The stock market could be entering a period of short-term strength within a longer-term downtrend.

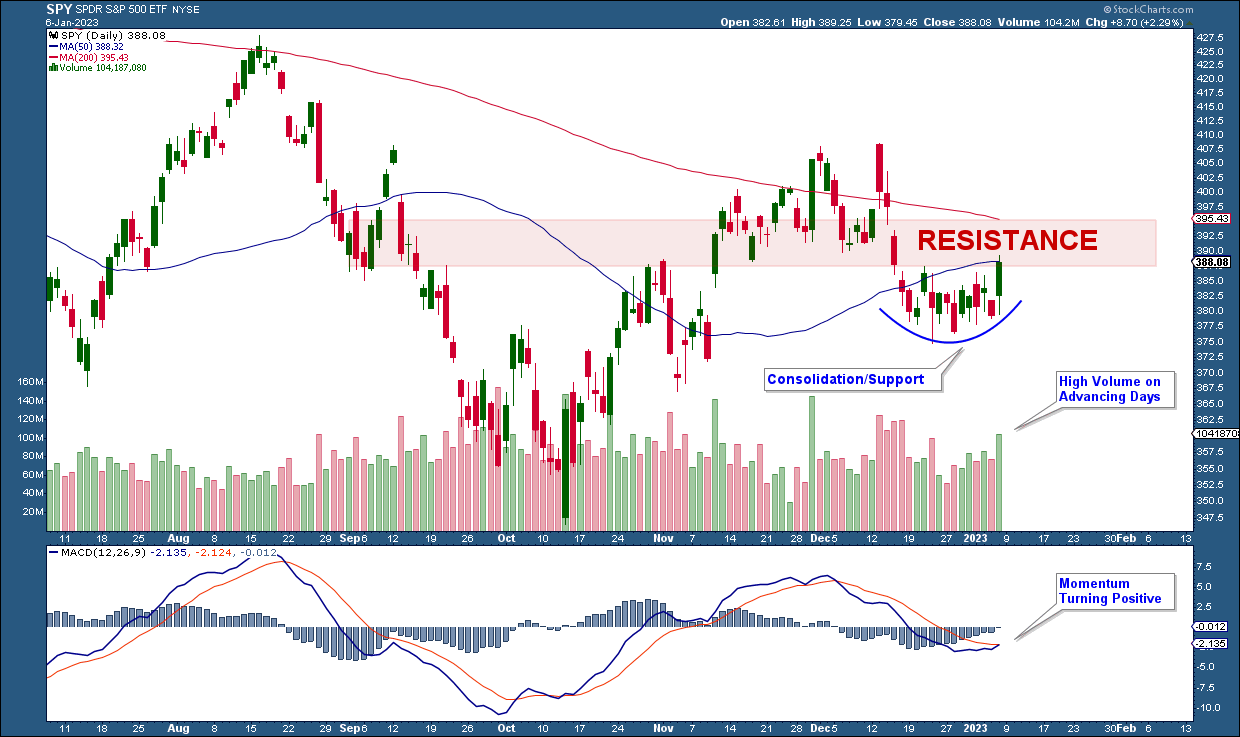

Below is a chart of the S&P 500 ETF (SPY) in the top panel and the MACD ( a momentum indicator) in the bottom panel.

Notice how the MACD is turning up and is close to turning positive. In addition, the volume has been strong over the past two weeks on up days, and price action has formed an area of consolidation.

This week I will be watching to see if the index can advance above resistance.

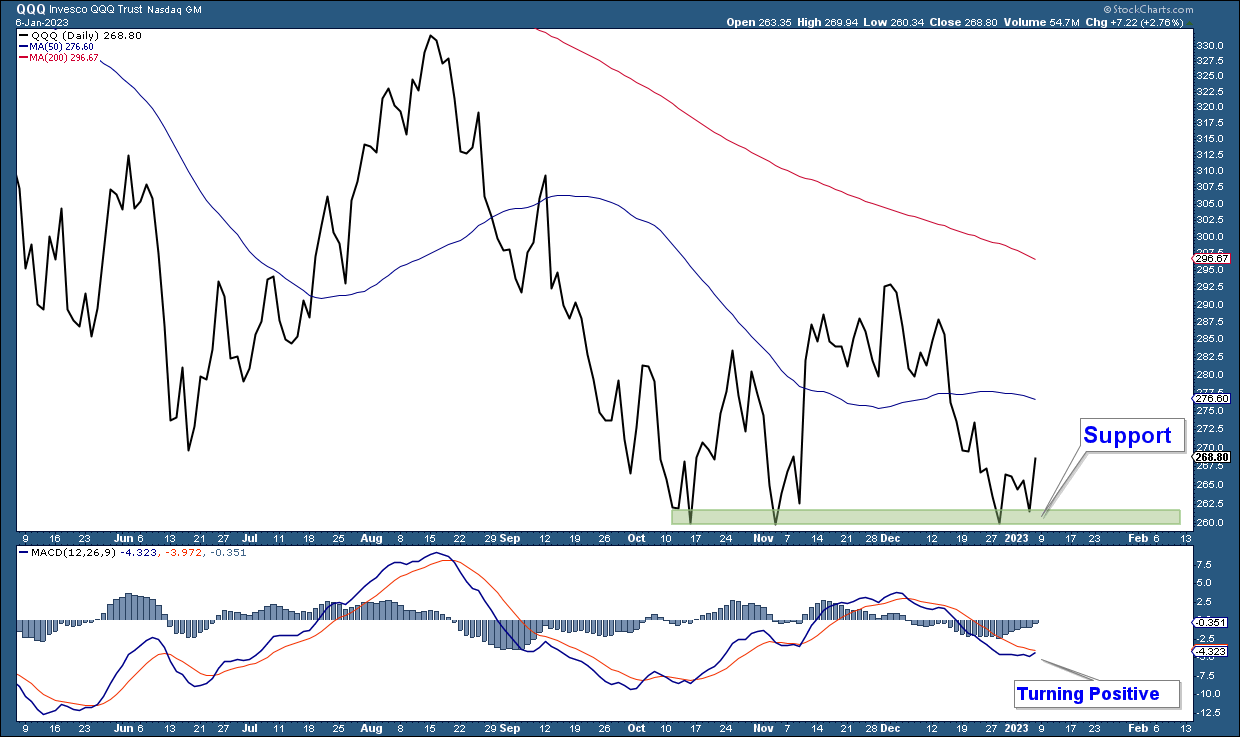

Notably, the market is starting to display strength, and the Nasdaq 100 is sitting on a major area of support. Like the S&P 500, Nasdaq momentum is also turning positive.

If the market continues to advance in the coming days, it would be a bullish sign in the short-term. On the other hand, if the Nasdaq and S&P 500 fall below support, it would be bearish.

In bear markets, you have to be nimble.

I reduced our short hedges last week and will continue to add equity exposure if market conditions continue to improve.