- Nvidia stock plunged 15% in 3 days, losing its crown as the most valuable company in the world.

- Analysts debate if this is a buying opportunity or the start of a deeper correction.

- We analyze Nvidia's financials and technicals to see if the dip is worth the risk.

- Unlock AI-powered Stock Picks for Under $7/Month: Summer Sale Starts Now!

Nvidia shares have fallen by more than 15% in the last 3 trading sessions, resulting in a loss of nearly $550 billion in the company's market value. Consequently, the AI behemoth lost the briefly acquired title of the world's most valuable company.

Although the correction in NVDA's shares seems limited compared to its longer-term trend, analysts have begun to speculate on whether this is the start of a deeper correction for the stock.

The company has gained a whopping 180% since the start of the year. While financials have kept up with the share price rise, the uptrend has fueled rumors of potential profit-taking in the stock. As a matter of fact, the downward momentum continued when Nvidia's CEO Jensen Huang reported a share sale worth around $95 million.

There are also worries that a continued sell-off could trigger a broader market correction, given the importance of Nvidia's meteoric rise for the current bull market. In fact, the decline that started last week has led to comparisons to the dotcom bubble of the early 2000s.

However, the consensus is that the artificial intelligence sector is still in its early stages, making such a possibility seem remote for Nvidia and other AI-focused technology companies.

By the way, you can leverage AI to maximize your portfolio gains. Here's how:

Take Advantage of Our Summer Sale to Maximize Your Portfolio Gains!

Stop missing out! Subscribe to ProPicks today.

Getting back to the main topic, let's take a deep dive into Nvidia's financials with InvestingPro for more clues on whether this correction presents a new buying opportunity for long-term investors.

Should You Buy the Dip?

Nvidia's 2024 earnings account for about one-third of S&P 500's. Moreover, the chipmaker continues to present a reassuring image with its strong financials.

