One of the double-edged swords when it comes to technical analysis is the abundance of tools, indicators, and methodologies. I call this a double-edged sword because while the plurality of options in the tool box allows traders greater flexibility in developing a system or process that works best for them. It also allows a greater ability for false security to be gained and money to be lost. While studying for the Chartered Market Technician I read numerous books that covered a vast amount of tools available to technical analysts. Some I use… some I don’t. It’s up to you (and me) as the trader to determine what we allow into our investment process.

This leads me into the discussion of Fibonacci retracements. The notion of Fibonacci numbers have been around for hundreds of years. It was brought into more established cultures by Leonardo of Pisa, who is known as Fibonacci. When applied to the financial markets there are three sets of numbers (viewed as percentages) used to find retracement levels: 61.8%, 38.2%, and 23.6%. Many software packages and website will add 50% to the mix, but this is actually not a Fibonacci retracement number but is the middle number between 61.8% and 38.2%.

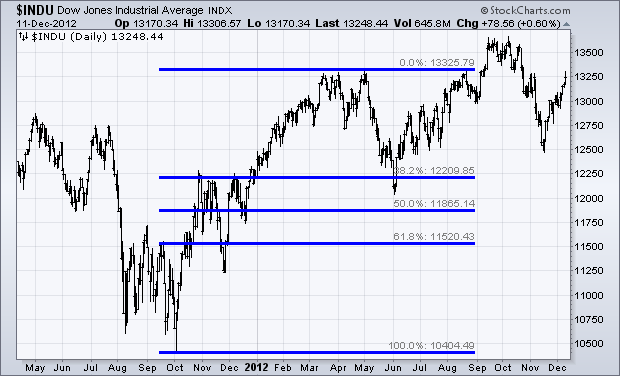

Here’s a chart of the Dow Jones Industrial Average (INDU) with a Fibonacci retracement overlay during the advance off the October ’11 low to the mid-2012 high. This would have been used to find potential support during the drop in May ’12. I’m not simply using this time period as an example because the Fibonacci levels did not act as support, I just picked a period of time to show how the retracement levels are used.

Adam Grimes, author of The Art and Science of Technical Analysis, writes a very interesting blog looking at different aspects of charting. Recently Adam has dived into the math behind Fibonacci retracements and showed some surprising results.

Adam tested retracements using 600 stocks, 16 futures markets, and 6 currencies over a 10-year period starting in 2001 in order to capture different market environments. Adam writes at length about the study he performed but I’m going to discuss some of the highlights here today, but I encourage you to read his posts on the topic.

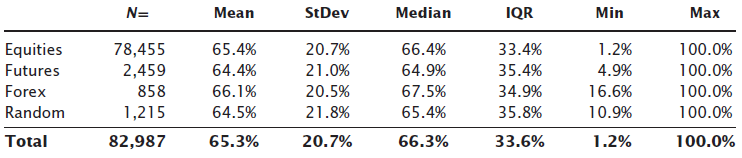

The table below shows the results of Adam’s test of the average retracement made in each of the asset classes. As you can see over the 10-year period there was a very close mean between the three markets, however the random set of data also shows a close fit to 65% retracement. Also notice the standard deviation of 20.7%. Adam explains, “we can’t see any clear evidence of Fibonacci ratios in this table. The average retracement, around 65%, is not the Golden Mean, and the very high standard deviation means that we’re not even very “sure”, statistically speaking, that the mean is a valid measure.”

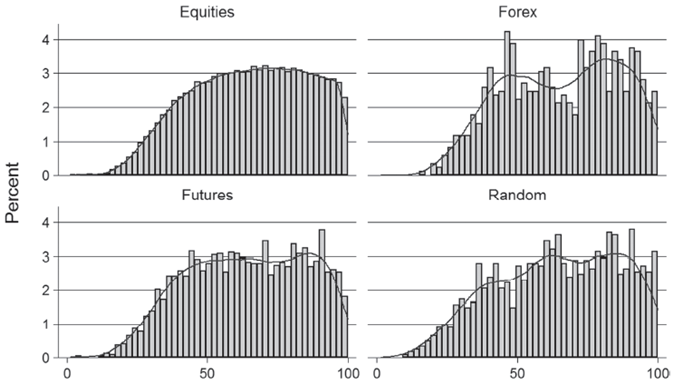

Next Adam showed the retracements for each market on a histogram. If retracements worked, he points out, then we should see a cluster around the Fibannaci numbers commonly used as retracement support and resistance. But his is not the case. For all three asset classes, as well as the random data set, there does not appear to be clear bias to any one or multiple numbers.

Adam concludes that mathematically it does not make sense for traders to use Fibonacci retracements when trading. So why do traders use them?

Here’s Adam’s thoughts:

People like mystery and intrigue, and I think the idea that your trading system somehow rests on the harmonic convergence of the Sacred Geometry of the Pillars of the Universe [...] appeals to a certain mindset—people will overlook the aberrations of the Gann/Elliot/Fibonacci crowd.

[...]

There is also something reassuring about being able to forecast exact turning points to the tick, even if there is no validity to those forecasts. If you make enough predictions, some of them will work out just by chance, and that’s all you need to embed a pretty deep cognitive bias.

So with this, will I stop using Fibonacci retracements in my analysis? I’ve never been one to put all the weight on a single tool or methodology and by no means would I trade off a retracement level. I will have to do more of my own research before making my personal conclusion. However, I think this type of research is important and we as traders should always be challenging what we see and read. I will admit I now do view retracements in a different light. It’s hard to ignore this type of study and its results.

I write this post not to condemn those that use Fibonacci numbers. I simply found Adam’s work very interesting and worth sharing. You can make your own judgments and conclusions.

Source: Testing Fibonaccis (Adam Grimes) and Fibonacci Conclusions (Adam Grimes)