On Tuesday the S&P 500 plunged in the biggest selloff in months. As expected, volume was elevated as some owners used this opportunity to lock-in profits.

There was no clear headline driving this selling and instead it was a natural release following this month’s overbought condition. The financial press blamed it on rising bond yields, but they’ve been rising for a while, so why all of a sudden the worry? Journalists are paid to come up with a reason even when there isn’t a reason and yesterday this is what they came up with.

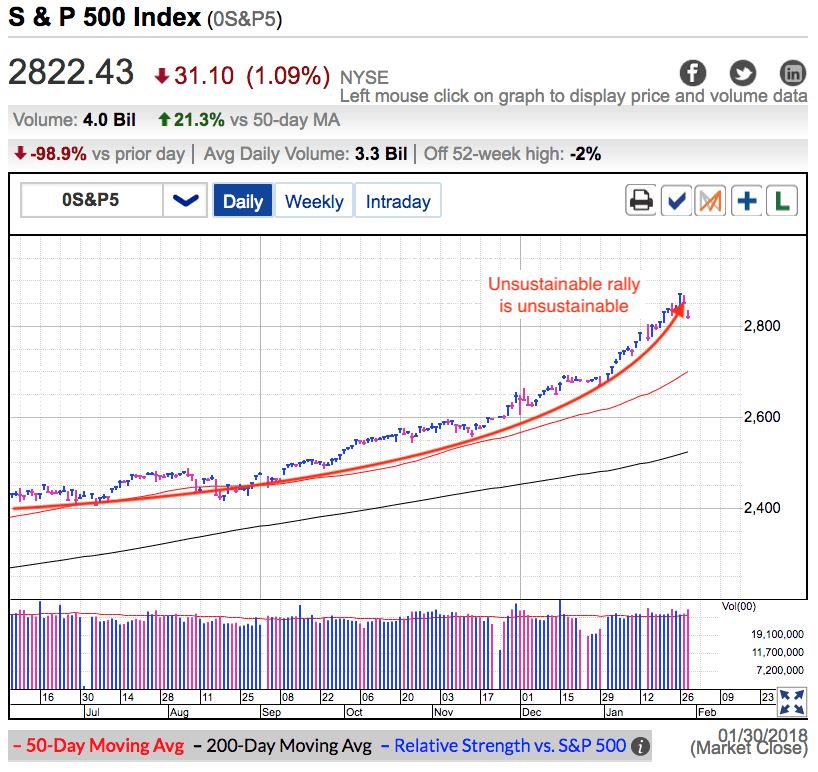

It’s been one heck of a rally since the start of the year and clearly the rate of gains was unsustainable. No doubt the gains encouraged others to chase prices higher, but there always comes a point where we run out of buyers. And it looks like we reached that point last Friday when the market surged to record highs.

The bigger question is if this is just another routine, buyable dip on our way higher. Or the start of something bigger. The first thing to note is the market hasn’t been blindsided by a scary headline. There is no systemic risk threatening to take our economy down. Instead we topped on good news.

Most of this rally has been driven by confident owners refusing to sell. While conventional wisdom tells us complacency is a bad thing, what it fails to mention is periods of complacency last far longer than even the bulls expect. That’s because confident owners don’t sell and the resulting tight supply makes it hard for any selloff to build momentum.

Given yesterday’s benign headlines, I don’t expect this weakness to do much to deter confident owners. They held through everything else the market’s thrown at them and this time won’t be any different. What could be different is the lack of dip buying. Previously we would bounce within hours of a selloff and finish the day well off the lows. The last two days that hasn’t happened. That means demand is becoming an issue.

Not a surprise given how much buying has already taken place this month. At some point this unsustainable climb had to run out steam and this appears to be that point.

But the thing to remember about natural swings in the market is they tend to be benign. That’s because we don’t have a spooky story of doom and gloom making the rounds. Traders are most definitely concerned about this weakness, but so far there isn’t anything to make them change their outlook. This is more of a cool-down than the start of a plunge.

No doubt the last two days has been shocking given the almost non-existent selling over the last few months. But this is simply the market catching its breath and we are not on the verge of collapse. Confident owners will remain confident and it won’t take long for us to run out of supply yet again.

Tuesday we found support near 2,820. Maybe this is as low as we go, or maybe we slip under 2,800. Either way there is nothing to panic over. Even a dip to the 50dma would be normal and healthy. There is nothing wrong with taking profits at these levels if that is what your trading strategy dictates. But if you are a long-term investor, don’t let a little weakness scare you off. If we get lucky and the market slips to the 50dma, that would be an attractive entry point. But most likely we will run out sellers long before then.

I wish I could be as positive for Bitcoin. Prices slipped under the psychologically significant $10k level for the second time this month. This selloff is now more than a month old. If anyone was tempted to buy the dip, they already did. BTC bulls loaded up on the “discounts” earlier in the month and now they are fully invested. Unfortunately their buying wasn’t enough to prop up the market for more than a few days. Without new money, prices continue to slump.

For the last few weeks $10k was a floor for prices and we kept bouncing off support. But the longer we held near support, the more likely it becomes that we break it. And that is what happened yesterday. Sentiment in BTC is getting worse not better. Every bounce fails to go as high as the previous bounce and we keep making lower highs and lower lows. At this point I expect $10k support to turn into a ceiling. Unfortunately for Bitcoin owners, it looks like the worst is still ahead of us.