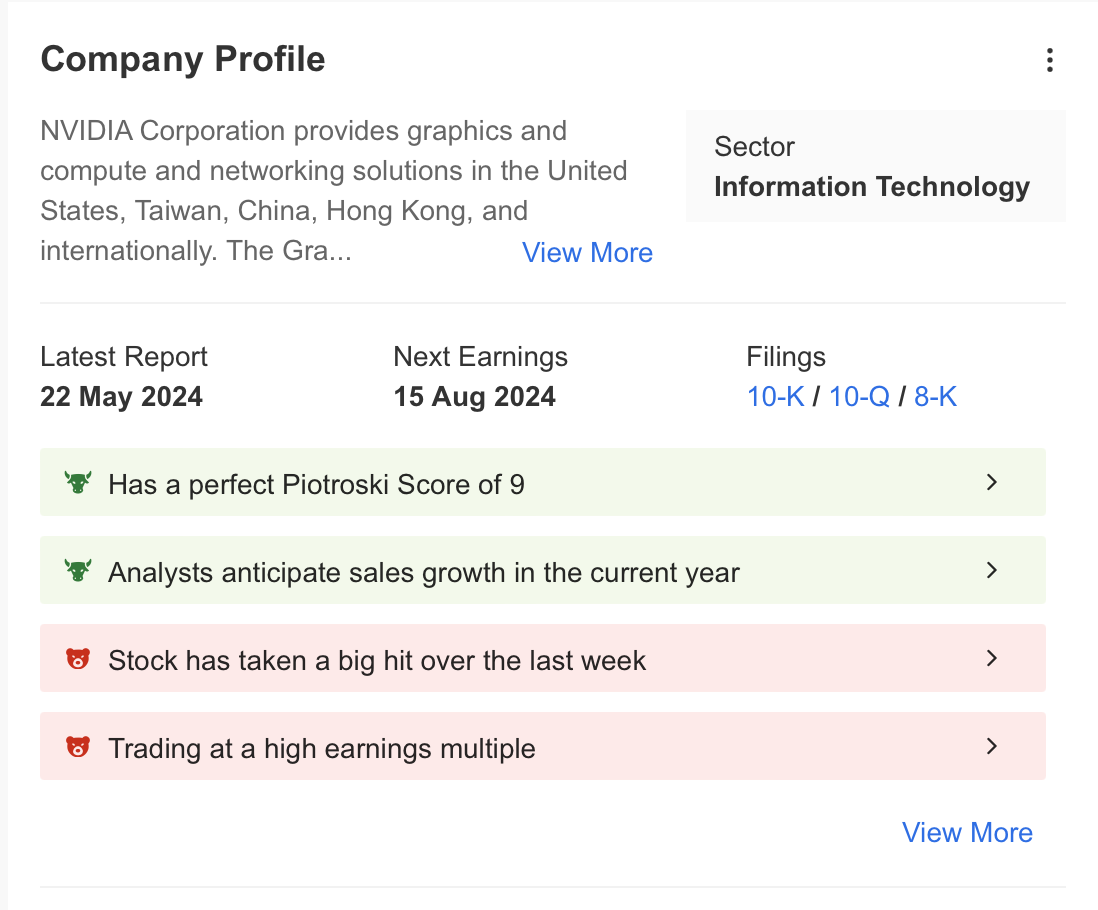

Nvidia's financial summary via InvestingPro highlights the following strengths:

- Piotroski score is the highest at level 9.

- Analysts expect sales growth this year.

- Cash flow is sufficient to cover interest expenses.

- 13 years of regular dividend payments.

- Liquid assets exceed liabilities.

- Continues to offer high returns in the long and short term.

Source: InvestingPro

But despite the positive aspects, Nvidia also exhibits some financial warning signs - as seen above.

Foremost among these is the high valuation ratios relative to the rapidly rising share price. Additionally, the company's average debt level, amid the Fed's high interest rates, can be considered a warning sign in the current environment, which the Fed intends to maintain at least until September.

Moreover, the extreme volatility of the stock can also be considered a risk factor for short-term investors.

Source: InvestingPro

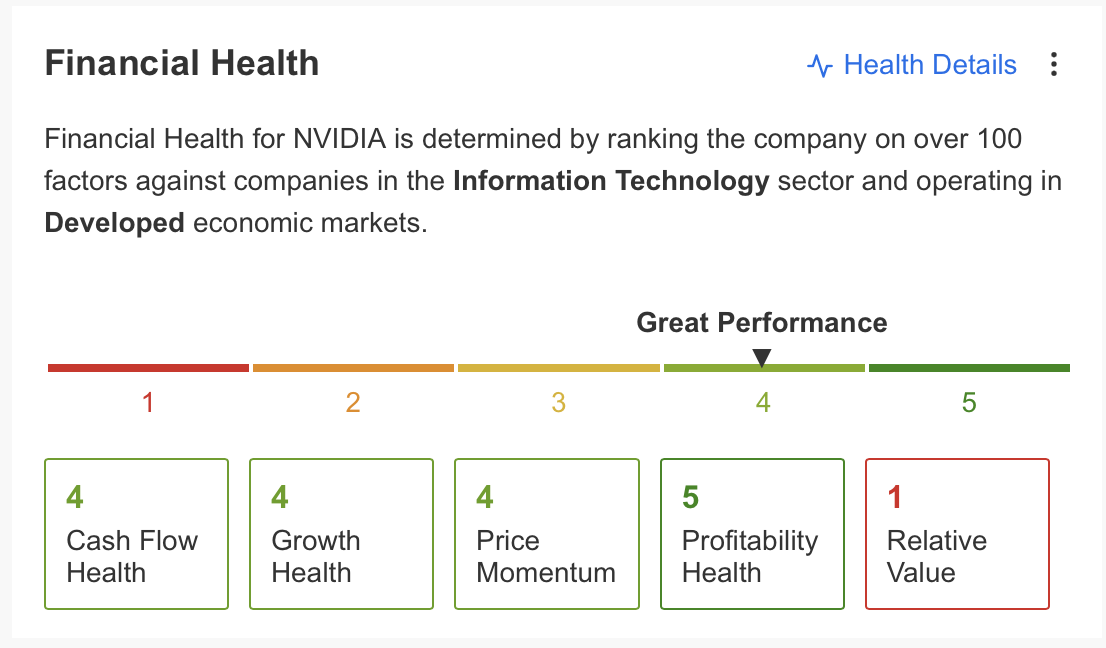

Despite these factors, Nvidia's financial health score continues to post a very good 4 out of 5 according to InvestingPro's financial health analysis.

