Our approach to covered call writing and put-selling in bear markets include an arsenal of trading concepts that will enhance our opportunities for successful outcomes. These include:

- Use of deep in-the-money calls

- Use of deep out-of-the-money puts

- Use of lower implied volatility securities

- Use of low-beta stocks

- Use of exchange-traded funds

- Lowering our time value return goals during the bear market environment

- Use of appropriate position management bear-market techniques

- Use of inverse exchange-traded funds in confirmed bear markets

Some of our members have asked about shorting stocks as an alternative strategy during these bear markets and this article is dedicated to a discussion of this approach.

What is shorting a stock?

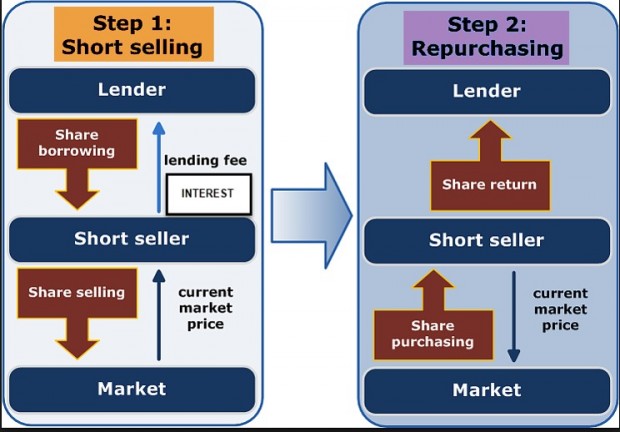

This when an investor sells a stock not currently owned and therefore needs to be borrowed before selling. The expectation is for the share value to decline so it can be repurchased at a lower price and therefore generate a profit. The stock is generally borrowed from a broker’s inventory and there will be a lending or interest fee. The short sale will result in a cash deposit into the investor’s account. Eventually the shares are re-purchased at market and returned to the lending broker. The profit or loss will be determined by the price the shares are repurchased. The chart below summarizes the process:

Short-selling a Stock

Note: Short-selling cannot be used with penny stocks and must be sold in round lots (100 share increments)

Why are there short-sellers?

Speculating: Investors speculating that there will be a share price decline

Hedging: Protecting long positions in the same vein that portfolio managers may aspire to achieve Delta-neutral portfolios… a long position is Delta-positive and a short position is Delta-negative

Risks

- Stock markets have upward bias…short-selling is like running uphill

- Losses are potentially unlimited (stock price can go as high as infinity) but gains are limited (stock price cannot go below zero). Use of buy stop-loss orders are critical

- May be exposed to margin call since borrowing shares mean margin trading. We may be required to add cash to our account or liquidate positions

- A short squeeze (short-sellers covering positions) can cause stock price to accelerate exponentially

- Short-sellers may be required to pay dividends to the stock lenders (best to short sell a stock that pays no dividends)

Discussion

Shorting a stock is a bear-market strategy that may be appropriate for some sophisticated investors with a high risk-tolerance. For most retail investors, in my humble opinion, there are better, less speculative, approaches to bear market scenarios which I enumerated in the first paragraph of this article.

Market tone

This week’s economic news of importance:

- Industrial production Dec 0.09% (above expectations)

- Weekly jobless claims for week ending 1/13 220,000 (below expectations)

- Housing starts Dec 1.192 million (below expectations)

- Building permits Dec 1.302 million

- Consumer sentiment Jan 94.4 (below expectations)

THE WEEK AHEAD

Mon Jan 22nd

- Chicago Fed national activity index Dec

Tue Jan 23rd

- None scheduled.

Wed Jan 24th

- Markit manufacturing PMI Jan

- Markit services PMI Jan

- Existing home sales Dec

Thu Jan 25th

- Weekly jobless claims for week ending 1/20/18

- New home sales Dec

- Leading economic indicators Dec

Fri Jan 26th

- GDP Q4

- Durable goods orders Dec

For the week, the S&P 500 rose by 0.86% for a year-to-date return of 5.11%

Summary

IBD: Market in confirmed uptrend

GMI: 6/6- Buy signal since market close of August 31, 2017

BCI: I have a short-term bullish approach to the market, selling 2 out-of-the-money strikes for every 1 in-the-money strike. The potential of a government shutdown may represent a short-term bum-in-the-road.

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

The 6-month charts point to a slightly bullish outlook. In the past six months, the S&P 500 was up 15% while the VIX (11.20) moved up by 15% but still historically low.