please see below:

On top of that, Bloomberg’s U.S. Labor Market Surprise Index has soared to its highest level in more than 10 years.

Please see below:

To explain, the black line’s surge on the right side of the chart highlights how U.S. labor demand continues to outpace supply. This is bullish for wage inflation and Fed policy.

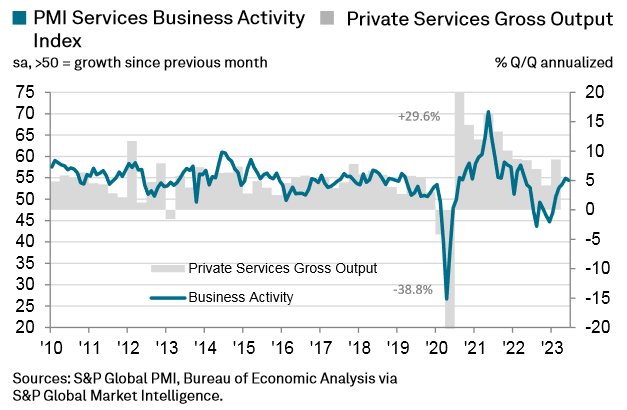

If that wasn’t enough, U.S. Services PMI came in at 54.4 on Jul. 6, which is only a slight drop from the 54.9 seen last month. The report stated:

“Output continued to rise at a solid pace as the demand environment improved, spurring a strong upturn in new orders. Domestic and foreign client demand supported new business growth, as new export orders rose for a second month running. Subsequently, firms were more upbeat in their year-ahead expectations for activity and sought to expand employment accordingly. Job creation was also linked to greater pressure on capacity as backlogs of work returned to growth.”

In addition, while output inflation was more muted, the report added:

“Service sector firms saw a marked rise in cost burdens at the end of the second quarter. The increase in business expenses was reportedly driven by greater wage bills, with some companies also noting upticks in supplier prices and higher borrowing costs. The pace of cost inflation reaccelerated and was the sharpest since January.”

So, with robust demand and accelerating cost inflation confronting the U.S. service sector, the fundamentals remain aligned with our medium-term thesis.

Please see below:

Don’t Fight the Fed

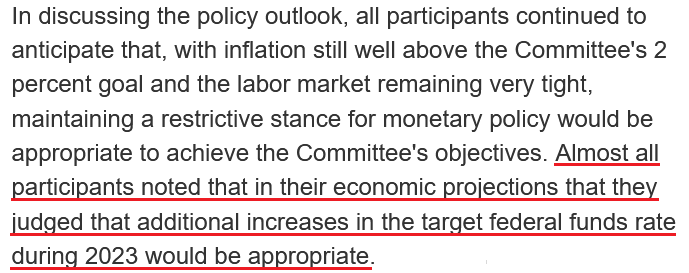

We warned that inflation’s deceleration due to base effects and lower oil prices was a short-term phenomenon and that resilient consumption and wage inflation would pick up the slack. And with the Fed waking investors up to these realities, higher interest rates should remain problematic for the PMs. The FOMC Minutes revealed on Jul. 5:

“Almost all participants stated that, with inflation still well above the Committee's longer-run goal and the labor market remaining tight, upside risks to the inflation outlook or the possibility that persistently high inflation might cause inflation expectations to become unanchored remained key factors shaping the policy outlook.”

Please see below:

Overall, while the stock market remains relatively uplifted, risk assets are in precarious positions. We’ve stated repeatedly that higher interest rates and a hawkish Fed are the first part of our bearish fundamental thesis, while a recession is second. And with the USD Index often soaring during periods of economic stress, a volatility spike and a stock market sell-off should culminate with the PMs reaching their long-term lows.

Will silver hold its 200-day MA, or is a breakdown below $22.60 inevitable?