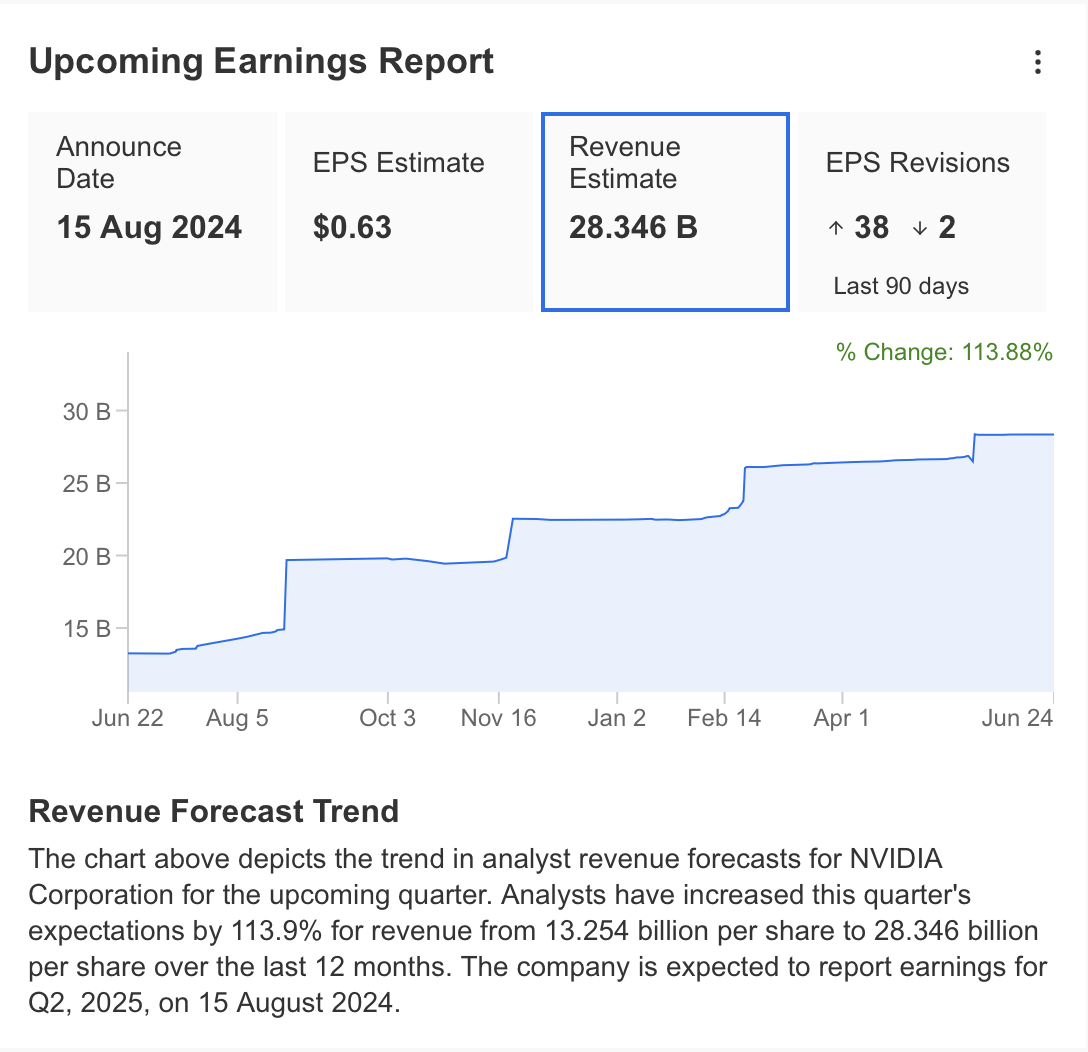

Looking at the current estimates for the next earnings report, 38 analysts have positively revised their outlook for Nvidia's revenue and earnings per share. The consensus among analysts is that Nvidia's EPS could be $0.63 for Q2, and quarterly revenue could reach $28.3 billion, representing an increase of over 100% year-over-year.

Source: InvestingPro

Technical View

An important development for Nvidia this month was its 10-to-1 stock split on June 7, which significantly expanded perceived growth potential from an investor perspective. Following the split, the stock price rose from a new level of $119 to $140 by last week, marking a 17% increase.

Technically, looking at NVDA, the last correction occurred in April, with the stock falling 20% from $95 to $75 adjusted for post-split prices. Unlike the previous decline, this partial correction unfolded gradually over nearly a month.

The recent 17% decline over the last 3 trading days triggered heightened market FOMO amidst sharper decreases. However, in such steep declines, confident bulls in the stock may set a bear trap.

Following the April correction trend, support levels at $130 and $124 were breached with volume. Currently, the stock has retreated to $118, nearing critical support at $115 (Fib 0.382). A weekly close above this level could potentially trigger a swift recovery. If investors perceive the current movement as a corrective phase and shift to buying, NVDA could target a new peak around $150.

Conversely, if downward momentum persists below $115, the price may retreat towards the Fib 0.618 level at $100.

What's Nvidia's Current Fair Value?

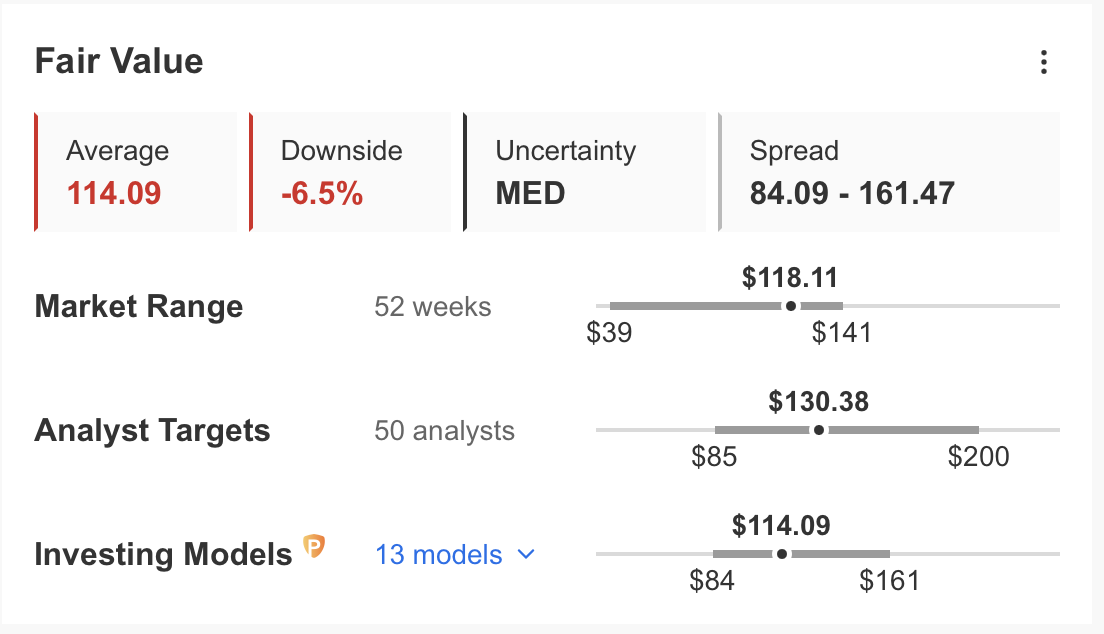

InvestingPro fair value calculation, as seen in our analysis at the beginning of the month, pointed to $95 levels according to the post-split adjusted price. Following the latest developments, Pro has calculated the current fair value of NVDA as $114. It can also be seen that the calculated fair value is currently in line with the Fib 0.382 value.

As a result, the decisive price level for the new direction of NVDA stands at $ 115. Depending on the reaction of investors in this price zone, we can see that the stock may head towards the next support and resistance levels.

Source: InvestingPro

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $7 a month!

Tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.